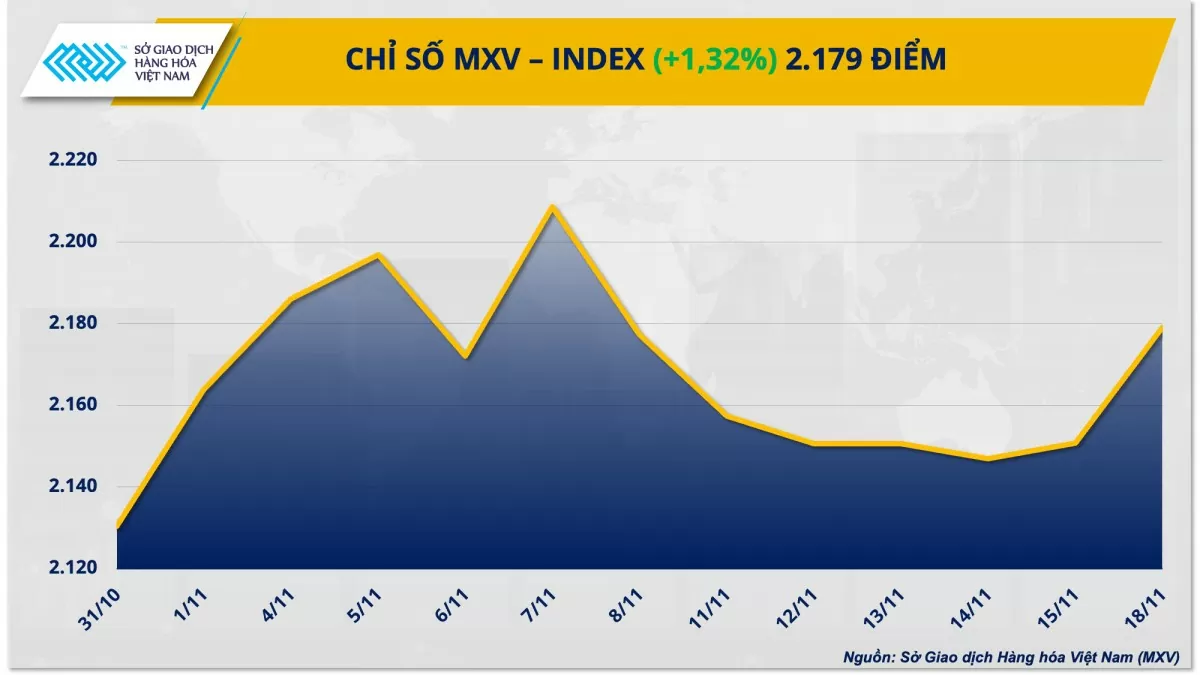

Energy and metal prices rose sharply, with crude oil prices surging thanks to new developments in the international market. In addition, the metal market also recorded positive developments with the recovery of silver and platinum. At the close, the MXV-Index increased by 1.32% to 2,179 points.

