The central exchange rate increased by 36 VND, the VN-Index decreased slightly by 2.33 points compared to the previous weekend, or the State Bank of Vietnam pumped a net 65,450 billion VND into the market... are some notable economic news in the week from November 4-8.

| Review of economic information on November 7. Will Mr. Donald Trump's re-election as US President have a big impact on Vietnam's economy? |

|

| Economic news review |

Overview

Former US President Donald Trump was re-elected, the world is waiting for new moves from this powerful leader in the 2025-2028 period.

After 4 years of setting the goal of “America First”, from 2017-2020, US President Donald Trump has left behind many remarkable economic and political activities. Specifically, throughout his years in office, President Trump has continuously expressed his desire for a low interest rate environment, to help businesses operate more easily and create more jobs.

Next, during the trade war, from March 2018 to early 2019, President Trump imposed tariffs on about 370 billion USD worth of imported goods from China (15% and 25% depending on the type of item).

In return, Beijing responded by imposing tariffs on $185 billion worth of US imports (10% and 25% depending on the type of product). In addition, Washington also imposed sanctions on many leading Chinese companies, most notably the embargo on telecommunications giant Huawei.

Next, the former US President stepped up investigations and made conclusions about “currency manipulation” against a number of countries with “unusual” trade relations with the US, including Vietnam. Politically, Mr. Trump withdrew the US from the Iran nuclear deal in 2018, shifting to a confrontational state through embargoes and sanctions against this Middle Eastern country. However, in 2019, President Trump was the first US leader to set foot in North Korea, and held a summit with North Korean leader Kim Jong Un. Although specific goals were not achieved, the move somewhat eased US-North Korea tensions and opened the way for diplomatic negotiations between the two sides.

Thus, after 4 years in power from 2017 to 2020, President Trump's unexpected policies that broke the norms made the world doubt the relationship between allies or enemies of the United States. However, it can be affirmed that the US-China confrontation is always clear and consistent, greatly affecting global economic and political activities.

In this election, Republican President Donald Trump defeated Democratic rival Kamala Harris by 312 to 226 electoral votes, and 75 million to 71 million popular votes. In addition, the Republican Party now controls the Senate (53 to 46 out of 100 seats), and temporarily dominates the House of Representatives (213 to 202 out of 435 seats).

During the election campaign, the former US President proposed imposing a 10-20% tax on imported goods from other countries, including 60% on China. This message from Mr. Trump once again raised concerns about the weakening of the supply chain of goods, including US allies such as Japan, France and South Korea.

But he has also pledged to cut corporate taxes by trillions of dollars and offer incentives for companies to choose the U.S. as a place to manufacture their goods. He has also promised to end inflation by producing more crude oil, which could lower interest rates and create a more favorable business environment.

Regarding diplomacy, the US President affirmed that the country needs to get out of unnecessary conflicts in some parts of the world, and said that the conflict in Ukraine can be ended through a negotiated agreement with Russia. The above messages of the new US President once again caused conflicting opinions about the world economic outlook for the period 2025-2028.

For Vietnam, it is very likely that our economy will face many fluctuations in the coming years, due to its large economic openness and increasing trade surplus with the US. However, reality shows that Vietnam has been continuously successful in the field of foreign economic relations in recent years, and there is no convincing reason that this trend will change.

