Inflation returned to the US in February after global gas prices rose, making it more difficult for the Federal Reserve to cut interest rates and raising doubts about whether a “soft landing” scenario is still as promising as before.

Rising oil prices bring back US inflation

Contrary to market confidence at the beginning of the year that core US inflation was under control, data released by the US Bureau of Labor Statistics on March 12 showed the difficulties the Fed faces in the final leg of its price stabilization battle. In February, the US headline consumer price index (CPI) recorded its second consecutive month of increase, rising 3.2% year-on-year, 0.1 percentage points higher than forecast.

While down significantly from a peak of 9.1% in 2022, 3.2% is still far from the Fed’s 2% target. Meanwhile, energy costs, which have contributed to a significant slowdown in inflation over the past year, are rising again.

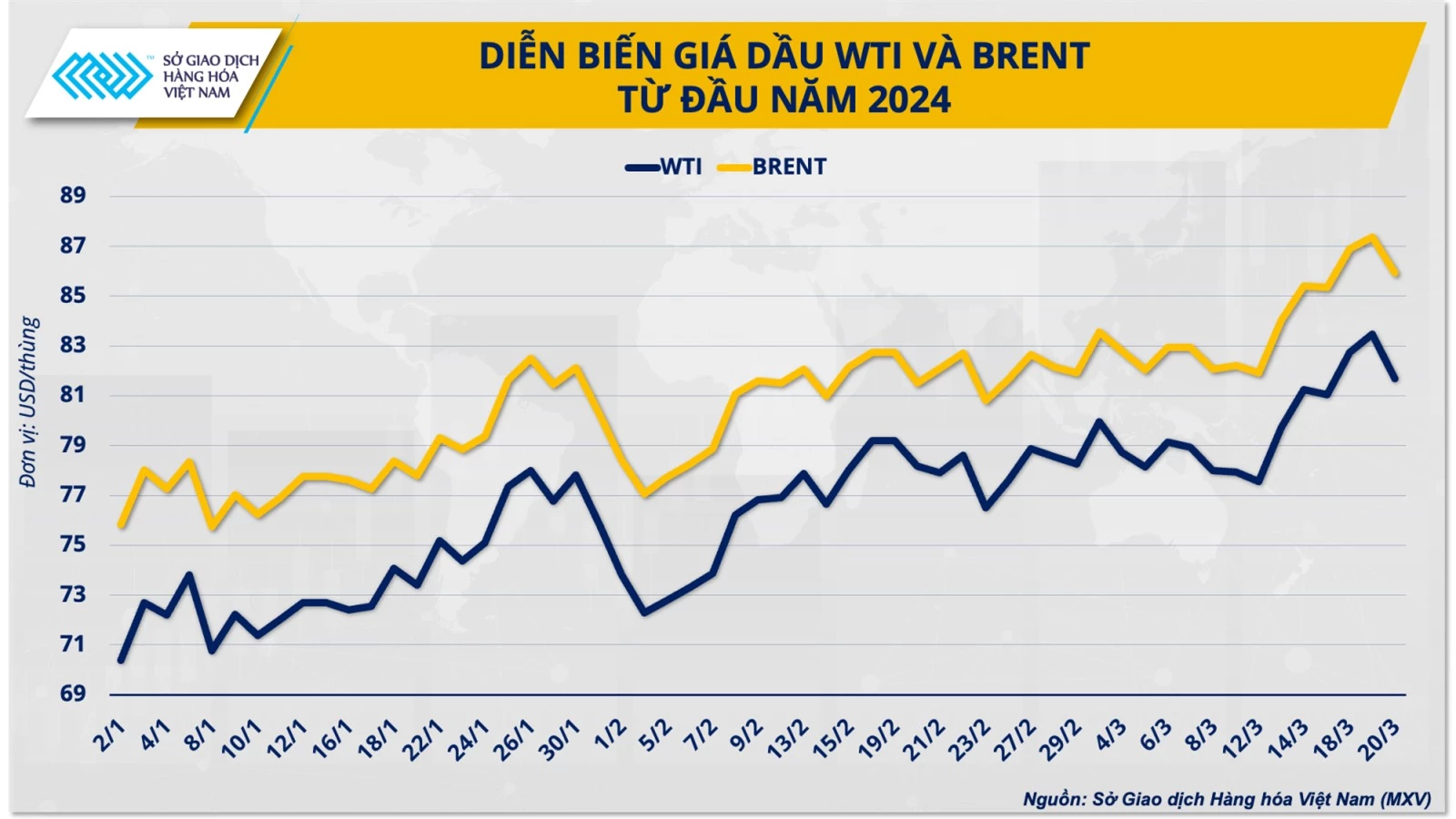

As a general rule, a $10 increase in oil prices raises global inflation by about 0.3 percentage points. WTI crude briefly touched $80 a barrel in February, up about 13% since the start of the year. In line with global crude oil prices, U.S. retail gasoline prices rose 3.8% last month, the biggest increase among the basket of goods used to measure the CPI.

