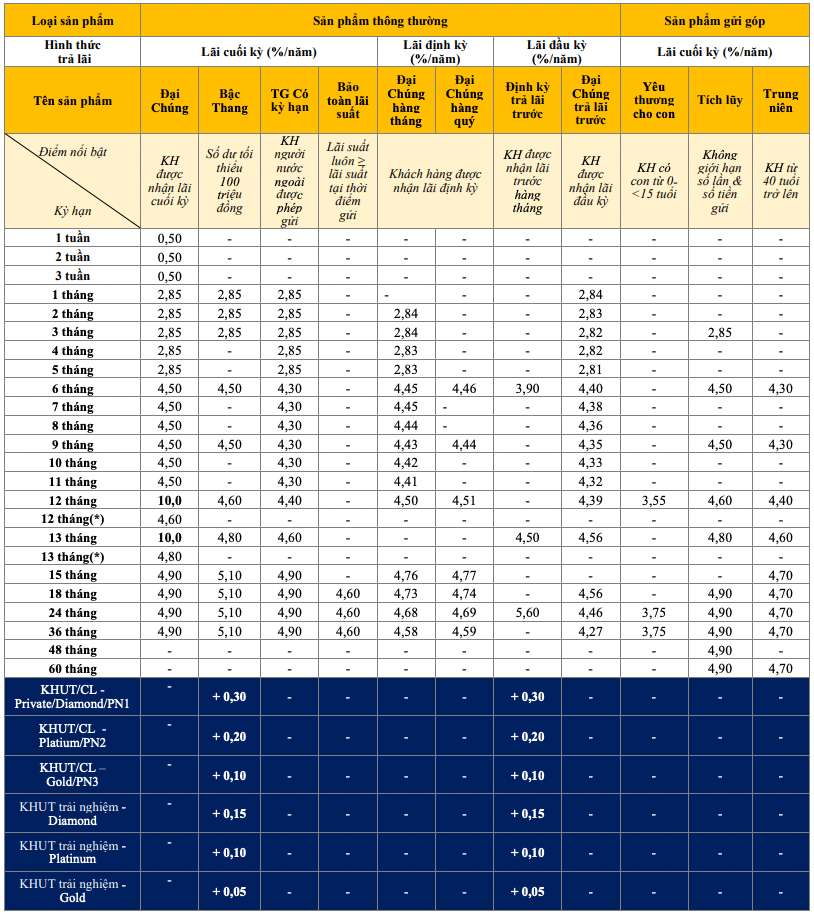

According to a survey by Lao Dong Newspaper reporters at 0:30 on February 20, 2024, leading the 12-month savings interest rate table, PVcomBank listed an interest rate of up to 10%/year. However, to enjoy this extremely high interest rate, customers need to meet the condition of depositing at least 2,000 billion VND at the counter and only applies to products that receive interest at the end of the term.

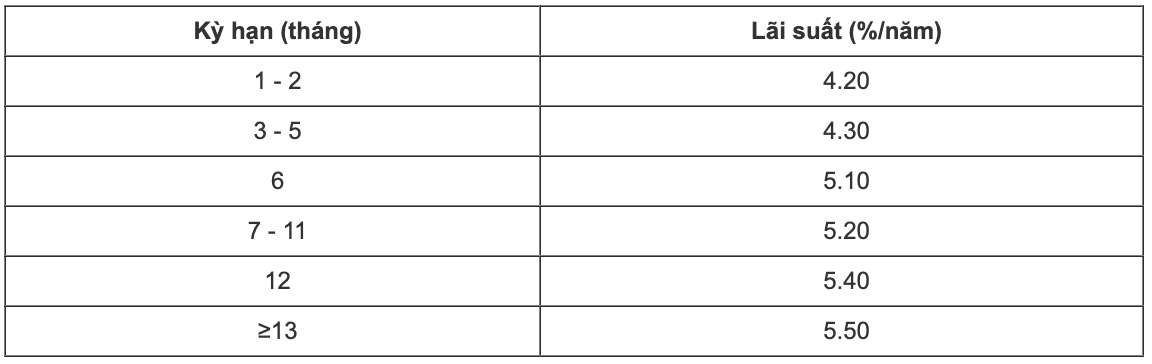

Under normal conditions, PVcomBank is listing the highest interest rate at 4.9%/year when customers deposit savings online and receive interest at the end of the term. If customers deposit money at the counter, they will only receive an interest rate of 4.6%/year.