Domestic market summary week from November 4-8

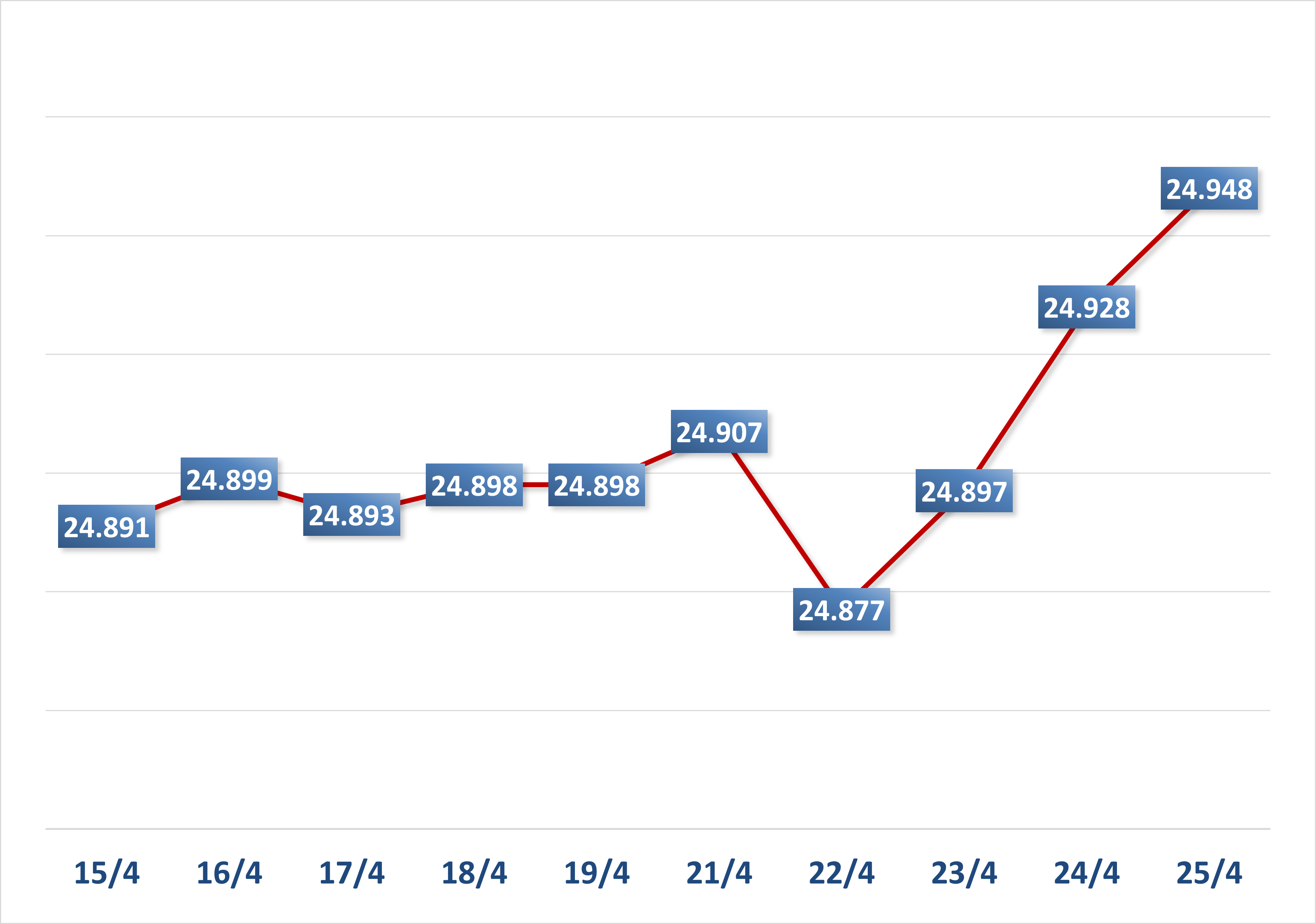

In the foreign exchange market, during the week of November 4-8, the central exchange rate was adjusted by the State Bank in an upward trend. At the end of November 8, the central exchange rate was listed at 24,278 VND/USD, an increase of 36 VND compared to the previous weekend session.

The State Bank of Vietnam's transaction office continues to list the USD buying price at 23,400 VND/USD and the USD selling price at 25,450 VND/USD.

The interbank USD-VND exchange rate fluctuated between increases and decreases during the week from November 4-8. At the end of the session on November 8, the interbank exchange rate closed at 25,275, down slightly by 19 VND compared to the previous weekend session.

The dollar-dong exchange rate on the free market increased in the first three sessions of the week and then decreased again. At the end of the session on November 8, the free exchange rate decreased by 190 VND in the buying direction while increasing by 10 VND in the selling direction compared to the previous weekend session, trading at 25,500 VND/USD and 25,800 VND/USD.