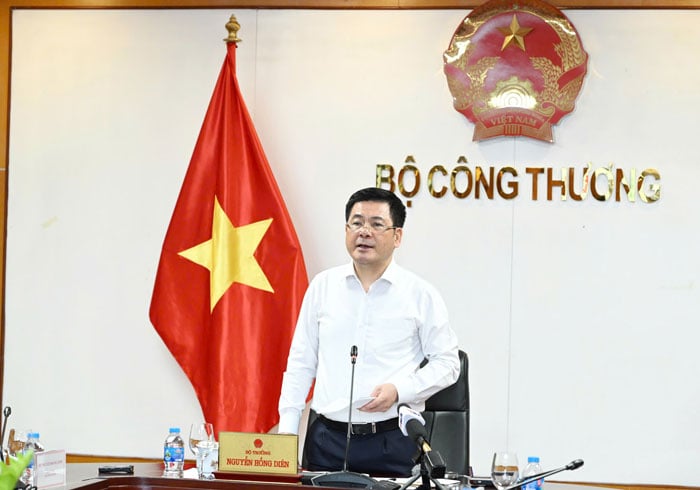

Mr. Duong Duc Quang, Deputy General Director of the Vietnam Commodity Exchange (MXV) said: “The 2.3% increase in the energy group and the 0.4% increase in the housing group accounted for nearly 65% of the total increase in the US CPI in February. This trend is expected to continue and create a major obstacle for the Fed's fight against inflation.”

In its March Short-Term Energy Outlook, the US Energy Information Administration (EIA) said the global crude oil market will have a deficit of about 870,000 barrels per day in the second quarter. EIA forecasts that WTI oil prices may approach the $85/barrel range. Given the close correlation between energy prices and inflation, the Fed's interest rate cut cycle this year may have many surprises.

The timing of interest rate cuts remains a mystery.

