In the third quarter of 2023, many small securities companies unexpectedly increased their outstanding margin loans while large securities companies recorded modest increases.

Small securities company suddenly pumps money into lending

The third quarter of 2024 continues to witness growth in the scale of margin lending by securities companies. TCBS is still at the top with a margin lending value of VND 24,988 billion at the end of September 2024, up 53.7% compared to the beginning of the year and up 3.3% compared to the end of the second quarter of 2024. The market's leading lending group continues to name big names with strong financial potential such as HSC, SSI, Mirae Asset, VPS.

However, in the third quarter alone, many securities companies had a strong acceleration in margin lending, among the large companies, the most prominent one is Vietcap Securities (VCI).

Vietcap has now brought its margin lending balance to over VND10,000 billion at the end of the third quarter, up 28.6% compared to the end of the second quarter and up 32.8% compared to the beginning of the year. VCI's loans currently account for nearly 50% of the company's total assets.

Reported business results for the third quarter, VCI's interest from loans and receivables reached VND206.3 billion, up 17% over the same period last year. Interest from loans in the first 9 months of this year reached VND621 billion, up 23%. Also in this quarter, VCI accelerated to rank up to enter the top 5 securities companies with the largest brokerage market share on HoSE at position 4. Previously, VCI ranked 6th in the Top 10 list.

But the strongest performance is probably from a number of small-scale securities companies. Many names recorded a sharp increase in margin debt compared to the beginning of the year as well as compared to the end of the second quarter of 2024.

Kafi Securities Company's Q3/2024 financial report shows that interest from loans and receivables increased sharply this quarter to VND85.6 billion, 4 times higher than the same period last year. This securities company has continuously pumped money into lending activities in recent times.

If at the beginning of the year, Kafi's margin loan balance was at the threshold of 1,000 billion, this number skyrocketed to 4,663 billion VND at the end of the third quarter, an increase of 328% compared to the beginning of the year and an increase of 18.9% compared to the end of the second quarter of 2024.

Kafi also successfully increased its capital from VND1,500 billion to VND2,500 billion at the beginning of the year. In addition to increasing margin lending, the company also increased investment in FVTPL assets, reaching VND7,547 billion at the end of the third quarter, a growth of 65%.

A sudden factor is LPBank Securities (LPBS) when loans suddenly increased abnormally. If in recent years, LPBS did not have outstanding loans, in the first 9 months of the year, the company suddenly increased this item to 3,004 billion VND, especially in the third quarter, this number increased by 2,500 billion VND. The business results report for the third quarter of this year recorded that LPBS reached 47.9 billion VND from interest on loans and receivables, becoming the segment that brought in the largest revenue for the company, accounting for 70% of total operating revenue.

In addition, another small securities company, DNSE, also increased its outstanding loans by 65% compared to the beginning of the year and increased by 16.6% in the third quarter, to VND3,978 billion.

Margin increase is not enough to create momentum for the market

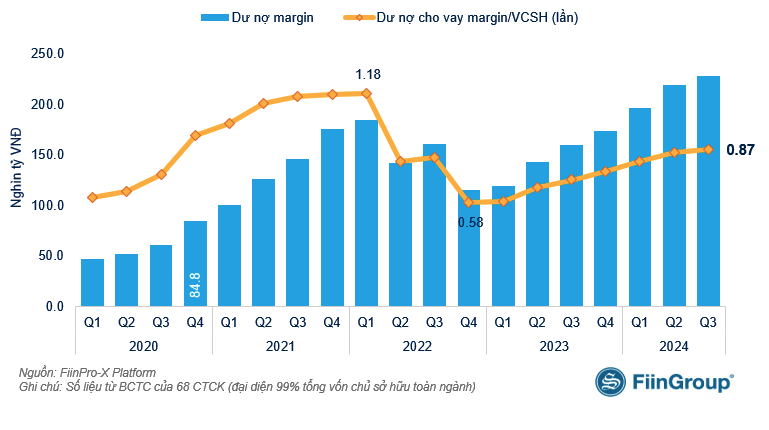

FiinTrade's latest statistics from the third quarter 2024 financial statements of 68 securities companies (representing 99% of the industry's equity capital) show that outstanding margin lending reached more than VND 228 trillion as of September 30, 2024, a slight increase compared to the end of the second quarter.

FiinTrade assessed that the growth in margin lending balance is uneven among securities companies. As of September 30, 2024, there are 7 securities companies with margin balance of over 10 trillion VND, of which VCI is the newest "face" and the remaining 6 securities companies are TCBS, SSI, HCM, Mirae Asset, VPS, VND. Except for VCI, other companies in the group recorded modest increases or even declines (SSI, VND). On the contrary, the scale of margin debt suddenly increased sharply in the third quarter at some small securities companies, including DSE, KAFI, and Lien Viet Securities.

With a slight increase, margin lending continued to hit new highs. However, this still did not create the momentum to make the market vibrant.

|

| Margin debt compared to equity of securities company |

Margin lending value continued to increase to a new peak in the third quarter, but overall liquidity deteriorated and individuals reduced net buying (even turning to net selling in August and September through order matching). In addition, the leverage ratio (the ratio between Margin/total capitalization adjusted according to free-float) and the margin/average transaction value ratio remained high. This shows that the increase in margin debt did not help speed up the transaction turnover in the market (due to the increase in “deal” lending).

FiinTrade data also shows that investor deposit balances decreased for the second consecutive quarter despite the number of newly opened accounts increasing sharply, reaching 819 thousand accounts in the third quarter. The ratio of Margin/total asset value of investors has also been flat for many quarters, since the beginning of 2023 until now.

Source: https://baodautu.vn/dot-bien-cho-vay-margin-o-cong-ty-chung-khoan-nho-d228015.html

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)