Interbank money market, week from November 4-8, interbank VND interest rates increased sharply in the first session of the week and then gradually decreased afterwards. Closing on November 8, interbank VND interest rates were trading around: overnight 4.57% (+0.60 percentage points); 1 week 4.67% (+0.47 percentage points); 2 weeks 4.77% (+0.47 percentage points); 1 month 4.88% (+0.51 percentage points).

Interbank USD interest rates for all terms during the week fluctuated slightly in the first 4 sessions of the week, and decreased sharply in the last session of the week. Session 08/11, interbank USD interest rates, traded at: overnight 4.61% (-0.22 percentage points); 1 week 4.68% (-0.20 percentage points); 2 weeks 4.73% (-0.18 percentage points) and 1 month 4.76% (-0.17 percentage points).

In the open market last week, in the mortgage channel, the State Bank of Vietnam offered a 7-day term with a volume of VND90,000 billion, the interest rate remained at 4.0%. There were VND89,999.91 billion in winning bids, and VND33,999.91 billion maturing last week in the mortgage channel.

The State Bank of Vietnam bid for 28-day State Bank bills, bidding for interest rates. There were 3,950 billion VND in winning bids, the interest rate in the first 4 sessions of the week was at 3.90%, the last session of the week increased to 4.0%. There were 13,400 billion VND in bills maturing last week.

Thus, the State Bank of Vietnam pumped a net VND65,450 billion into the market last week through the open market channel. There were VND89,999.91 billion circulating on the mortgage channel, and VND76,650 billion in State Bank bills circulating on the market.

Bond market, November 6, the State Treasury successfully bid 6,099 billion VND/10,000 billion VND of government bonds called for bid, the winning rate reached 61%. Of which, the 5-year term mobilized 1,000 billion VND/3,000 billion VND of the call, the 10-year term mobilized the entire 5,000 billion VND of the call and the 30-year term mobilized 99 billion VND/500 billion VND of the call. The 15-year and 20-year terms called for bids of 1,000 billion VND and 500 billion VND respectively, however, there was no winning volume in both terms. The winning interest rate for the 5-year term was 1.90% (+0.01 percentage point compared to the previous auction), the 10-year term was 2.66% (unchanged) and the 30-year term was 3.10% (unchanged).

This week, on November 13, the State Treasury plans to bid for VND10,000 billion in government bonds, of which VND3,000 billion will be offered for 5-year terms, VND5,000 billion for 10-year terms, VND1,500 billion for 15-year terms, and VND500 billion for 30-year terms.

The average value of Outright and Repos transactions in the secondary market last week reached VND10,323 billion/session, slightly down from VND11,728 billion/session the previous week. Government bond yields fluctuated up and down last week. At the end of the session on November 8, government bond yields were trading around 1 year 1.85% (+0.004 percentage points compared to the session at the end of last week); 2 years 1.85% (-0.01 percentage points); 3 years 1.89% (+0.02 percentage points); 5 years 1.93% (+0.02 percentage points); 7 years 2.22% (+0.02 percentage points); 10 years 2.73% (+0.03 percentage points); 15 years 2.94% (+0.04 percentage points); 30 years 3.16% (unchanged).

The stock market, from November 4 to 8, continued to fluctuate, with both indexes increasing and decreasing. At the end of the session on November 8, VN-Index stood at 1,252.56 points, down slightly by 2.33 points (-0.19%) compared to the previous weekend; HNX-Index increased by 1.47 points (+0.65%) to 226.88 points; UPCoM-Index increased by 0.19 points (+0.21%) to 92.15 points.

Average market liquidity reached about VND14,200 billion/session, down from VND15,800 billion/session the previous week. Foreign investors net sold more than VND3,700 billion on all three exchanges.

International News

In the US, the Federal Reserve (Fed) continued to cut its policy interest rate for the second time in 2024, while the country also recorded some notable economic indicators. In the 2-day meeting on November 6-7, the Federal Open Market Committee (FOMC, under the Fed) said that recent indicators show that the US economy continues to expand solidly. The labor market has generally loosened and the unemployment rate has increased, but remains low. Inflation has made progress towards the Fed's 2.0% target, but remains high.