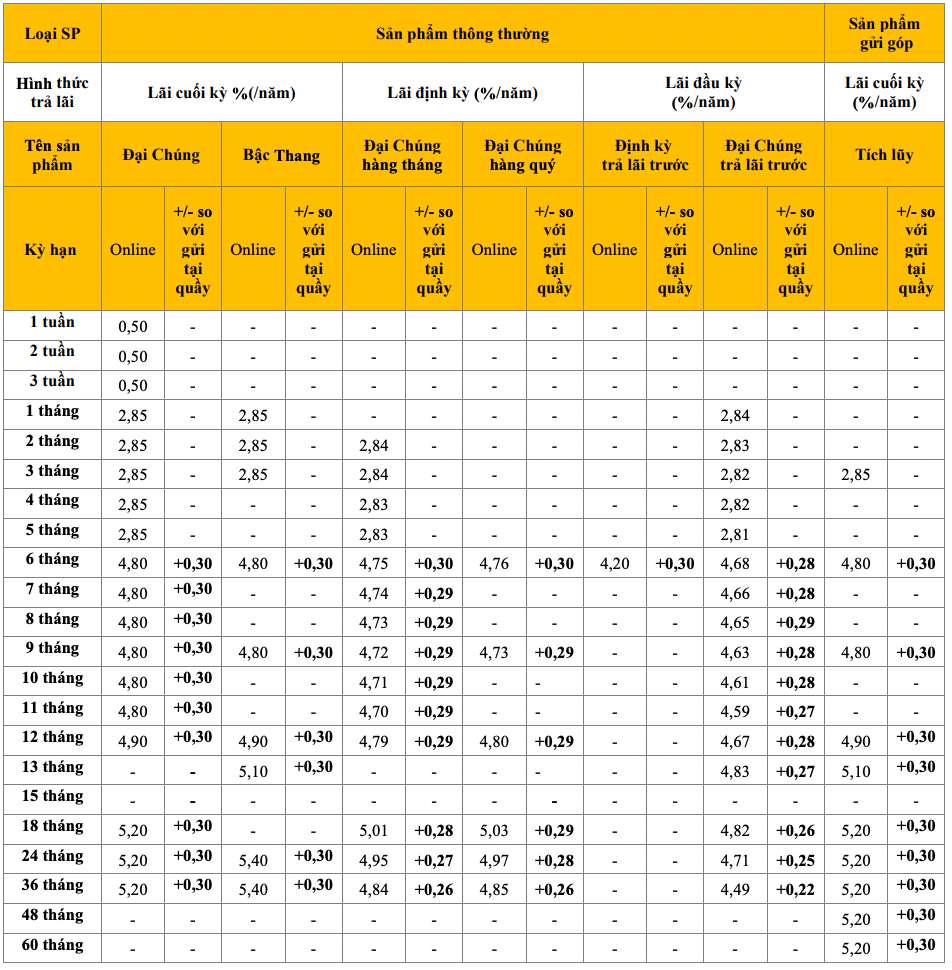

HDBank 's 12-month savings interest rate has decreased by 0.1% to 7.7%/year, provided that a minimum balance of VND300 billion is maintained. Under normal conditions, when making a 12-month online savings deposit, customers receive an interest rate of 4.8%/year. If customers deposit money at the counter, they only receive an interest rate of 4.9%/year.

Under normal conditions, HDBank is listing the highest interest rate at 5.7%/year when customers deposit money online for an 18-month term. This interest rate has decreased by 0.2% compared to the beginning of the week.

