Removing "Pre-funding" obstacles: Proposing to add one more day of negotiation if foreign investors have not paid yet

In case of unsuccessful transactions, there is a proposal that it is not necessary to sell immediately when the securities are in the self-trading account, but that there should be an additional day for the foreign institutional investor to negotiate with the securities company.

|

| Resolving the pre-funding bottleneck is one of the key topics at the Scientific Workshop on Solutions to Upgrade the Vietnamese Stock Market. |

Propose an additional day of negotiation

Foreign institutional investors can trade without depositing 100% of the money. Securities companies evaluate the client's capacity to determine the agreed margin level... If a foreign institutional investor lacks payment funds, the securities company where the investor places the order is responsible for paying the shortfall through the proprietary trading account.

Pre-funding is the requirement that funds must be available in an account at a payment institution before the payment institution can use the account for payment.

Pre-funding is the requirement that funds must be available in an account at a payment institution before the payment institution can use the account for payment.These are the contents being proposed in the Draft Circular amending and supplementing a number of articles of the circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions (Circular 120/2020/TT-BTC).

Mr. Nguyen Khac Hai, Director of SSI Securities Law and Compliance Control, even suggested that the management agency should consider adding an extra day for foreign investors to propose negotiations in case of unsuccessful transactions. Mr. Hai mentioned this suggestion at the Scientific Workshop on Solutions to Upgrade the Vietnamese Stock Market organized by the Institute of Financial Strategy and Policy in coordination with the State Securities Commission on April 16.

Accordingly, it is not necessary that securities arriving on T+2 must be sold immediately. In case negotiations cannot be reached, a compulsory sale will be carried out.

At present, the Ministry of Finance is seeking comments on the draft Circular amending and supplementing a number of articles of the circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions; activities of securities companies and information disclosure on the securities market. In particular, an important content of the Draft is the transaction without 100% deposit of money of foreign institutional investors. Next, the payment instructions of the Vietnam Securities Depository Center (VSDC) are what market members are waiting for.

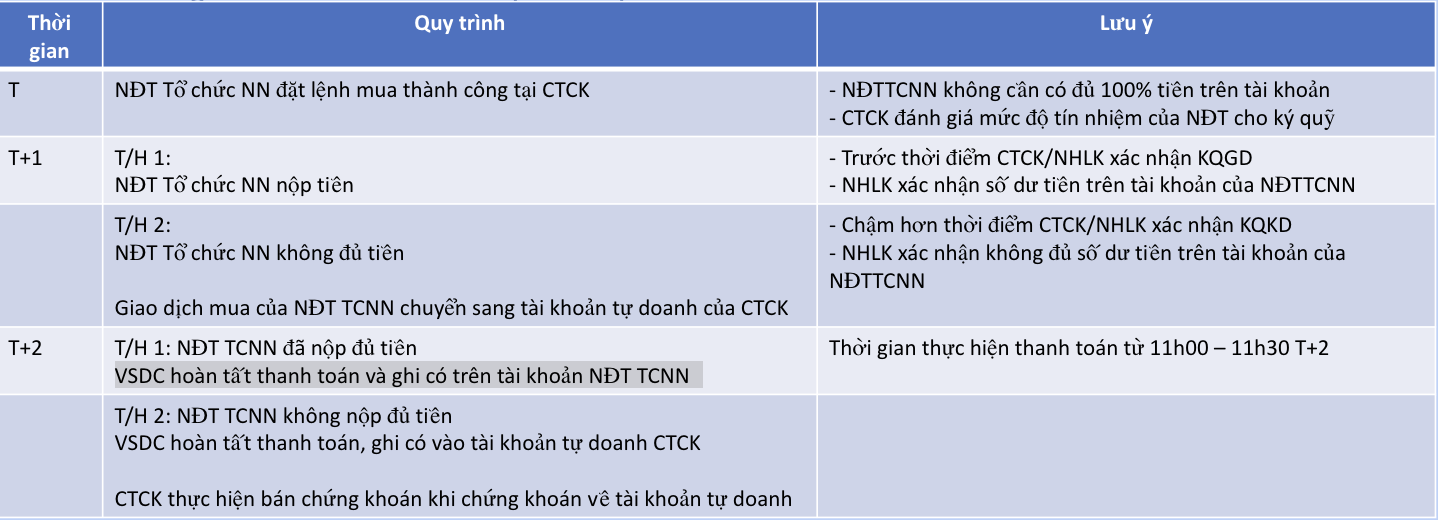

Mr. Duong Ngoc Tuan, Deputy General Director of Vietnam Securities Depository and Clearing Corporation (VSDC), said that according to the current draft process, on day T+1, if the foreign institutional investor does not have enough money, the purchase transaction will be transferred to the securities company's proprietary trading account. Then, on day T+2, VSDC completes the payment and credits the investor's account if the investor has deposited enough money with the payment time from 11:00 to 11:30 on day T+2. If the investor does not deposit enough money on day T+2, VSDC completes the payment and credits the securities company's proprietary trading account.