The FOMC assessed that risks to inflation and the labor market are roughly balanced, the economic outlook is uncertain, and the Fed will focus on its dual mandate of achieving full employment and helping inflation return to its 2 percent objective on a sustained basis. To support these goals, the FOMC decided to lower the target range for the federal funds rate by 25 basis points, from 4.75% to 5.0% to 4.50% to 4.75%. The FOMC will continue to monitor future economic data to determine the appropriate stance of monetary policy.

Regarding the US economy, the Institute for Supply Management (ISM) said its services PMI index was at 56.0% in October, up from 54.9% the previous month and contrary to forecasts of a decrease to 53.8%.

Next, in the labor market, initial jobless claims for the week ending November 1 were 221,000, up slightly from 218,000 the previous week and in line with expectations of 223,000. The four-week average was 227,250, down 9,750 from the previous four-week average.

Finally, the Chicago University survey said the US consumer confidence index rose to 73.0 points in November from 70.5 points in October, and higher than the forecast of 71.0 points. This is the highest consumer confidence index since April 2024.

The Bank of England (BOE) also cut its policy rate slightly last week. At its meeting on November 7, the BOE said that the consumer price index (CPI) fell to 1.7% year-on-year in September but could return to 2.5% by the end of the year as energy prices rebounded. However, services inflation fell to 4.9% year-on-year in September from above 5% in previous months.

The BOE also forecasts a contraction in GDP growth in the final quarter of the year, along with further tightening in the labor market. The BOE is determined to achieve its 2.0% inflation target in a timely and sustained manner.

At this meeting, the BOE Monetary Policy Committee (MPC) approved a decision to cut the policy rate by 25 basis points, from 5.0% to 4.75%.

After the meeting, BOE Governor Andrew Bailey stressed that the policy rate cannot be cut too quickly or too much because inflation is always close to the target. However, he also mentioned that interest rates could continue to decrease gradually if the economy develops as expected by the BOE.

Regarding the UK economy, the UK construction PMI came in at 54.3 in October, down from 57.2 in the previous month and below the forecast of 55.3. In addition, the UK services PMI officially recorded 52.0 in October, slightly revised up from 51.8 in the preliminary survey.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-tuan-tu-4-811-157651-157651.html

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] General Secretary To Lam receives Philippine Ambassador Meynardo Los Banos Montealegre](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/6b6762efa7ce44f0b61126a695adf05d)

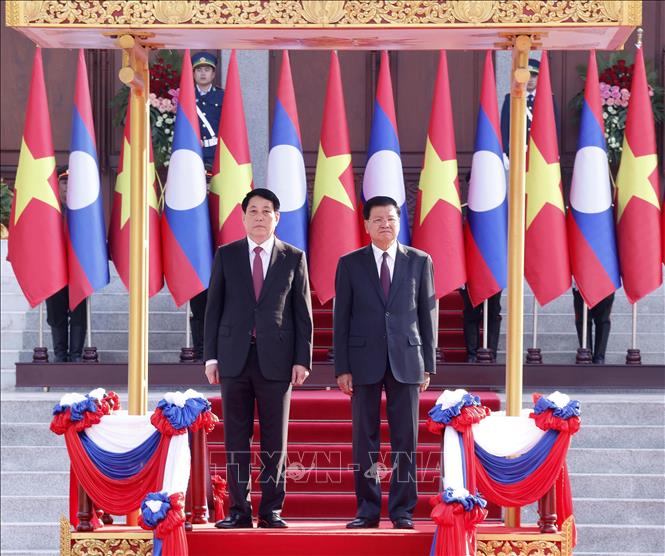

![[Photo] President Luong Cuong holds talks with Lao General Secretary and President Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/98d46f3dbee14bb6bd15dbe2ad5a7338)

![[Photo] President Luong Cuong meets with Lao National Assembly Chairman Xaysomphone Phomvihane](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd9d8c5c3a1640adbc4022e2652c3401)

Comment (0)