|

| MXV-Index |

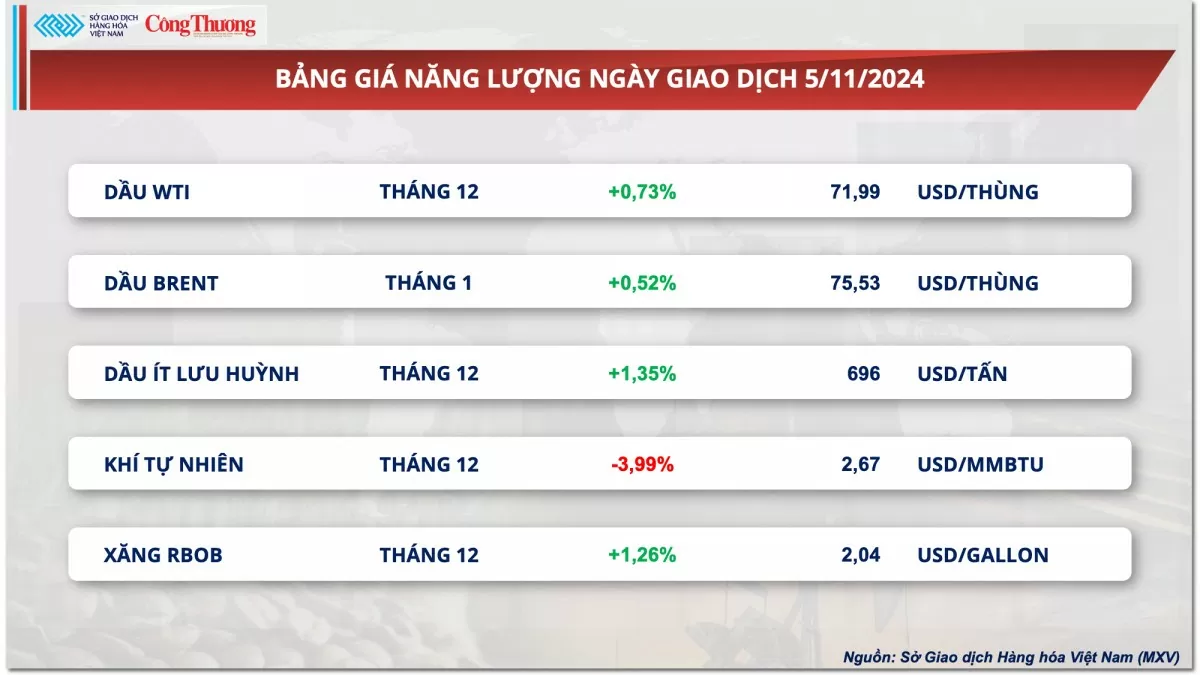

Crude oil prices rose sharply again

At the end of the first trading session of the week, world crude oil prices increased sharply, almost erasing the cumulative decline of the previous week. The market's bottom-fishing buying force and escalating geopolitical tensions in the world are the main factors supporting oil prices.

|

| Energy price list |

WTI crude oil prices increased by 3% to more than 69 USD/barrel, Brent crude oil prices also increased by 3% to 73 USD/barrel.

With the Middle East conflict showing no signs of abating, the US policy shift regarding the war in Ukraine has raised concerns in the market. Specifically, President Joe Biden’s administration is said to have given Ukraine the green light to use US missiles to attack targets deep inside Russian territory. The decision comes with only two months left in Biden’s term and goes against President-elect Donald Trump’s commitment to promoting a peace deal.

Earlier, Russian President Vladimir Putin warned that Ukraine's use of US-made missiles on Russian territory would be seen as Washington's direct involvement in the war. If the situation becomes more tense, global crude oil supplies could be disrupted, which has helped support prices.

A decline in the amount of crude stored on tankers around the world also helped support prices. According to Vortexa, crude oil stored on tankers in the week ending November 15 was 50.97 million barrels, down 14% from the previous week.

On the other hand, China's crude oil demand continued to show signs of weakness and somewhat put pressure on oil prices yesterday. Reuters reported that China's crude oil surplus in October was 550,000 barrels per day, down from 930,000 barrels per day in September. China's total crude oil available for refining in October was 14.57 million barrels per day, down from 15.22 million barrels per day in September. In addition, the country's refining capacity last month was 14.02 million barrels per day, also down from 14.29 million barrels per day in September.