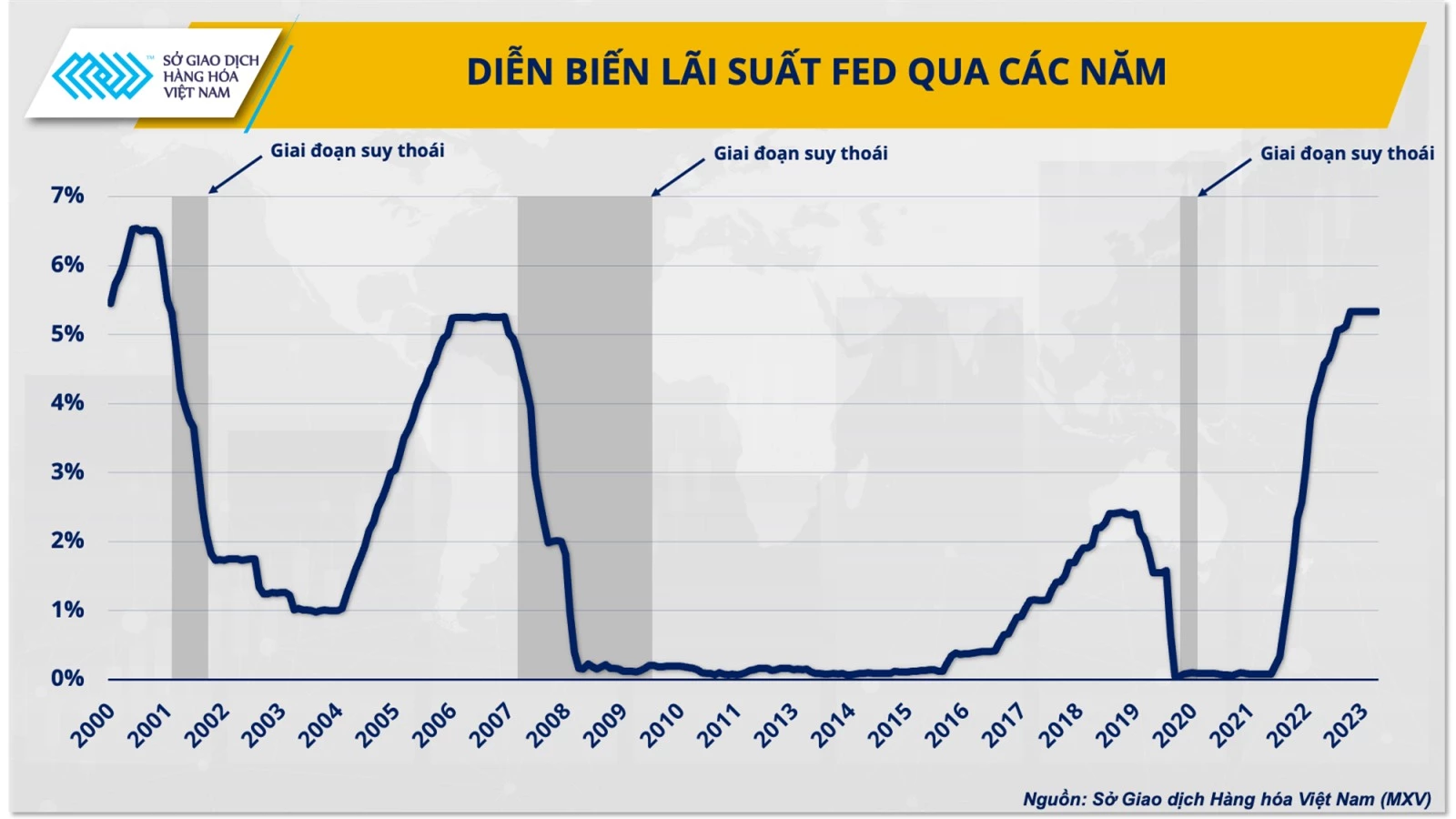

At the conclusion of its two-day meeting on March 19-20, the Fed maintained its outlook for three rate cuts this year. However, officials revised down their expectations for rate cuts in 2025. Policymakers now expect only three cuts next year, down from four as forecast in December.

