Small and medium enterprises (SMEs) are very interested in the new policy that VPBank has applied since last July, according to which the bank will lend with a limit equal to 100% of the value of the collateral, with all steps of loan registration and disbursement being done online. Up to now, not many banks have approved loans up to 100% of the value of the collateral, due to the risk appetite of each bank. By launching an online mortgage product for SMEs to borrow up to 100% of the value of the collateral, up to 20 billion VND,

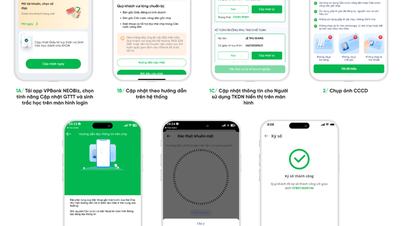

VPBank has increased access to capital for a variety of businesses. This demonstrates VPBank's efforts in wanting to bring truly effective and practical support to SMEs. In addition to businesses that have been operating for a long time, VPBank is also willing to support newly established businesses, because the bank understands the capital difficulties that businesses encounter in the early stages of starting a business when they have not yet affirmed their brand and have not yet established a position in the market. By digitizing the lending process, VPBank has helped SMEs fully master the loan process, from the initial steps such as registering the loan purpose to the decisive steps such as providing documents related to collateral (TSDB) and finally the capital disbursement step. Allowing businesses to proactively carry out the steps, and especially clearly explaining them during the online process, has created peace of mind and trust for customers due to the transparency as well as the speed of processing documents on the system. "As a pioneer in the market in accompanying SMEs, we always set ourselves the task of truly understanding the concerns of businesses in order to design highly practical policies. Therefore, VPBank's online loan product with a limit of up to 100% of the value of collateral is expected to break down the capital barrier for young, small-scale businesses that has existed for many years. We expect to maintain the No. 1 position in products for SMEs for many years to come" - VPBank representative shared. Experts in the financial sector advise businesses that when they need to borrow capital, they should carefully study the lending policies on the market before "choosing a place to entrust their gold", because the loan can be with the business for at least 12 months (if borrowing to supplement working capital), or even up to 15 years (if borrowing to purchase fixed assets). During that time, market developments can be very unpredictable (interest rates change, asset values fluctuate due to market influences, etc.), so the choice of which bank to associate with needs to be calculated based on three main factors. The first is the size of the bank, which is very important, because it determines the stability of lending interest rates and the bank's liquidity. The second is the bank's "seniority" in providing capital to SME businesses, because this segment has its own characteristics, often greatly influenced by the market, so if the bank is not experienced enough, does not have enough time to empathize with businesses, it is very difficult to have appropriate policies to help businesses promptly cope with the challenges of the times. The third is the loan processing process. Due to the nature of the business, there will be times when urgent capital is needed, perhaps to seize the opportunity for a good order, or even to buy a fixed asset at a bargain price. Therefore, if the bank's process is not fast enough, the business will miss the golden opportunity to make a profit.

VPBank expects to maintain its No. 1 position in products for SMEs for many years to come.

Currently, VPBank is one of the banks that can most fully meet the above criteria. In terms of scale, this bank has the largest charter capital in the system. In terms of seniority, the bank has been accompanying hundreds of thousands of SMEs for more than 10 years with a variety of products and services. Regarding the loan processing process, VPBank is also a pioneer in applying digitalization with a series of improvements, of which online mortgage for businesses is a typical example at the present time. The product is evaluated by experts as outstanding, because it is operated online, approved quickly within just 2 days after completing the application, and is transparent, allowing customers to proactively monitor the processing progress on the system. These factors are plus points for businesses to confidently choose to accompany the bank on a long journey. Interested businesses can contact VPBank via phone number 1900 234 568 for specific advice or visit https://smeconnect.vpbank.com.vn/dangky/ThechapOnline to register for loan advice.

Source: https://nhipsongkinhte.toquoc.vn/doanh-nghiep-sme-co-the-vay-the-chap-online-len-toi-20-ty-dong-20240904181201986.htm

Báo Tổ quốc•05/09/2024

Báo Tổ quốc•05/09/2024

Comment (0)