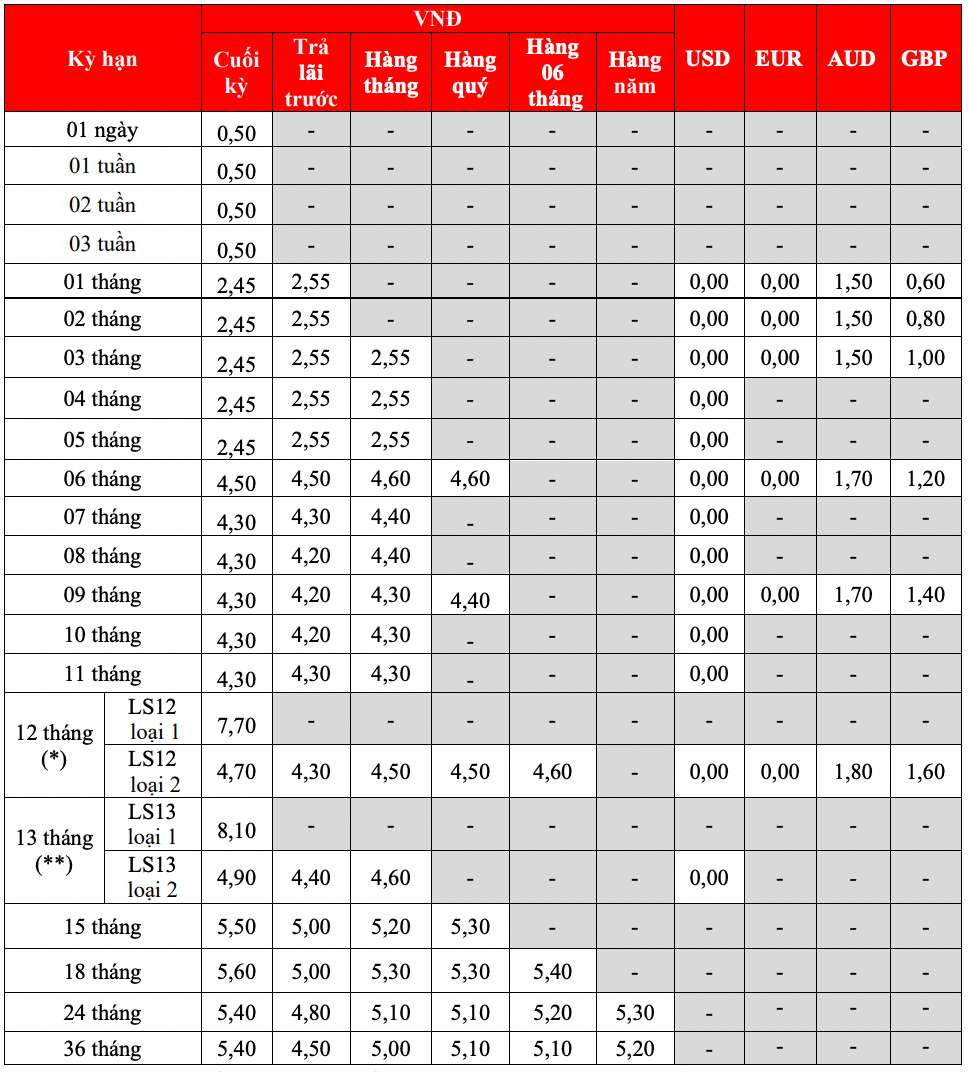

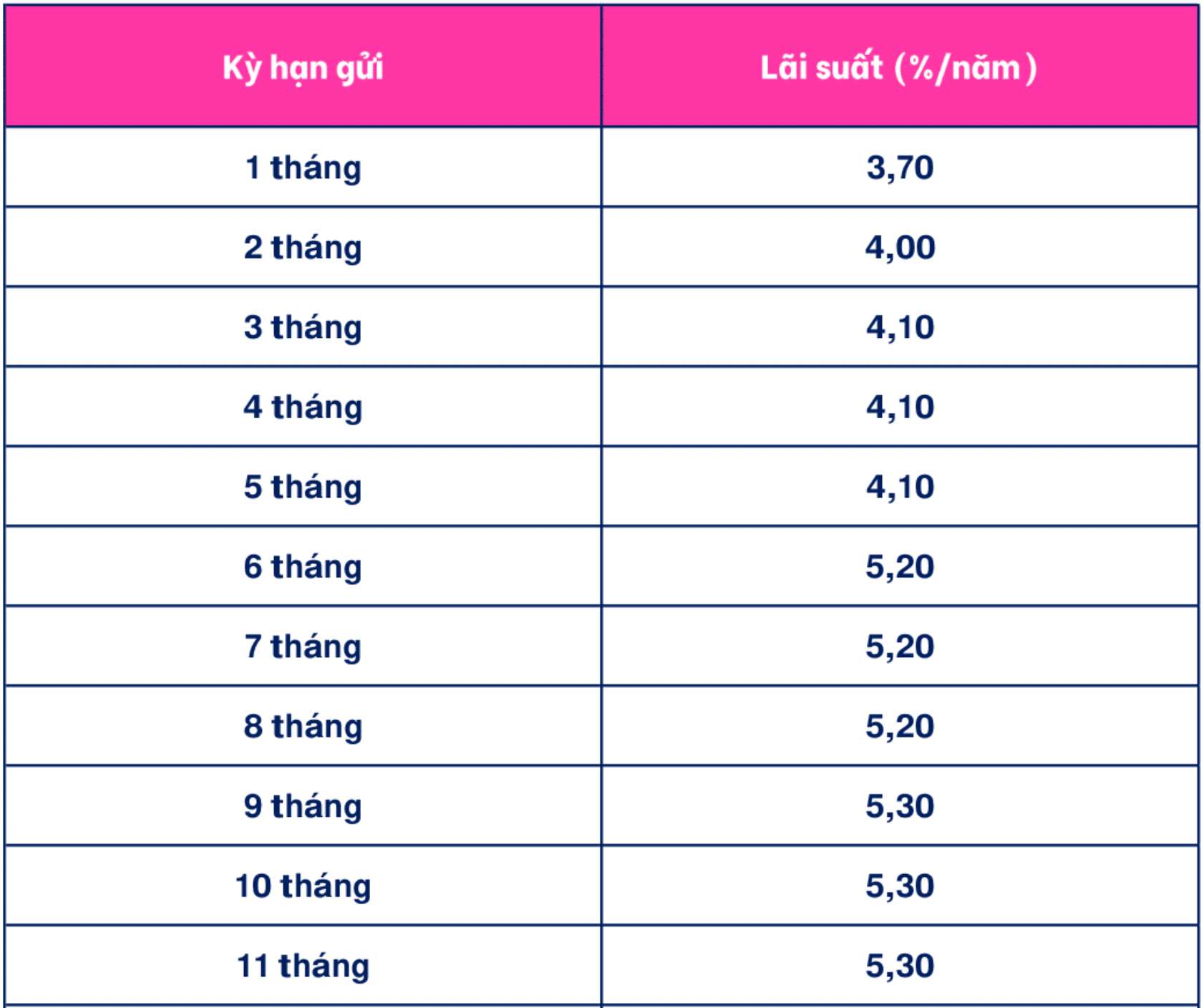

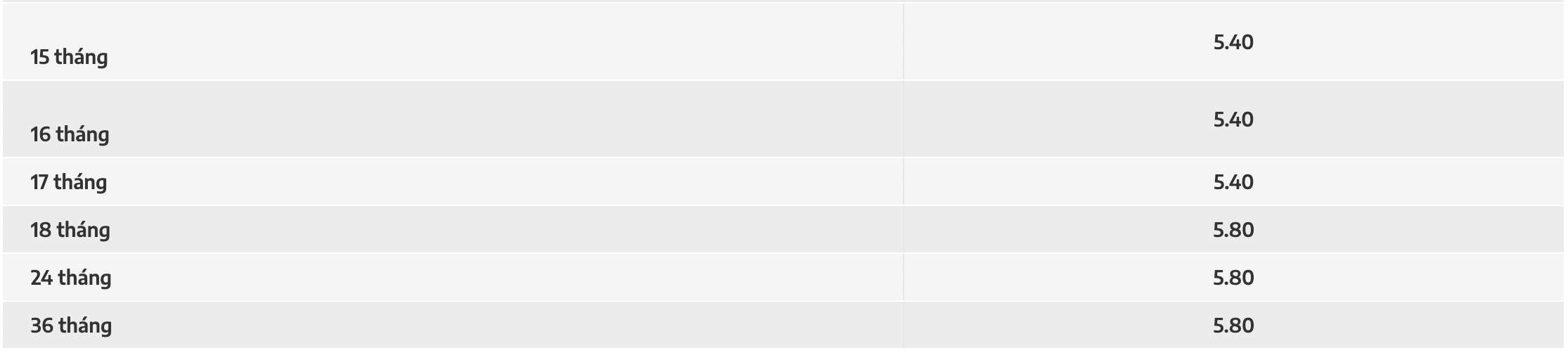

Cake by VPBank is listing the 12-month savings interest rate at 5.4%/year when customers receive interest at the end of the term. For other terms, Cake by VPBank lists interest rates ranging from 3.7-5.5%/year.

