| Gold price today plummeted, 999.9 gold ring fell below 69 million VND/tael. Gold price today "skyrocketed", 999.9 gold ring is 1.5 million VND more expensive than yesterday. |

Domestic gold price

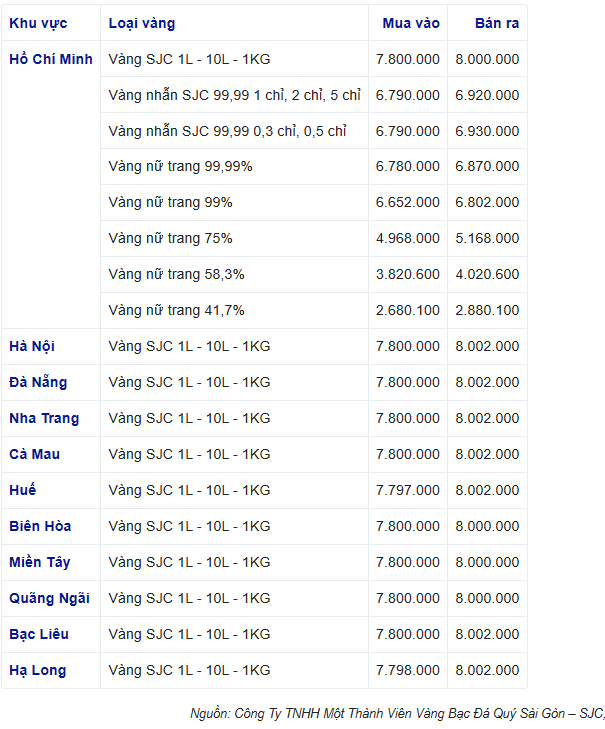

At noon on March 22, the price of SJC gold decreased by 1 million VND compared to yesterday. Specifically, the price of SJC gold traded at Saigon Jewelry Company in Ho Chi Minh City was around 78.00 - 80.00 million VND/tael, down 1 million VND/tael for buying and 1 million VND/tael for selling compared to yesterday's closing price. The difference between buying and selling is 2 million VND/tael.

|

The price at Saigon Jewelry Company in Hanoi is around 78.00 - 80.02 million VND/tael, down 1.2 million VND/tael for buying and 1.2 million VND/tael for selling compared to yesterday's closing price. The difference between buying and selling is 2 million VND/tael.

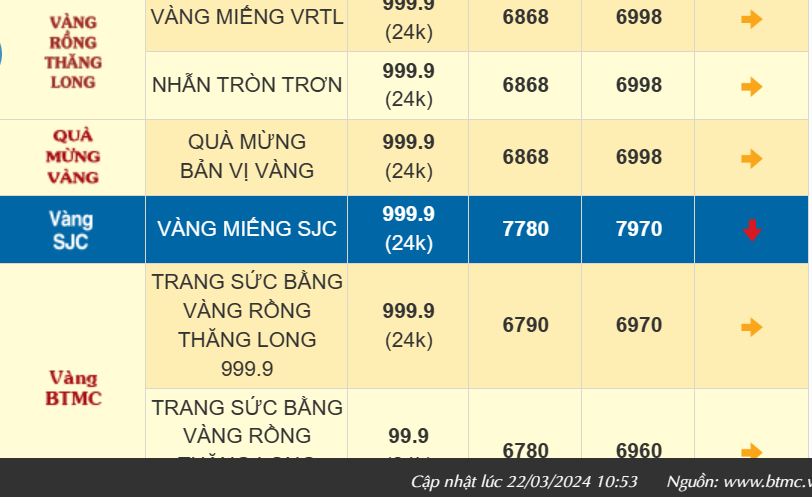

The price of SJC gold bars at Bao Tin Minh Chau Company is trading around 77.80 - 79.70 million VND/tael, down 1.45 VND/tael for buying and down 1.5 million VND/tael for selling compared to the previous closing price.

At Phu Quy Group, the price of SJC gold bars is currently trading around 77.60 - 79.60 million VND/tael for buying and selling, down 1.3 million VND/tael for buying and down 1.4 million VND/tael for selling compared to yesterday.

|

The price of SJC gold bars at Bao Tin Manh Hai Company is trading around 77.80 - 79.80 million VND/tael, down 1.3 million VND/tael for buying and down 1.4 million VND/tael for selling compared to the previous closing price.

In addition, the price of 999.9 gold rings (24k) reversed to decrease following the world price, the difference between buying and selling for some types was up to 2 million VND/tael. Specifically, the price of Thang Long dragon gold bars and plain round rings at Bao Tin Minh Chau Company was traded at 68.68 - 69.98 million VND/tael for buying and selling, down 750 thousand VND/tael for buying and down 780 thousand VND/tael for selling compared to yesterday.