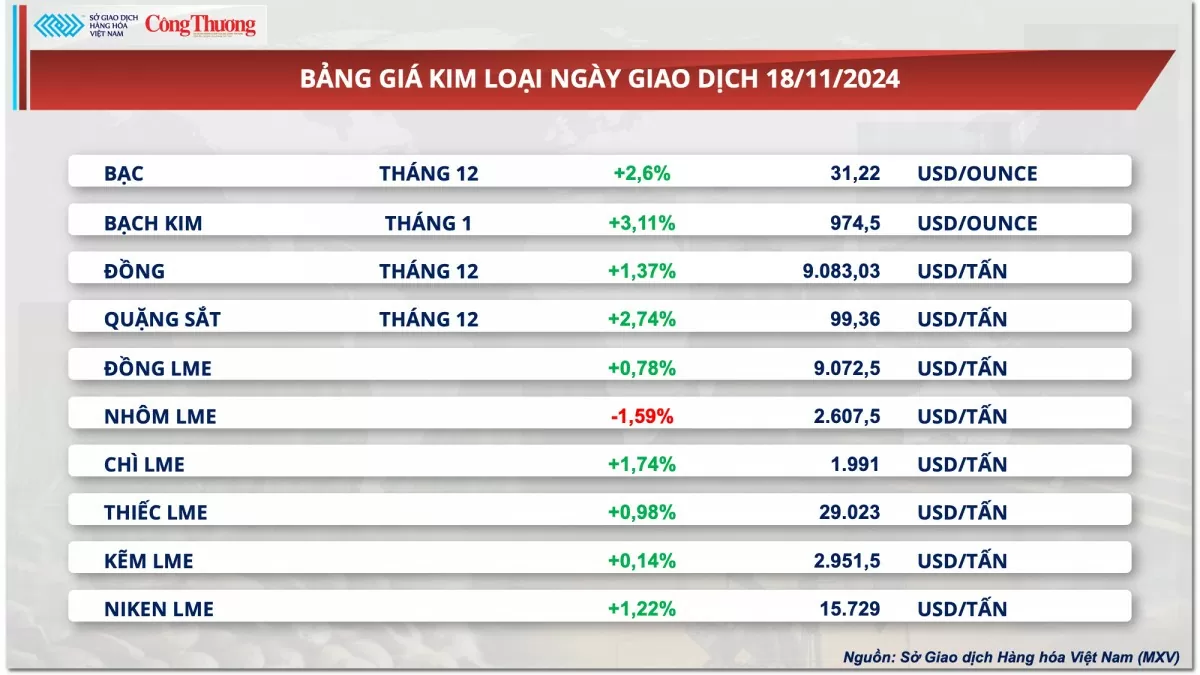

Precious metals market recovers on technical buying

Green returned to the metal price chart in the first trading session of the week. For precious metals, silver prices rose 2.6% to over $31/ounce. Platinum prices also continued to rise from the previous weekend session, rising more than 3% to $974.5/ounce. Prices of both commodities recovered after a recent decline, partly thanks to technical buying by speculators.

|

| Metal price list |

In addition, the slowing growth of the USD also helped the market gradually stabilize, thereby supporting the price of precious metals. The Dollar Index, a measure of the strength of the greenback compared to 6 other major foreign currencies, fell for two consecutive sessions, down 0.39% to 106.28 points.

However, this increase in silver and platinum prices is expected to be short-term and difficult to maintain for long due to the pressure from the increase in the USD exchange rate, which is still very large. Currently, the Dollar Index is still trading at a one-year high. Moreover, concerns that the US Federal Reserve (FED) will maintain high interest rates longer than before are also being pushed higher after FED Chairman Jerome Powell said last week that the FED is "in no rush to lower interest rates". Boston FED President Susan Collins also emphasized that there is no guarantee that the FED will lower interest rates in December.

This week, the precious metals market is expected to experience a quieter week as the market temporarily lacks new important macro reports, and the wave of US political news surrounding President-elect Donald Trump is also gradually cooling down.

For base metals, iron ore prices rose more than 2% to $99.36 a tonne, supported mainly by expectations of increased consumption in the short term and China's continued economic stimulus.

Specifically, yesterday (November 18), the Shanghai government said it would reduce some taxes on real estate transactions, expected to take effect from December 1. This move could support the local real estate market, thereby boosting steel consumption.

Meanwhile, data from consultancy Mysteel showed that in the week ended November 15, the average daily hot metal output of surveyed steelmakers rose 0.8% from the previous week to 2.36 million tonnes, the highest since early August.

