ANTD.VN - The State Bank of Vietnam (SBV) has just announced to collect opinions on the draft proposal to develop a Decree regulating the service of using telecommunications accounts to pay for goods and services in Vietnam (Mobile-Money).

More than 159 million Mobile – Money transactions after 2 years of piloting

Mobile-Money service has been approved for pilot implementation under Decision 316/QD-TTg with 03 enterprises approved to pilot from November 2021 to present.

Based on the reports of 3 pilot enterprises on customer development as of the end of September 2024, the total number of accounts registered and using Mobile-Money services is more than 9.8 million accounts (Viettel accounts for 73%, VNPT-Media accounts for 21%, MobiFone accounts for 6%), of which the number of customer accounts registered and using the service in rural, mountainous, remote, border and island areas is more than 7.1 million accounts (accounting for nearly 72% of the total number of accounts registered and using the service).

The total number of transactions via customers' Mobile-Money accounts from the pilot implementation to the end of September 2024 (including deposit/withdrawal/money transfer/payment transactions) is more than 159 million transactions with a total transaction value of nearly VND 5,685 billion.

Accordingly, the State Bank believes that maintaining the Mobile-Money service will ensure a smooth payment process, meeting the needs of more than 9.8 million Mobile-Money accounts of customers using the service, especially more than 7 million customers in rural, remote, border and island areas of Vietnam.

At the same time, maintain a cashless payment method, increase customer experience at payment acceptance units, most of which are payment acceptance units connected to the National Public Service Portal.

|

State Bank proposes to develop Decree on Mobile-Money |

Meanwhile, in terms of legal basis, the State Bank said that telecommunications enterprises providing Mobile-Money services are not subject to the application and scope of regulation of the Law on Credit Institutions 2024 as well as the Law on the State Bank, Decree 52/2024/ND-CP; at the same time, Mobile-Money services are not payment services through or without customers' payment accounts, nor are they a means of payment and have not been officially regulated in any legal document.

Therefore, according to the State Bank, to have an official legal corridor for Mobile-Money after the pilot period, the Government needs to issue a decree regulating this service.

Increase transaction limits, prioritize implementation in rural and mountainous areas...

According to the draft of the State Bank, the scope of this Decree only regulates the service of using telecommunications accounts to pay for goods and services in Vietnam (Mobile-Money service), not including other payment services.

Regarding the applicable subjects, the State Bank proposes to maintain the provisions of Decision 316. Specifically: Enterprises with a License to operate as an intermediary payment service provider for e-wallets and a License to establish a public terrestrial mobile telecommunications network using radio frequency bands or a subsidiary that is permitted by the parent company with a License to establish a public terrestrial mobile telecommunications network using radio frequency bands to use telecommunications infrastructure, networks, and data.

The service deployment is applied nationwide, in which service providers must prioritize the deployment of Mobile-Money services in rural, mountainous, remote, border and island areas of Vietnam.

Service providers are only allowed to provide Mobile-Money services to transfer money and pay for legal goods and services in Vietnam according to current laws to serve people's living needs; service implementation only applies to legal domestic transactions according to Vietnamese laws in Vietnamese Dong, and are not allowed to make payments or transfer money for goods and services provided across borders.

Regarding opening and using Mobile-Money accounts, the draft Decree proposes to increase the transaction limit of Mobile-Money accounts.

At the same time, regulations apply biometric verification in the process of opening an online Mobile-Money account; Consider expanding some operations after the Mobile-Money service is accurately authenticated through many steps.

In addition, the draft Decree also proposes regulations on documents, procedures, conditions for providing Mobile-Money services; on the responsibilities of relevant parties in State management of this service...

The State Bank of Vietnam (SBV) has just announced a request for comments on a draft proposal to develop a Decree regulating the service of using telecommunications accounts to pay for goods and services in Vietnam (Mobile-Money).

Source: https://www.anninhthudo.vn/hon-159-trieu-giao-dich-sau-2-nam-thi-diem-nhnn-de-xuat-xay-dung-nghi-dinh-ve-mobile-money-post594260.antd

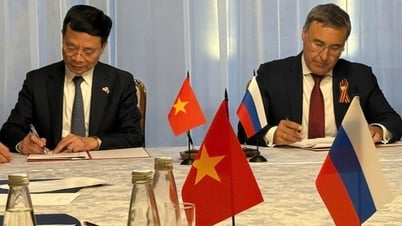

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)