| Domestic gold prices have cooled down, 999.9 gold rings fell below the 78 million VND/tael mark. Domestic gold prices reversed and increased rapidly, SJC gold reached the 85 million VND/tael mark. |

Gold price domestic

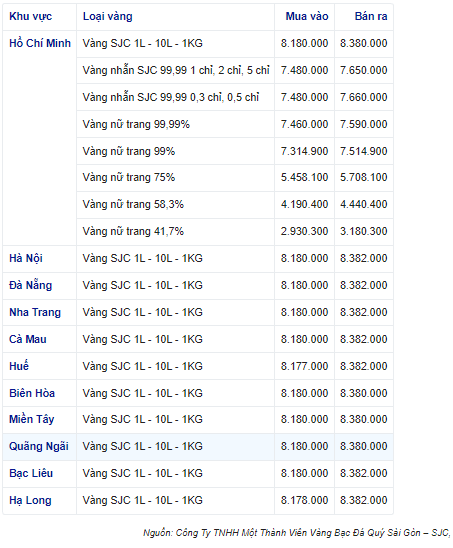

At noon on April 13, the domestic gold price reversed and plummeted, with yesterday's buyers losing nearly 2 million VND. Currently, the SJC gold price at Saigon Jewelry Company in Ho Chi Minh City is trading around 81.80 - 83.80 million VND/tael, down 100,000 VND/tael for buying and 100,000 VND/tael for selling compared to yesterday. The difference between buying and selling is 2 million VND/tael.

|

The price at Saigon Jewelry Company in Hanoi is around 81.80 - 83.82 million VND/tael, down 100 thousand VND/tael for buying and down 100 thousand VND/tael for selling compared to yesterday. The difference between buying and selling is 2 million VND/tael.

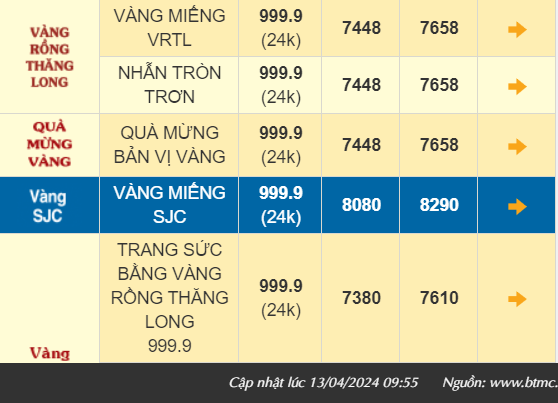

The price of SJC gold bars at Bao Tin Minh Chau Company is trading around 80.80 - 82.90 million VND/tael, down 1.2 million VND/tael for buying and down 2.1 million VND/tael for selling compared to yesterday.

At Phu Quy Group, the price of SJC gold bars is currently trading around 80.80 - 83.00 million VND/tael for buying and selling, down 1.2 million VND/tael for buying and down 2 million VND/tael for selling compared to yesterday.

The price of SJC gold bars at Bao Tin Manh Hai Company is trading around 80.60 - 83.10 million VND/tael, down 1.4 million VND/tael for buying and down 1.9 million VND/tael for selling compared to the previous session.

|

Along with the price of SJC gold, the price of 999.9 gold rings today turned around and dropped by nearly 2 million VND. Specifically, the price of 999.9 gold rings (24k), the price of Thang Long gold dragon gold bars, and plain round rings at Bao Tin Minh Chau Company traded at 73.48 - 76.58 million VND/tael for buying and selling, down 1.4 million VND/tael for buying and down 1.4 million VND/tael for selling compared to yesterday.

Thang Long 999.9 (24k) gold jewelry is trading around 73.80 - 76.10 million VND/tael, down 700 thousand VND/tael for buying and down 600 thousand VND/tael for selling compared to yesterday.

|

| Gold price traded at Bao Tin Manh Hai |

Similarly, Thang Long Gold Dragon blister rings and Kim Gia Bao blister rings are being traded at Bao Tin Manh Hai Company at around 74.48 - 76.58 million VND/tael for buying and selling, down 1.4 million VND/tael for buying and down 1.3 million VND/tael for selling compared to yesterday.

