| World gold price at historic high, domestic 999.9 gold ring price exceeds 71 million VND/tael. Gold price today reversed sharply, 999.9 gold ring price sold at 70.58 million VND/tael. |

Domestic gold price

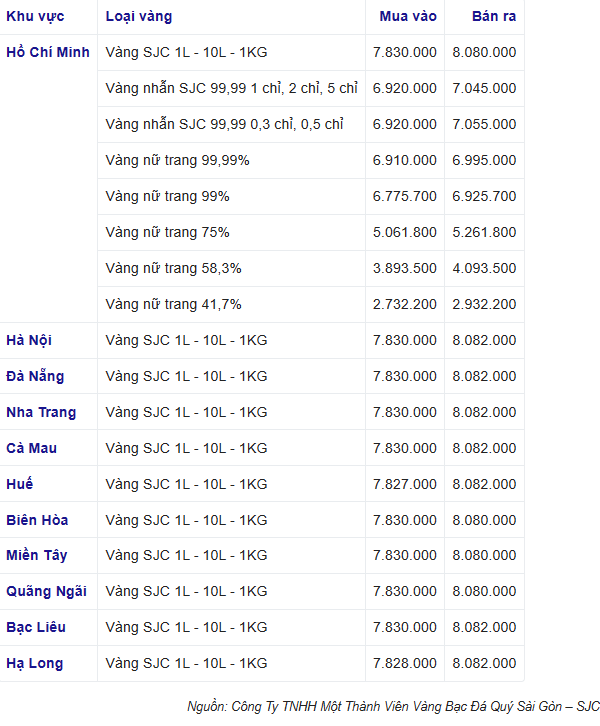

At noon on March 31, the price of SJC gold traded at Saigon Jewelry Company in Ho Chi Minh City was around 78.30 - 80.80 million VND/tael, an increase of 100 thousand VND/tael for buying and 100 thousand VND/tael for selling compared to the closing price yesterday. The difference between buying and selling is 2.5 million VND/tael.

|

The price at Saigon Jewelry Company in Hanoi is around 78.30 - 80.82 million VND/tael, an increase of 100 thousand VND/tael for buying and 100 thousand VND/tael for selling compared to yesterday's closing price. The difference between buying and selling is 2.5 million VND/tael.

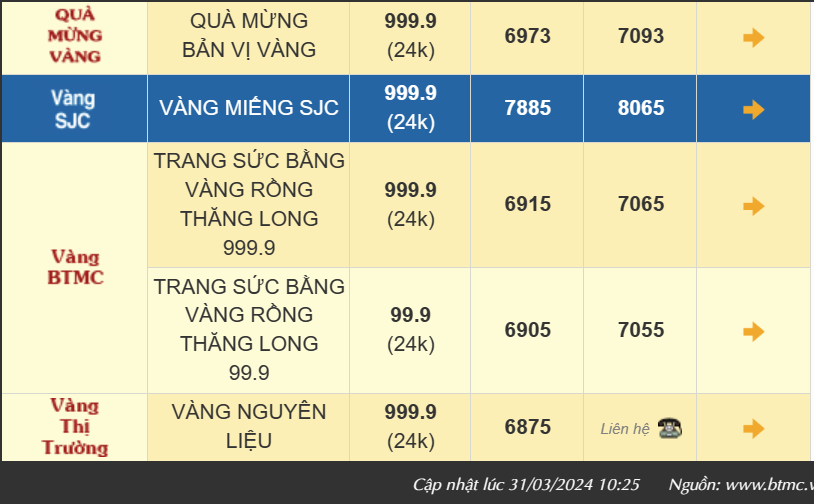

The price of SJC gold bars at Bao Tin Minh Chau Company is trading around 78.85 - 80.65 million VND/tael, an increase of 200 thousand VND/tael for buying and 100 thousand VND/tael for selling compared to the previous closing price.

At Phu Quy Group, the price of SJC gold bars is currently trading around 78.40 - 80.70 million VND/tael for buying and selling, an increase of 100,000 VND/tael for buying and an increase of 100,000 VND/tael for selling compared to yesterday.

|

The price of SJC gold bars at Bao Tin Manh Hai Company is trading around 78.45 - 80.65 million VND/tael, an increase of 100,000 VND/tael for buying and 100,000 VND/tael for selling compared to the previous closing price.

Along with the upward trend in SJC gold prices, the price of 999.9 gold rings today also increased sharply. Specifically, the price of 999.9 gold rings (24k), Thang Long gold dragon gold bars, and plain round rings at Bao Tin Minh Chau Company traded at 69.73 - 70.93 million VND/tael for buying and selling, an increase of 530 thousand VND/tael for buying and an increase of 580 thousand VND/tael for selling compared to yesterday.

|

| Gold price traded at Bao Tin Manh Hai |

Thang Long 999.9 (24k) gold jewelry is trading around 69.05 - 70.55 million VND/tael, an increase of 350 million VND/tael for buying and 350 thousand VND/tael for selling compared to yesterday.

Similarly, Thang Long Gold Dragon blister rings and Kim Gia Bao blister rings are being traded at Bao Tin Manh Hai Company at around 69.73 - 70.93 million VND/tael for buying and selling, up 350 thousand VND/tael for buying and up 350 thousand VND/tael for selling compared to yesterday's closing price.

The price of 999.9 gold is around 69.10 - 70.60 million VND/tael, an increase of 450 thousand VND/tael for buying and an increase of 300 thousand VND/tael for selling compared to yesterday's closing price. The price of 99.9 gold is currently around 69.00 - 70.50 million VND/tael, an increase of 450 thousand VND/tael for buying and an increase of 300 thousand VND/tael for selling compared to yesterday's closing price.

|

| Gold price traded at Phu Quy Group |

At Phu Quy Group, Phu Quy 999.9 round rings and Phu Quy 999.9 God of Wealth rings are trading around 69.60 - 70.80 VND/tael, an increase of 250 thousand VND/tael for buying and 250 thousand VND/tael for selling compared to yesterday.

24K 999.9 gold is trading around 68.90 - 70.40 million VND/tael, up 100 thousand VND/tael for buying and up 100 thousand VND/tael for selling compared to yesterday.

World gold price

Closing the trading day on March 31, the world gold price stopped at 2,233 USD/ounce. Thus, after 1 week of trading, the world gold price increased by 68.5 USD/ounce, equivalent to 3.16% compared to the end of last week.

|

| Gold price traded at Phu Quy Group |

At this level of world gold, SJC gold is converted to about 67 million VND/tael. Thus, the price of SJC gold is only about 13.5 million VND/tael higher than the world gold price. This is the lowest level in 2024.

Some analysts say gold is gaining momentum as inflation becomes less of a threat. Last week, the Federal Reserve signaled it still looks for three interest rate cuts this year even as it sees inflation holding above its 2% target.

The gold rally is a signal that investors are worried that the Fed will not be able to control inflation when it starts cutting interest rates, said Darin Newsom, senior market analyst at Barchart.

“Geopolitical concerns remain and will only continue to increase as we get closer to the November US elections. If the Fed starts cutting rates, bond yields will fall, making gold a more attractive safe haven,” he said.

At the same time, some analysts note that the US dollar is losing influence in the gold market as US government debt continues to rise.

Source

Comment (0)