According to a survey by Lao Dong Newspaper reporters at nearly 30 banks in the system, 6-month savings interest rates are fluctuating around 3.25 - 5.5%/year.

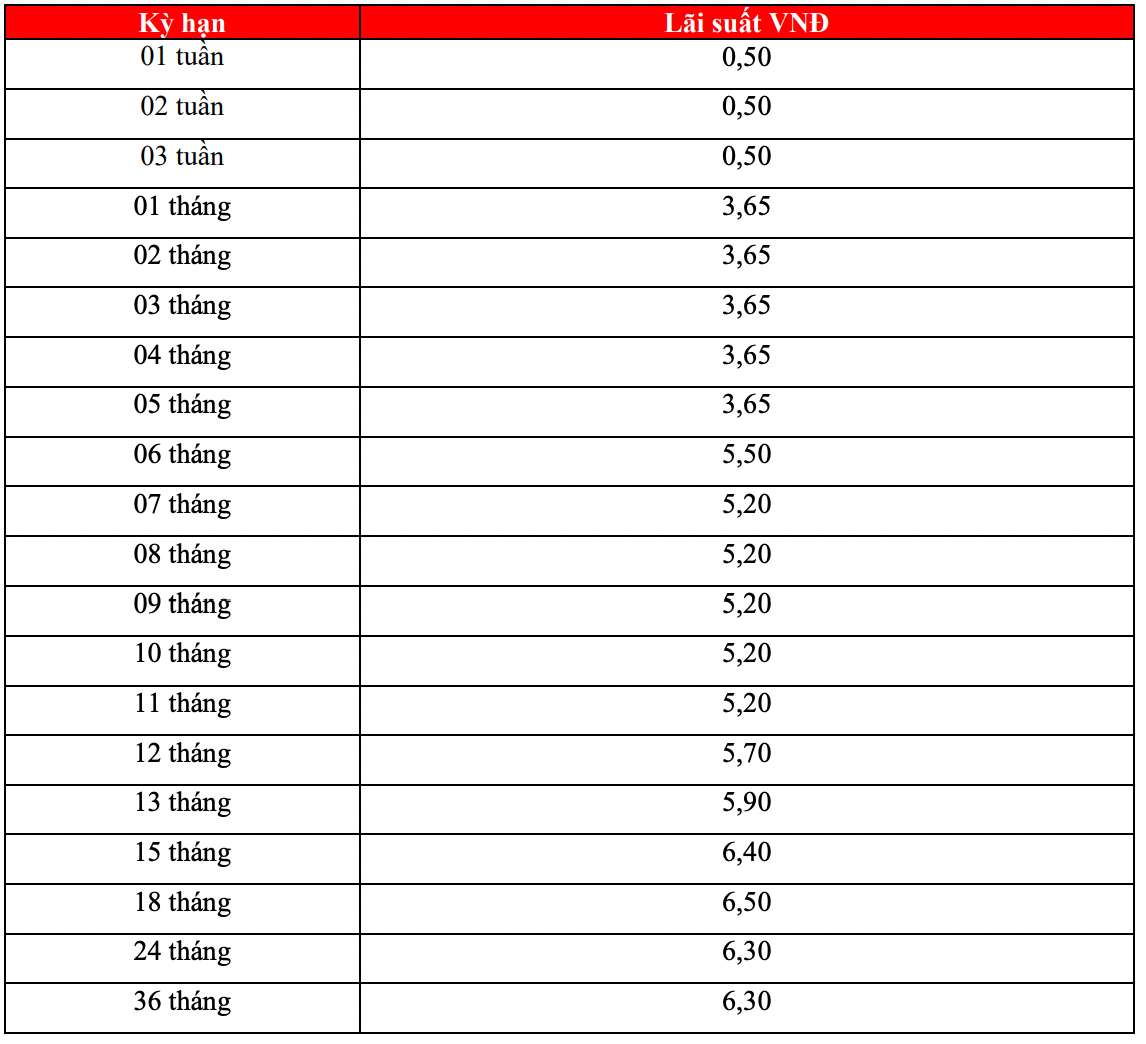

Leading the banks in the survey, HDBank is listing the highest 6-month term interest rate at 5.5%/year when customers deposit money online. In addition, the highest interest rate under normal conditions that HDBank is listing is 6.5%/year when customers deposit money online for an 18-month term.