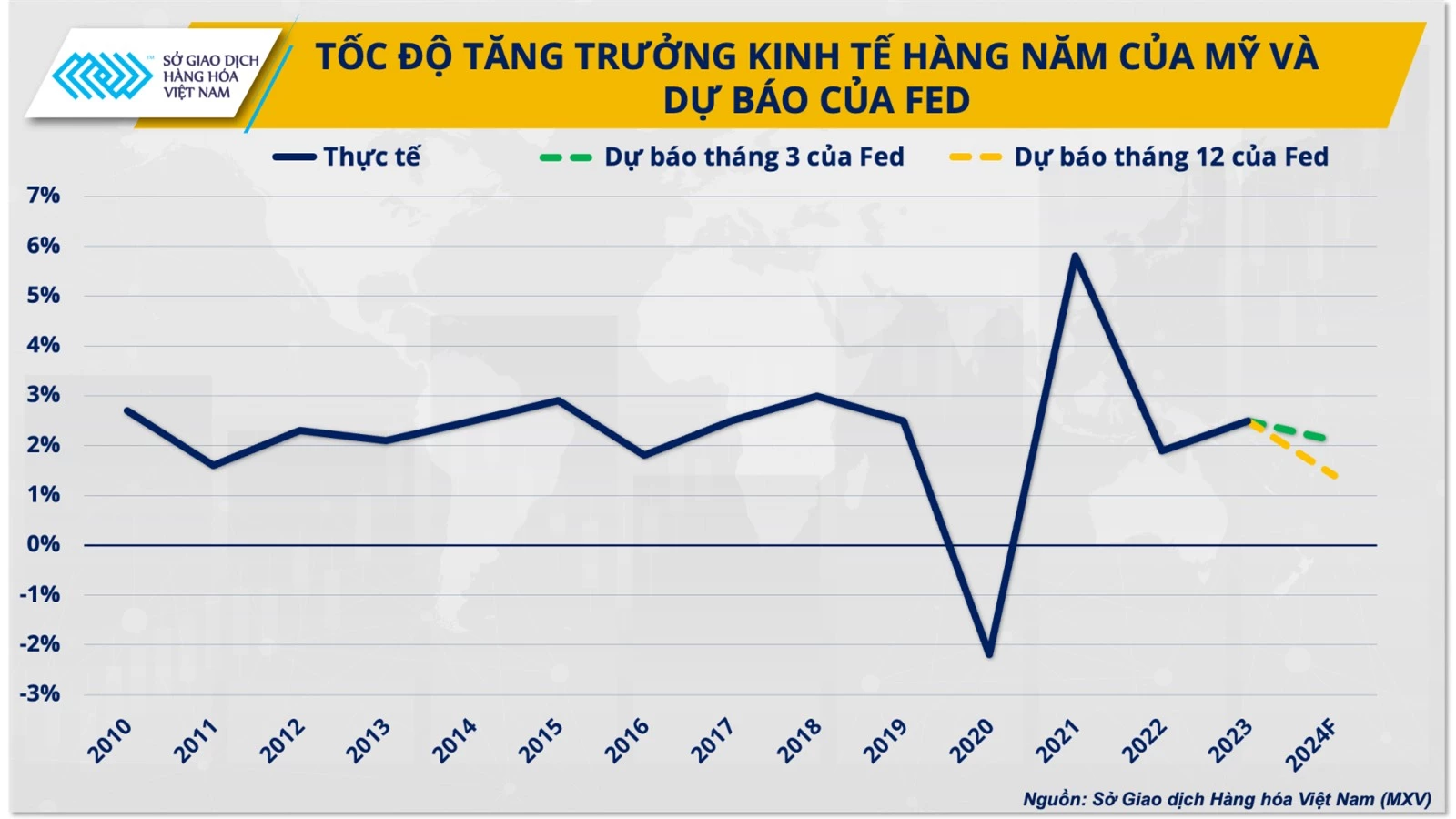

The strength of the US economy will be the basis for the Fed's decision to slow down the process of reducing interest rates. Specifically, the Fed said that US growth in 2024 will reach 2.1%, 0.7 percentage points higher than estimated.

Previously, the market was very optimistic that the Fed would soon pivot its policy in 2024, possibly starting as early as March with a series of forecasts from banks. Even UBS Investment Bank, a large bank from Switzerland, said that the Fed would cut interest rates by 275 basis points this year.

Market optimism was further boosted at the December meeting, when the Fed sent a more dovish message for the first time, acknowledging positive developments in inflation and projecting a 75 basis point rate cut in 2024.

However, market confidence has been shaken by the strong impact of inflation that unexpectedly rebounded in January. That makes the timing of interest rate cuts still unknown, but it is almost certain that the Fed will pivot its policy later this year.

Thus, the Fed's more than year-long monetary tightening policy is gradually coming to an end. The path to finding a solution to the problem of inflation - increasing interest rates is gradually giving way to the problem of lowering interest rates - growth.

Is the Fed's "soft landing" scenario still promising?

Despite the Fed keeping interest rates high for more than a year, the US economy has held up surprisingly well in 2023. The country's GDP grew at a 3.3% pace in the fourth quarter of 2023, marking a strong end to a year when many economists thought the US would fall into recession.

For now, the Fed is still successful in keeping demand growth while minimizing price pressures. However, besides the positive factors, there are still risks for the world's number 1 economy.

“Cost-push inflation, caused by rising global energy prices, is beyond the Fed’s control. Although there is still a 70% chance that the US will continue to escape a recession this year, the Fed’s continued delay in pivoting policy and trying to pursue its inflation target could put pressure on the economy in the medium term,” said Duong Duc Quang.

Indeed, the current US economic picture has begun to show “blurred spots” as monetary policy really begins to sink in. Consumer spending, which accounts for two-thirds of US economic activity, started 2024 on a sluggish note, even weakening 1.1% in the first month of the year compared to the same period last year.

On the labor market, the US unemployment rate also jumped to 3.9% in February after holding at 3.7% for three consecutive months. Moreover, inflation risks remain a major drag on US economic growth. According to a recent survey by Morgan Stanley, coping with inflation remains the top concern for US consumers, except for those with incomes above $150,000.

The US economy could face a greater risk of weakening later this year, as history has shown that the time when the Fed cuts interest rates is also the time when the US is at risk of falling into recession. As in 2000 and 2008, the US economy suffered two major recessions just 4 to 6 months after the Fed started cutting interest rates.

According to VNA

Source

![[Photo] Special supplement of Nhan Dan Newspaper reaches readers in the south](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/cbaf889a1edf4201b172de308c84dfab)

![[Photo] Party and State leaders commemorate Uncle Ho in Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/af98c337ab8b4d709c4391d877642b4a)

Comment (0)