At the same time, strictly handle cases of businesses that delay debt repayment and cases of taking advantage of the situation to disrupt security and order. Investors should self-assess the ability of bond issuers to fully and timely pay interest and principal of bonds and be responsible for their investment decisions.

Customers transact at Bao Viet Securities, 8 Le Thai To, Hanoi. (Illustration photo: Tran Viet/VNA)

The Ministry of Finance said that in the coming time, it will continue to closely follow the Party's guidelines and policies and comply with the State's policies and laws, including the Enterprise Law, the Securities Law and guiding documents on the issuance of individual corporate bonds. The State will ensure macroeconomic stability, remove difficulties for businesses to stabilize their operations, and have adequate and timely payment sources for investors according to bond contracts.

Along with that, the State creates a mechanism for handling by economic measures, complying with market rules according to current laws and encouraging enterprises and investors to agree on a bond payment plan in case enterprises cannot fully and timely pay the principal and interest of bonds according to the issuance plan, ensuring security and order on the motto of "harmonized benefits, shared risks".

In addition, continue to improve the legal framework from the Law level and restructure the corporate bond market towards encouraging public issuance, moving towards private issuance focusing only on institutional investors.

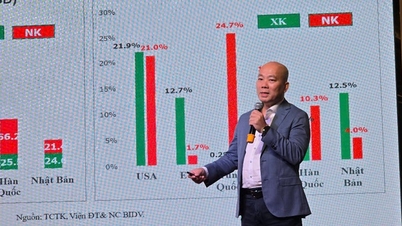

Mr. Nguyen Hoang Duong, Deputy Director of the Department of Banking and Finance (Ministry of Finance) said that in the period from 2017 to 2022, the corporate bond market will develop strongly, contributing to the gradual balanced development between the capital market and the bank credit market according to the policies and development orientations of the Party and the State, forming a medium and long-term capital mobilization channel for enterprises.

However, the market has grown rapidly in recent times, creating a number of risks for both issuing enterprises, service providers and individual investors.

In 2022, the corporate bond market fluctuated strongly due to violations of the law, while the domestic and foreign macroeconomics and financial markets developed complicatedly, interest rates increased, and at times the economy's liquidity faced difficulties.

Faced with that situation, the Government and the Prime Minister have given very strong directions to stabilize the market. Accordingly, they have synchronously implemented policies to stabilize the macro economy; reasonably operated fiscal policies such as reducing, extending, and deferring taxes, supporting affected subjects, and accelerating the disbursement of public investment. Operated flexible monetary policies, ensured liquidity, reduced interest rates, facilitated access to credit, extended debt, transferred debt groups, etc.; removed difficulties for businesses; including the real estate market, etc.

According to the Ministry of Finance, from the beginning of the year to July 28, 36 enterprises issued private bonds with a volume of 62.3 trillion VND. Accordingly, the corporate bond market has stabilized but has not recovered due to economic difficulties, so the capital demand of enterprises has decreased.

In addition, demand for corporate bond investment has continuously decreased because according to the Law on Insurance Business, insurance enterprises from 2023 are not allowed to invest in some corporate bond products, individual investors are still very cautious, and businesses and service providers are concerned about inspections, so they choose other borrowing methods.

With the drastic and synchronous implementation of solutions to stabilize the market under the direction of the Government and the Prime Minister, since the second quarter of 2023, the corporate bond market has shown signs of improvement and investor sentiment has gradually stabilized, with some organizations proactively buying back bonds to restructure capital sources.

Negotiations to restructure bonds continue to be implemented, helping issuers have more time to recover production and business and generate cash flow to repay debts, creating conditions to improve and relieve liquidity pressure in the long term.

(Source: Tin Tuc Newspaper)

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)