With Mr Trump in his second term in the White House, tariffs are a concern for the rest of the world, especially China. But many experts say the world's second-largest economy is well-positioned to cope.

|

| Mr. Trump has proposed a 60% tariff on all Chinese goods imported into the US. (Source: Industryweek) |

In the summer of 2018, when then-President Donald Trump launched a trade war with Beijing, China’s economy was booming. There was even talk that the country could soon surpass the United States to become the world’s largest economy.

Now that Mr. Trump is back in the White House, the situation is different. The world's second largest economy is facing challenges in assets, deflation, and a real estate crisis.

Reduce dependence on the US

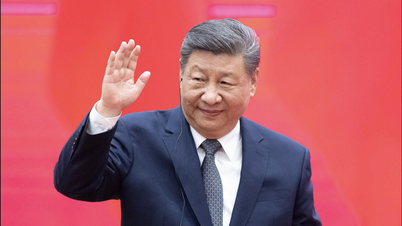

According to economists, with Mr. Trump's second term, China is equipped with an understanding of how this President operates and is capable of responding.

During his first term, the Trump administration used executive power to impose tariffs of up to 25% on $250 billion worth of electronics, machinery and consumer goods imported from the world's second-largest economy.

Beijing then used similar measures against Washington's agricultural, auto and technology exports.

During his election campaign, Mr. Trump proposed a 60% tariff on all Chinese goods imported into the US and a tariff of up to 20% on imports from other countries.

The Asian giant has been preparing for this day for a long time, said Dexter Roberts, a senior fellow at the Atlantic Council. The United States is no longer so important to China's trade network.

Explaining the reason, Mr. Dexter Roberts said that after the trade war took place, Chinese companies began to actively reduce their trade dependence on the world's largest economy. The impact can be clearly seen in trade data and is happening at a dizzying speed.

Most recently, bilateral trade hit a record high in 2022. But in 2023, Mexico surpassed it to become the top exporter of goods to the US. Beijing had held that position for 20 years.

Just under 30% of Beijing's exports went to the Group of Seven (G7) leading industrialized nations last year, down from 48% in 2000, according to private equity firm Matthews Asia.

Recently, Mr. Wang Shouwen, international trade negotiator, Vice Minister of Commerce of China told reporters: "We have the ability to handle and resist the impact of external shocks."

What will China do?

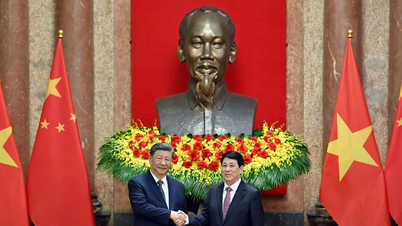

Many fear that Trump’s return will cause the world’s two largest economies to restart a trade war. If the US tariffs are officially imposed, how will China retaliate?

Experts note that China's "retaliatory arsenal" does not include major moves such as selling US Treasury bonds or sharply devaluing the Yuan.

Don’t expect a simple retaliation on tariffs, said Liza Tobin, senior director of economics at the Project for Competitiveness, a U.S. think tank. Instead, Beijing’s response is likely to be targeted and asymmetric.

“The world’s second-largest economy is putting pressure on foreign companies operating in the country, including American companies, thereby pushing businesses out of the Chinese market,” she predicted.

|

| China - a country of 1.4 billion people - has a huge domestic consumer market. This is a strength that Beijing can fully exploit, if it knows how to "play" it right. (Source: Xinhua) |

Economists also say retaliation against U.S. companies or the agricultural sector is much more likely than China selling U.S. Treasury bonds, which could hurt Beijing’s interests.

A weaker yuan could also help exports from the world’s second-largest economy if Mr Trump imposes new tariffs, although economists are skeptical that such a move will happen.

A sudden devaluation of the yuan in August 2015 caused chaos in the stock market, said Sean Callow, a senior foreign exchange analyst at ITC Markets.

In recent months, the Chinese government has indicated that it wants to boost confidence in its stock market. At the same time, the Asian giant wants the yuan to be a credible alternative to the dollar. Therefore, the possibility of devaluation of the domestic currency is unlikely.

China has "weapons" to exploit thoroughly

China is not the only target of Mr Trump's tariffs.

He has proposed tariffs of 10-20% on all imported goods, a significant increase from the current average of 0-2%.

With Beijing’s 60% tariffs, some economists have calculated, Washington’s import duties could cut China’s economic growth rate in half. Trump’s proposed tariffs would also cost the average American household an additional $2,600 a year, according to a separate analysis from the Peterson Institute.

Last month, China's National Bureau of Statistics released data showing that the economy grew at a slower pace in the third quarter of 2024 due to weak consumption. Gross domestic product (GDP) in the third quarter of 2024 increased 4.6% compared to a year ago.

The world's second-largest economy rolled out a much-needed stimulus package, largely focused on monetary measures, in the last week of September 2024. But for many, that was not enough.

Bigger moves may have to wait until Mr Trump’s tariffs are announced, Larry Hu, chief China economist at Macquarie Bank, wrote in a recent research note.

"As commodity exports slow, policymakers will have no choice but to step up stimulus to the economy," economist Larry Hu stressed.

But don't forget, China - a country of 1.4 billion people - has a huge domestic consumer market. This is a strength that Beijing can fully exploit, if it knows how to "play" it right.

Beijing's likely response to tariffs is to reorganize its domestic market, said Andy Rothman, China strategist at Matthews Asia.

By restoring the confidence of domestic businesses and boosting consumer confidence, the world’s second-largest economy may not have to worry too much about declining exports to the US. From there, Mr. Trump’s tariffs will no longer cause China a “headache”.

Source: https://baoquocte.vn/don-ong-trump-tro-lai-trung-quoc-da-san-sang-mo-kho-vu-khi-tra-dua-co-mot-van-de-khong-lo-cuu-kinh-te-294977.html

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)