|

| Payment process does not require deposit before trading - Source: VSDC |

The conference also recorded a series of opinions and proposals surrounding the removal of the requirement for advance deposit - one of the two bottlenecks that rating organizations and major international financial institutions believe that the Vietnamese stock market needs to focus on improving and have measures to remove, in order to create conditions for foreign investors to participate as well as move towards the goal of upgrading the market from frontier to emerging by 2025.

Regarding the time of determining payment obligations, at the Workshop, FTSE representative proposed that this time should be on the same day of payment. According to Mr. Nguyen Khac Hai, Director of SSI Securities Law and Compliance Control, opinions from foreign investors also want to "deliver money and receive securities" at the same time and propose to change the time of error notification from T+1 to T+2.

The problem of balancing efficiency and safety

In fact, when applying the new mechanism, not all transactions will fail. However, even if there is only a small possibility, it is still necessary to build a standard process in case it happens to have a solution and avoid risks for the payment system. Regarding the story of removing obstacles at the "pre-funding" bottleneck, walking on two legs to both improve efficiency for investors but still ensure no risks is also what Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, emphasized.

With the new proposal to determine the payment obligation on T+2 instead of T+1, VSDC representative said that further evaluation is needed based on the balance of efficiency and safety. Specifically, according to Mr. Tuan, the challenge here lies in the case where investors do not have enough money on the payment date, it will take time to handle technical issues such as transferring payment obligations. In addition, in the case where the securities company does not arrange enough money, this will also affect the safety of payment activities.

According to the current principle, securities companies base on the assessment of foreign investors' capacity to set limits. Currently, the Circular is very flexible, and can apply different margin rates. Mr. Nguyen Khac Hai, Director of SSI Securities Law and Compliance Control, said that this securities company will follow the method of assessing investors' capacity and will provide a limit of 100%.

According to the current principle, securities companies base on the assessment of foreign investors' capacity to set limits. Currently, the Circular is very flexible, and can apply different margin rates. Mr. Nguyen Khac Hai, Director of SSI Securities Law and Compliance Control, said that this securities company will follow the method of assessing investors' capacity and will provide a limit of 100%."However, smaller securities companies can apply lower margin rates. In my opinion, this is a concern because when working with foreign organizations, transparency, equality, and consistency in the market are required. If some securities companies apply a rate of 10 - 20%, the solution will not be comprehensive," the SSI representative also emphasized.

The implementation principle will be based on the securities company's assessment of capacity and determination of the margin level to ensure that payment can be completed on the payment date. In case the foreign investor is not eligible to pay, the payment obligation will be transferred to the securities company's self-trading account. After the securities are transferred to the account, the securities company will process them to recover the amount of money spent. This is also the reason why, according to the current plan, the securities company needs to sell immediately after the securities are transferred to the self-trading account to recover the money spent.

At the same time, setting transaction limits for market members is also being considered. “At the internal meeting, the Chairman of the State Securities Commission closely directed this content. VSDC will consider it to ensure a balance between factors. To control risks, we are considering setting transaction limits for market members,” said a VSDC representative.

Accordingly, with the scale of transactions performed for foreign investors, securities companies need to ensure that their payment capacity is sufficient to make payments in case of unsuccessful transactions. According to Mr. Tuan, this is the key to risk management when implementing this new transaction mechanism.

At the Scientific Workshop on Solutions to Upgrade the Vietnamese Stock Market organized by the Institute of Financial Strategy and Policy in coordination with the State Securities Commission on April 16, explaining the selection of foreign institutional investors as the applicable subjects, Mr. Duong Ngoc Tuan, Deputy General Director of the Vietnam Securities Depository and Clearing Corporation (VSDC) said that the number of accounts of foreign institutional investors only accounts for 10% but the value of buying/selling transactions of this group always accounts for a large proportion of the total transaction value of all foreign investors.

Besides, according to Mr. Tuan, the above group has high compliance and has never had a case of insolvency due to not being able to arrange money, so they will be given priority to resolve the issue first.

Source

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)