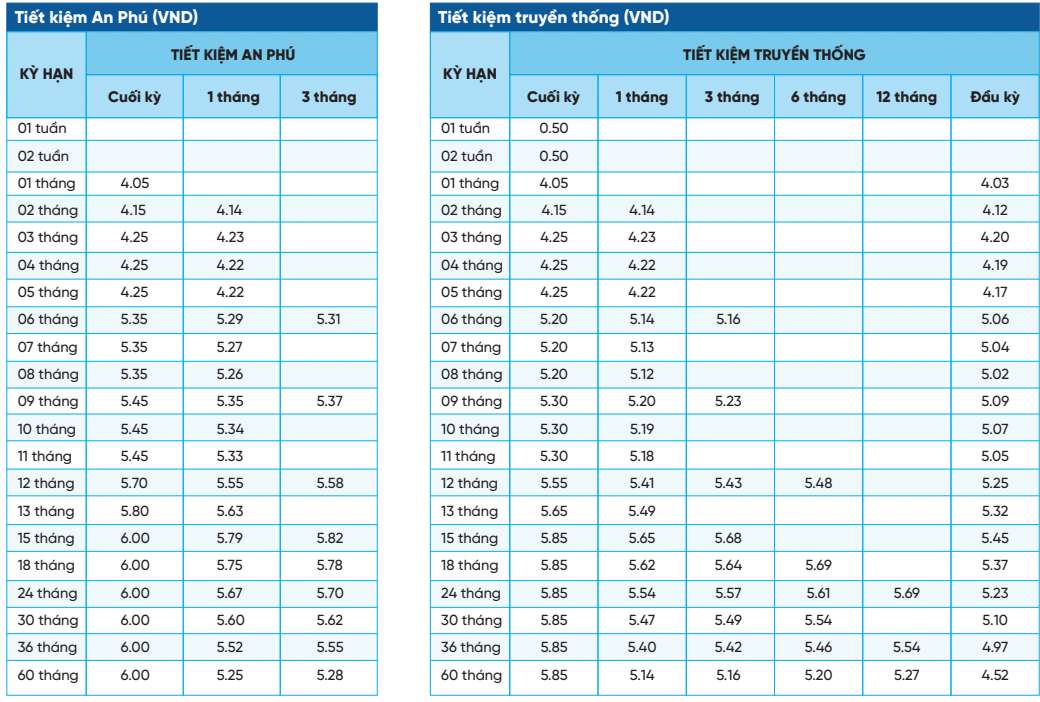

Customers who deposit money at NCB for 6 months receive the highest interest rate of 5.35%/year when depositing in An Phu savings. Customers who deposit money in traditional savings receive a lower interest rate of 5.2%/year.