The price of 999.9 gold is around 73.80 - 76.10 million VND/tael, down 1.4 million VND/tael for buying and 1.4 million VND/tael for selling compared to yesterday's session. The price of 99.9 gold is currently around 73.70 - 76.00 million VND/tael, down 1.4 million VND/tael for buying and 1.4 million VND/tael for selling compared to yesterday's session.

|

| Gold price traded at Phu Quy Group |

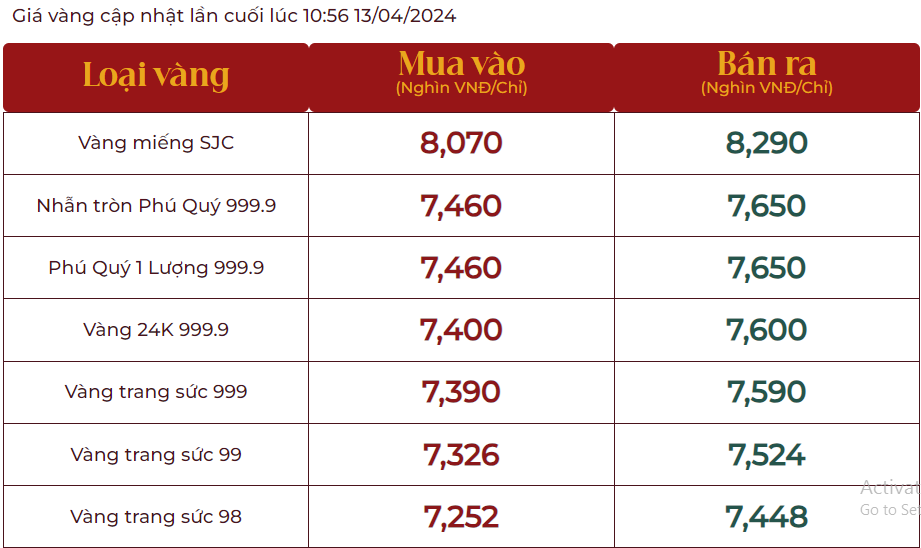

At Phu Quy Group, Phu Quy 999.9 round rings and Phu Quy 999.9 God of Wealth rings are trading around 74.60 - 76.50 million VND/tael, down 1.8 million VND/tael for buying and down 1.7 million VND/tael for selling compared to yesterday.

24K 999.9 gold is trading around 74.00 - 76.00 million VND/tael, down 1.4 million VND/tael for buying and 1.6 million VND/tael for selling compared to yesterday.

World gold price

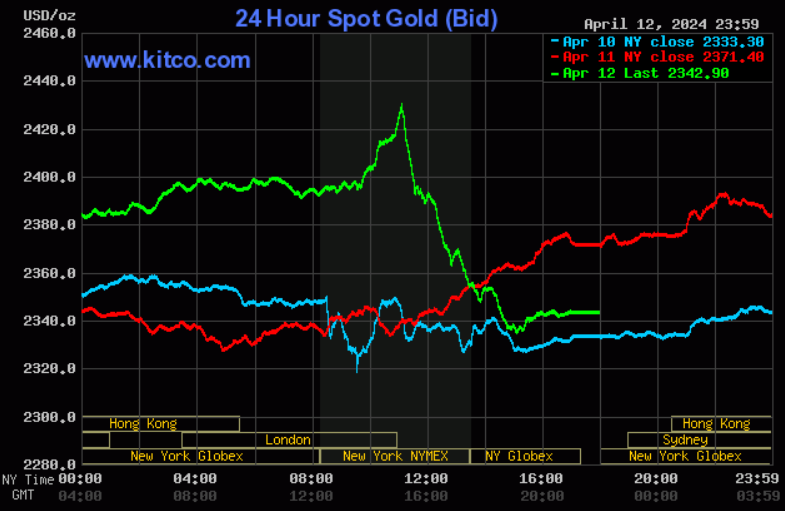

Early this morning, world gold prices turned down with spot gold falling 27.5 USD to 2,343.9 USD/ounce. Gold futures last traded at 2,360.1 USD/ounce, down 30.5 USD compared to early yesterday morning.

|

| World gold price chart (Source: Kitco) |

The world gold price is equivalent to nearly 71.2 million VND/tael if converted at Vietcombank exchange rate, excluding taxes and fees. The difference between domestic and world gold prices is about 13 million VND/tael.

The producer price index (PPI) rose 0.2% month-on-month in March 2024, lower than the 0.3% increase economists had expected, the US Department of Labor reported.

Investors are starting to accept the possibility that inflation could last longer and that the US Federal Reserve (Fed) will continue to be patient, not reversing monetary policy.

Economic data suggests that inflation toward the Fed’s 2% target may be too difficult for the Fed, with traders betting that the Fed could start cutting rates as soon as its meeting in late July 2024.

More and more analysts are optimistic that gold prices could reach $3,000 an ounce this year. Shaokai Fan, director of Asia-Pacific (excluding China) and global head of central banks at the World Gold Council, said strong buying demand from central banks is one of the main reasons for this situation.

According to statistics from the World Gold Council, central banks have been net buyers of gold for 14 consecutive years (net buyers since 2009, after the global economic crisis). Geopolitical instability and expectations that the US Federal Reserve (Fed) will cut interest rates this year have further increased this demand.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)