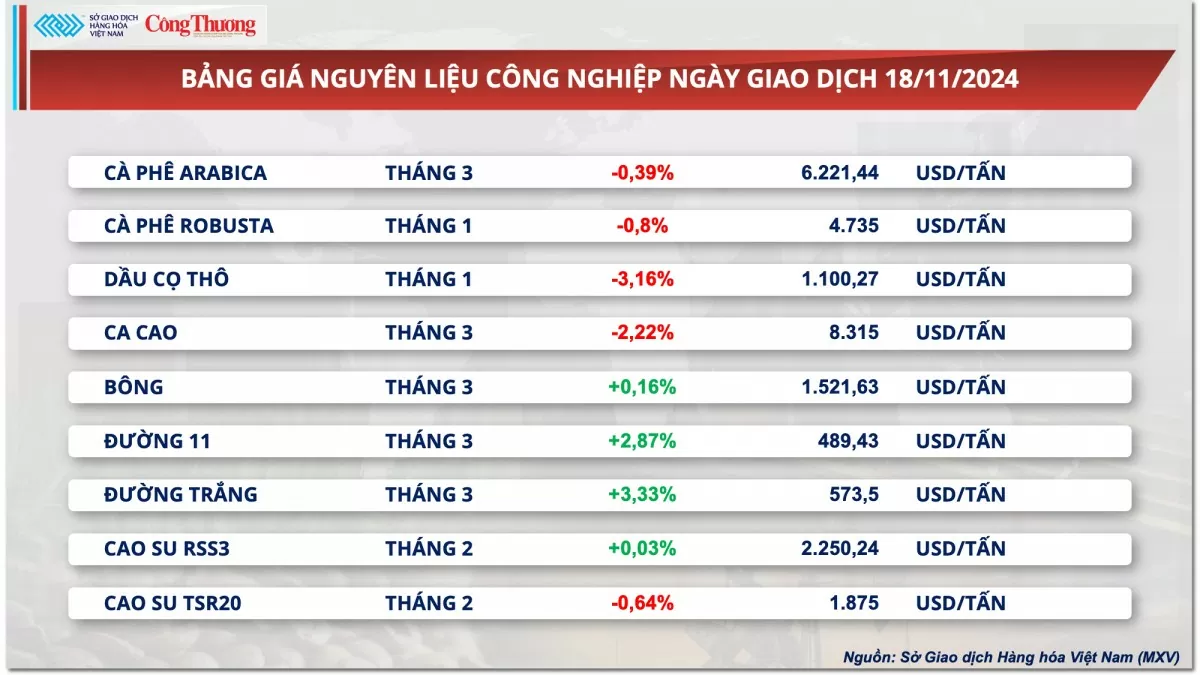

Prices of some other goods

|

| Industrial raw material price list |

|

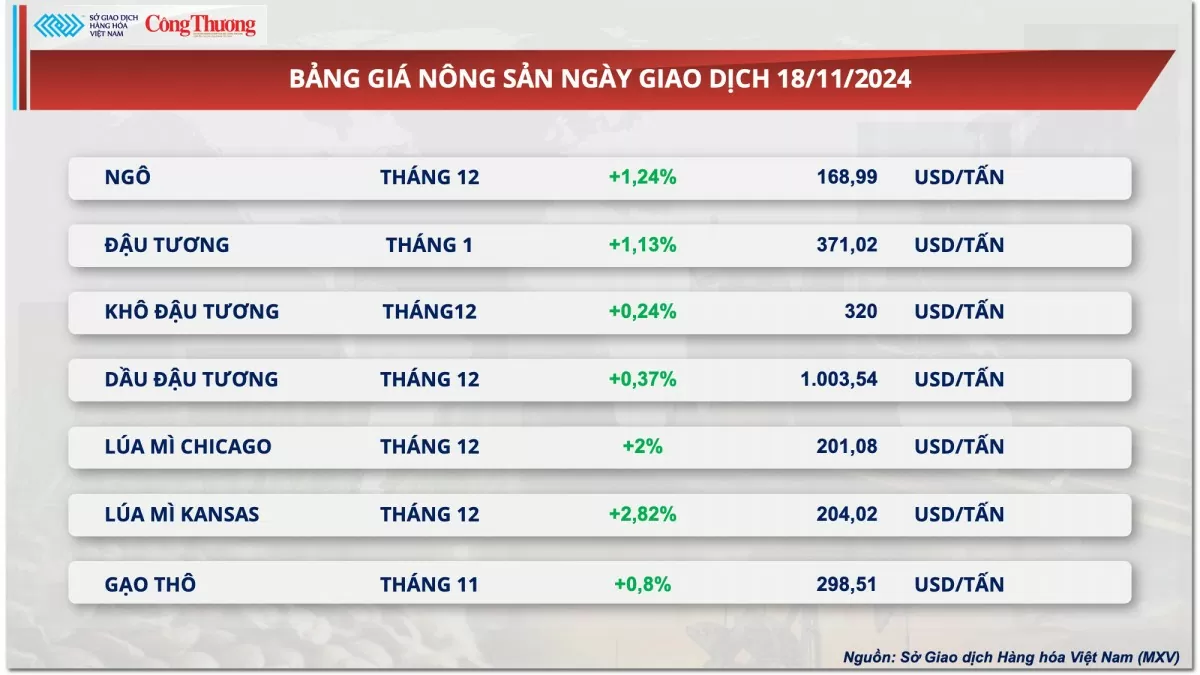

| Agricultural product price list |

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)