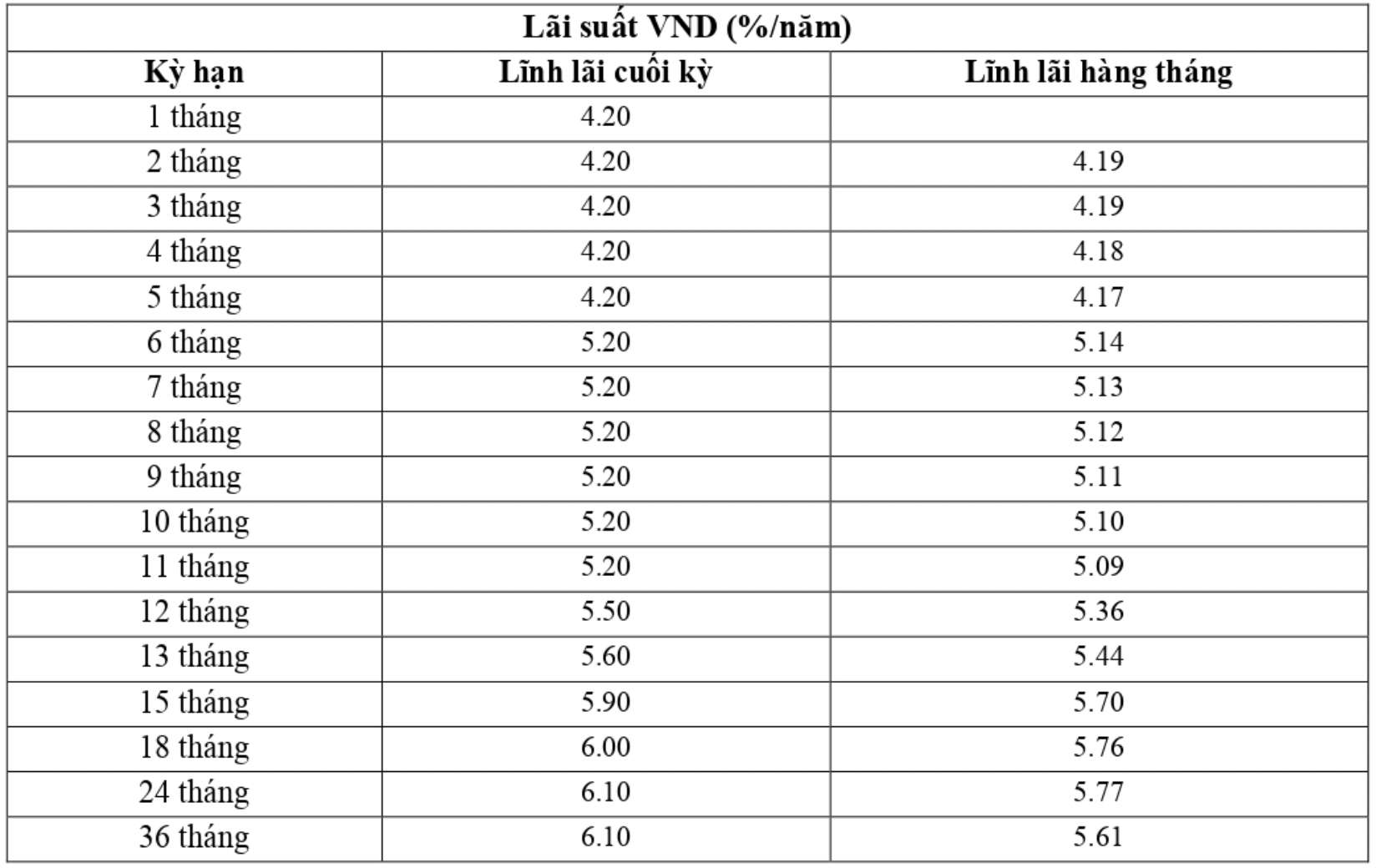

VietABank is listing the highest 6-month interest rate at 5.2%/year when customers receive interest at the end of the term. Customers receiving interest monthly receive the highest interest rate at 5.14%/year.