Thang Long 999.9 (24k) gold jewelry is trading around 67.90 - 69.70 million VND/tael, down 650 million VND/tael for buying and down 700 thousand VND/tael for selling compared to yesterday.

|

| Gold price traded at Bao Tin Manh Hai |

Similarly, Thang Long Gold Dragon blister rings and Kim Gia Bao blister rings are being traded at Bao Tin Manh Hai Company at around 68.68 - 69.98 million VND/tael for buying and selling, down 700,000 VND/tael for buying and down 750,000 VND/tael for selling compared to yesterday's closing price.

The price of 999.9 gold is around 67.70 - 69.70 million VND/tael, down 650 thousand VND/tael for buying and down 650 thousand VND/tael for selling compared to yesterday's closing price. The price of 99.9 gold is currently around 67.60 - 69.60 million VND/tael, down 650 thousand VND/tael for buying and down 650 thousand VND/tael for selling compared to yesterday's closing price.

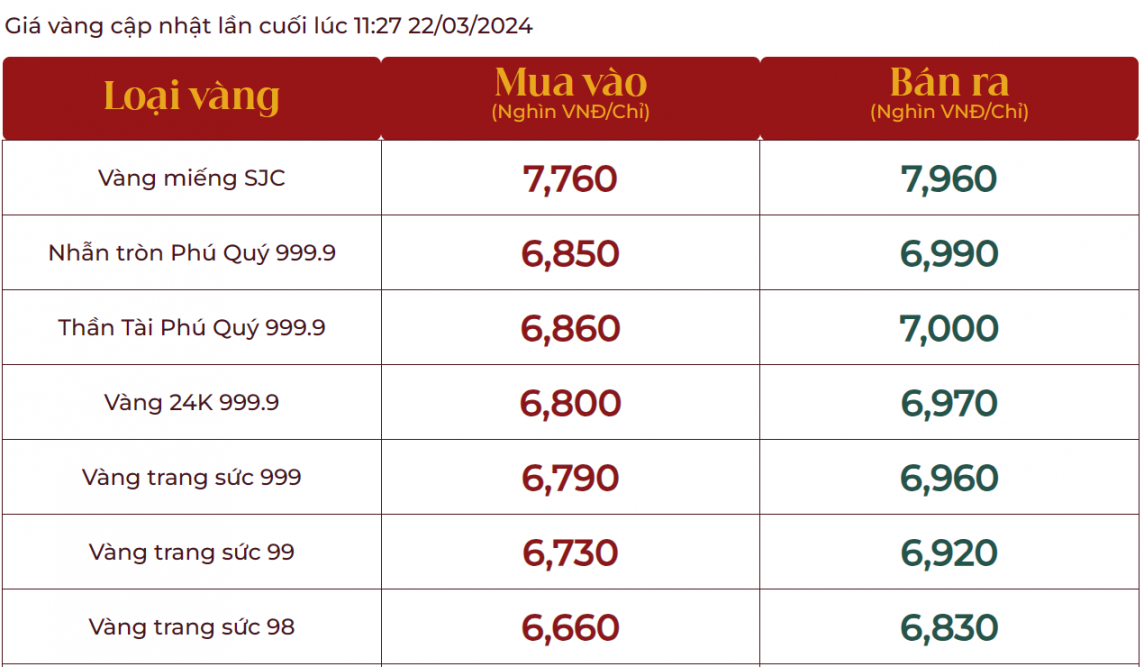

At Phu Quy Group, Phu Quy 999.9 round rings and Phu Quy 999.9 God of Wealth rings are trading around 68.50 - 69.90 VND/tael, down 800,000 VND/tael for buying and down 800,000 VND/tael for selling compared to yesterday.

|

| Gold price traded at Phu Quy Group |

24K 999.9 gold is trading around 68.00 - 69.70 million VND/tael, down 300 thousand VND/tael for buying and down 450 thousand VND/tael for selling compared to yesterday.

World gold price

At noon today (Hanoi time), the world spot gold price was around 2,174 USD/ounce, down more than 27 USD/ounce compared to the same time yesterday morning.

|

| World gold price chart this afternoon |

Closing the session last night - early this morning (Hanoi time), the world spot gold price in the US market stood at 2,181 USD/ounce, down more than 24 USD/ounce compared to the previous session. The domestic gold market stood at yesterday's session, March 21, the price of SJC gold bars also plummeted compared to the previous session.

Despite the decline in this session, however, according to experts, as a safe haven, gold has become attractive to investors, as central banks reduce lending costs. Expert Chris Weston of Pepperstone Group commented that the US Federal Reserve's acceptance of inflation and the current labor market situation is a green signal for gold investors.

BNP Paribas commodity strategist David Wilson also said that demand for gold from retailers and investors in China is increasing and that is also a strong driver for the precious metal.

Buying momentum appears to have run out and gold is correcting, as the market becomes a little less concerned about the Fed’s interest rate guidance in 2024, said Daniel Ghali, commodity strategist at financial brokerage TD Securities.

Despite recent high inflation readings, Chairman Jerome Powell said the Fed still has room to cut interest rates by 0.75 percentage points through the end of 2024.

Traders see a 72% chance the Fed will start cutting rates by June 2024, up from 65% before the decision from the latest meeting.

Source

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)