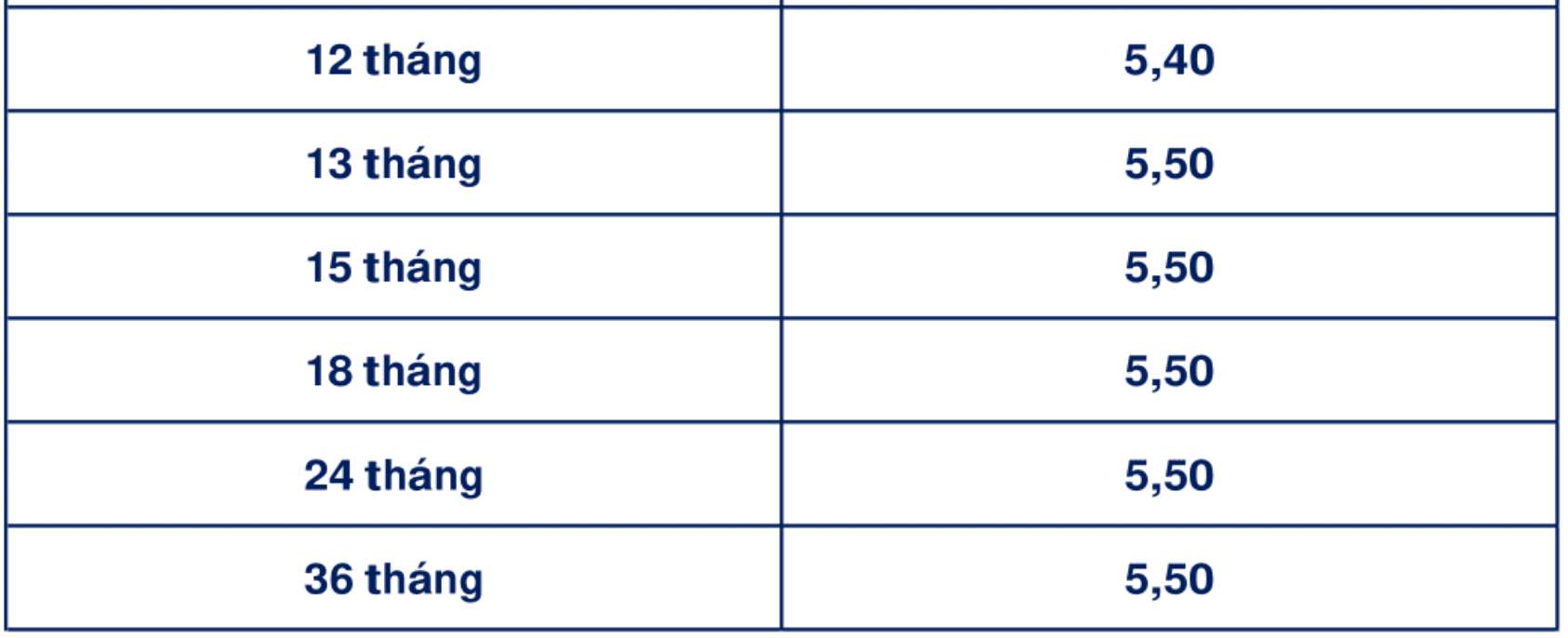

CBBank is listing the highest interest rate for a 12-month term at 5.4%/year when customers deposit money online. CBBank is listing the highest interest rate at 5.5%/year when customers deposit money online and receive interest at the end of the term.

NamABank lists the highest interest rate for a 12-month term at 5.4%/year when customers deposit money online and receive interest at the end of the term. NamABank is listing the highest interest rate at 5.8%/year when customers deposit money for 18-36 months and receive interest at the end of the term.