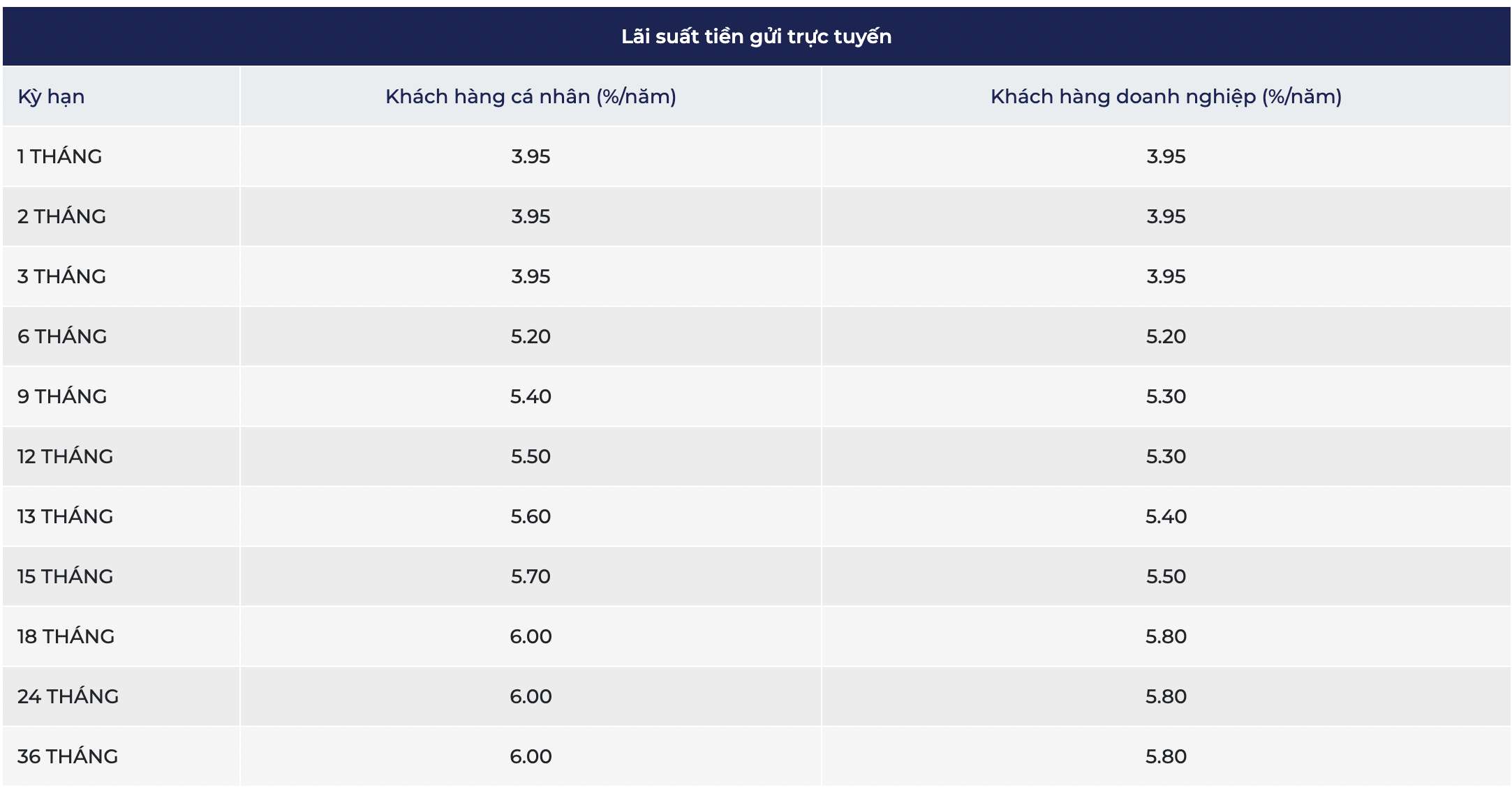

KienlongBank lists the 6-month savings interest rate at 5.2%/year when customers deposit money online. Customers receive the highest interest rate of 6%/year when depositing savings online at KienlongBank from 18-36 months.

KienlongBank's savings interest rates are listed from 3.95-6%/year.

How much interest do I receive if I deposit 1 billion VND for a 6-month term?

You can quickly calculate bank interest using the following formula:

Interest = Deposit x interest rate (%)/12 months x number of months of deposit

For example, you deposit 1 billion VND in Bank A, with an interest rate of 5.5% for a 6-month term. The interest you receive is estimated at:

Interest = 1 billion VND x 5.5%/12 x 6 months = 27.5 million VND.

So, before saving, you should compare savings interest rates between banks and interest rates between terms to get the highest interest.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.

Source

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)