Cautious but effective

BVFED was established and managed by Bao Viet Fund Management Company Limited (Baoviet Fund), which is one of the three pillars of Bao Viet Group (BVH), where prudence is always the top concern.

At the time of the establishment of the BVFED open-end fund, there were also a few other open-end funds established, mainly open-end bond funds and focusing on trading Government Bonds, which are considered quite safe assets. In this cautious trend, Baoviet Fund chose to invest in stocks, in order to seize the opportunity to create a distinct competitive advantage.

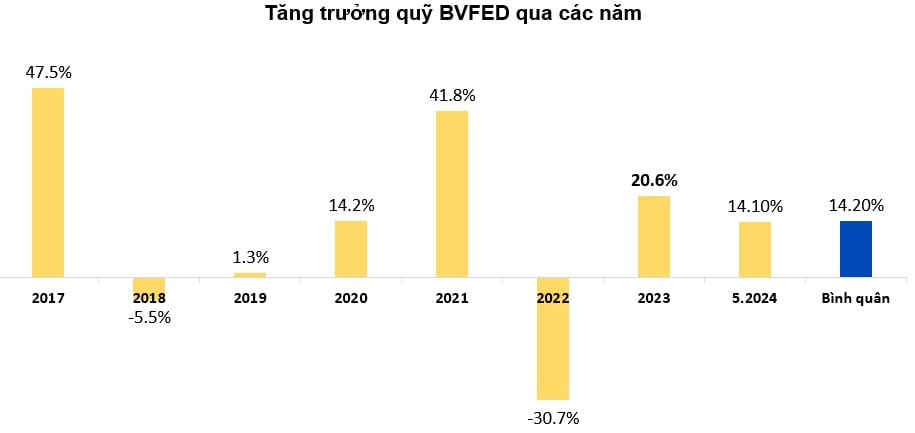

The “sweet fruit” came relatively early, when in 2017, BVFED achieved a growth rate of 47.5% and became the open-end fund with the best performance in the market. Also in 2017, another “brother” fund of BVFED, Bao Viet Bond Investment Fund (BVBF), also achieved a growth rate of 15.3% and ranked top 2 in terms of performance. In 2017, bank deposit interest rates were around 7-8%, so BVFED’s return at that time was about 7 times higher than savings deposits. If you invest cautiously in BVBF, the return rate is also 2 times higher than savings deposits.

At the time BVFED and some other open-end funds were born, the liquidity factor was emphasized much more than efficiency. Investors who wanted to withdraw money only needed to sell the open-end fund certificates back to the fund management company, very quickly and conveniently. But at that time, to have money ready to return to investors at any time, the open-end fund would have to be cautious, disburse into highly liquid assets or build a portfolio structure to meet investors' withdrawal needs. However, the "huge" performance of BVFED in 2017 changed this thinking and moved towards an open-end fund with high liquidity but also high operational efficiency.

Sustainable expectations

For many years, Baoviet Fund, along with 3 open-end funds and 1 member fund, have been prominent names in the domestic fund management industry. But recently, when products simulate investment fund portfolios or evaluate effective fund certificates, the name BVFED always appears.

BVFED's public portfolio consists of two parts: the core part, which includes VN30 basket stocks, and the satellite part, which includes stocks that meet BVFED's criteria, including liquidity criteria. However, the proportion of the satellite part does not exceed 30% of the fund's total assets, which can be considered a necessary prudence in portfolio management. In fact, the specific list of stocks that BVFED holds is regularly publicized, but buying which stocks, when, and in what proportion is also the "job" of fund managers.

The fund's dynamism is reflected in the fund's decision to structure its assets between stocks and cash, based on the relative movements between the stock and fixed interest markets, as well as the fund's expected liquidity needs, between the underlying and the incremental portion of the stock portfolio itself. This strategy has contributed to the fund's success through impressive growth over the years.

It is known that those in charge of portfolio management of Baoviet Fund in general or BVFED in particular are veterans in the fund management industry, with over 15 years of experience. That is also the reason why, when asked about the secret to Baoviet Fund always receiving international awards for its performance, the company's leaders always emphasize that high-quality, experienced and knowledgeable personnel with a good understanding of the market are always one of the most important values.

Baoviet Fund was established in November 2005 with a charter capital of 25 billion VND and has now increased to 100 billion VND, providing investment portfolio management services, establishing and managing investment funds, and investment consulting for many large insurance companies, businesses and individuals with financial investment needs. Having gone through two decades of ups and downs in the Vietnamese stock market, BaoViet Fund has always maintained its position and image as a fund management company operating "safely" and "effectively". Baoviet Fund is one of the few fund management companies that continuously operate profitably, with total assets under management always growing well over the years, and is one of the market leaders in terms of assets under management. Baoviet Fund has been voted the Best Fund Management Company in Vietnam by Global Banking & Finance Magazine for 4 years: 2016, 2018, 2019 and 2020. Alpha Southeast Asia awarded the Best Fund Management Company in Vietnam for the Fixed Interest Fund and Equity Fund categories in 2021, 2022 and International Finance Magazine voted it the Fastest Growing Fund Management Company in Vietnam 2022 and the Best Fund Management Company in Vietnam 2023. |

Ngoc Minh

Source: https://vietnamnet.vn/dau-an-10-nam-cua-quy-dau-tu-co-phieu-nang-dong-bao-viet-2286198.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)