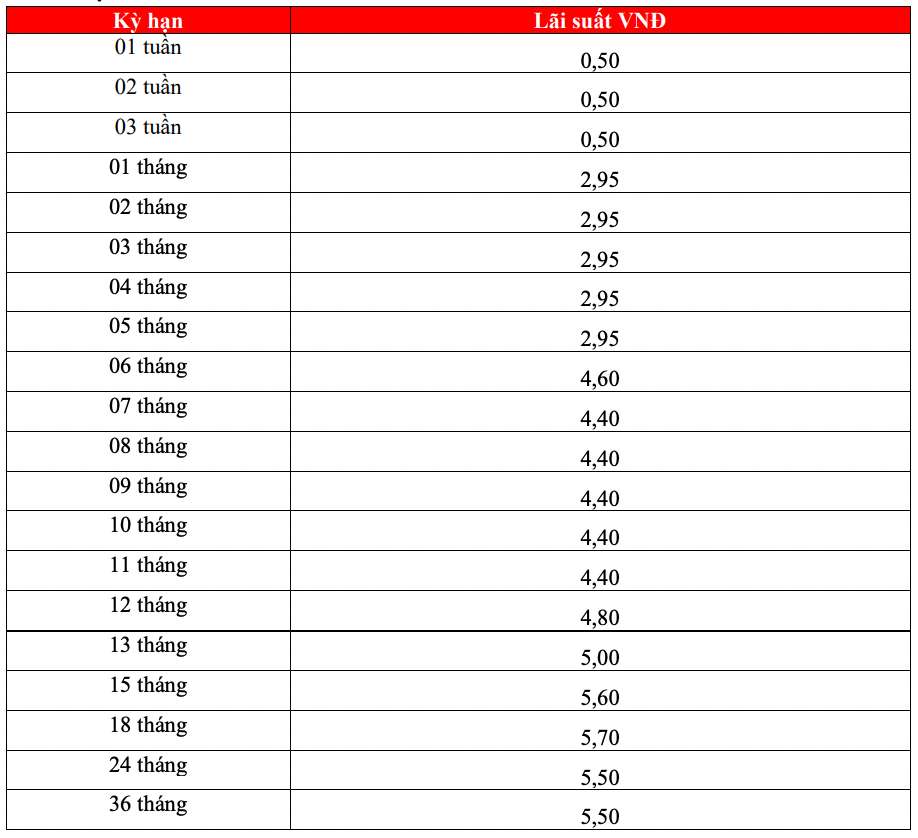

How much interest do I receive for 12-month savings?

You can refer to the interest calculation method to know how much interest you will receive after saving. To calculate interest, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit.

For example, you deposit 1 billion VND in Bank A, for a term of 12 months and enjoy an interest rate of 5.4%/year, the interest received is as follows:

1 billion VND x 5.4%/12 x 12 = 54 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more information about interest rates HERE.

Source

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

Comment (0)