According to a recent report by DKRA Group on land types in some southern provinces such as Ho Chi Minh City, Binh Duong , Dong Nai, Long An... the supply of new land plots has improved compared to the previous month but decreased sharply by 87% compared to the same period in 2022 with 108 plots. Binh Duong leads with 58 plots, accounting for 54% of the total supply of the entire market. Following are Dong Nai and Long An with 28% and 18% of new supply, respectively.

However, despite the increase in supply, the consumption of this type of land is very limited, with only 24 plots newly consumed in July, down 94% compared to the same period last year. The consumption rate is 22%, transactions are mainly concentrated in the group of products with completed legal documents with an average price of less than 13 million VND/m2.

Southern land plots recorded small transactions, concentrated in a number of projects with full legal documents.

In terms of selling price, this type of product recorded a slight decrease in both the primary and secondary markets. The primary price decreased by 4-6% compared to the previous opening, while preferential policies such as discounts, buyback commitments, interest rate support, etc. are still applied but have not improved liquidity. In the secondary market, the average price decreased by 2-4% compared to the previous month, most of the interested products are from projects with full legal documents and certificates.

According to the survey, the highest selling price of new supply by locality is in Long An at 37.4 million VND/m2, the lowest is 18.3 million VND/m2. The highest price in Dong Nai is 14.5 million VND/m2 and the lowest is 11.8 million VND/m2. In Binh Duong, the highest selling price is 16 million VND/m2 and the lowest has no big difference, at 15.4 million VND/m2.

However, looking at the market trend with the general price level decreasing slightly, the demand for searching and the level of interest in the real estate market is recovering.

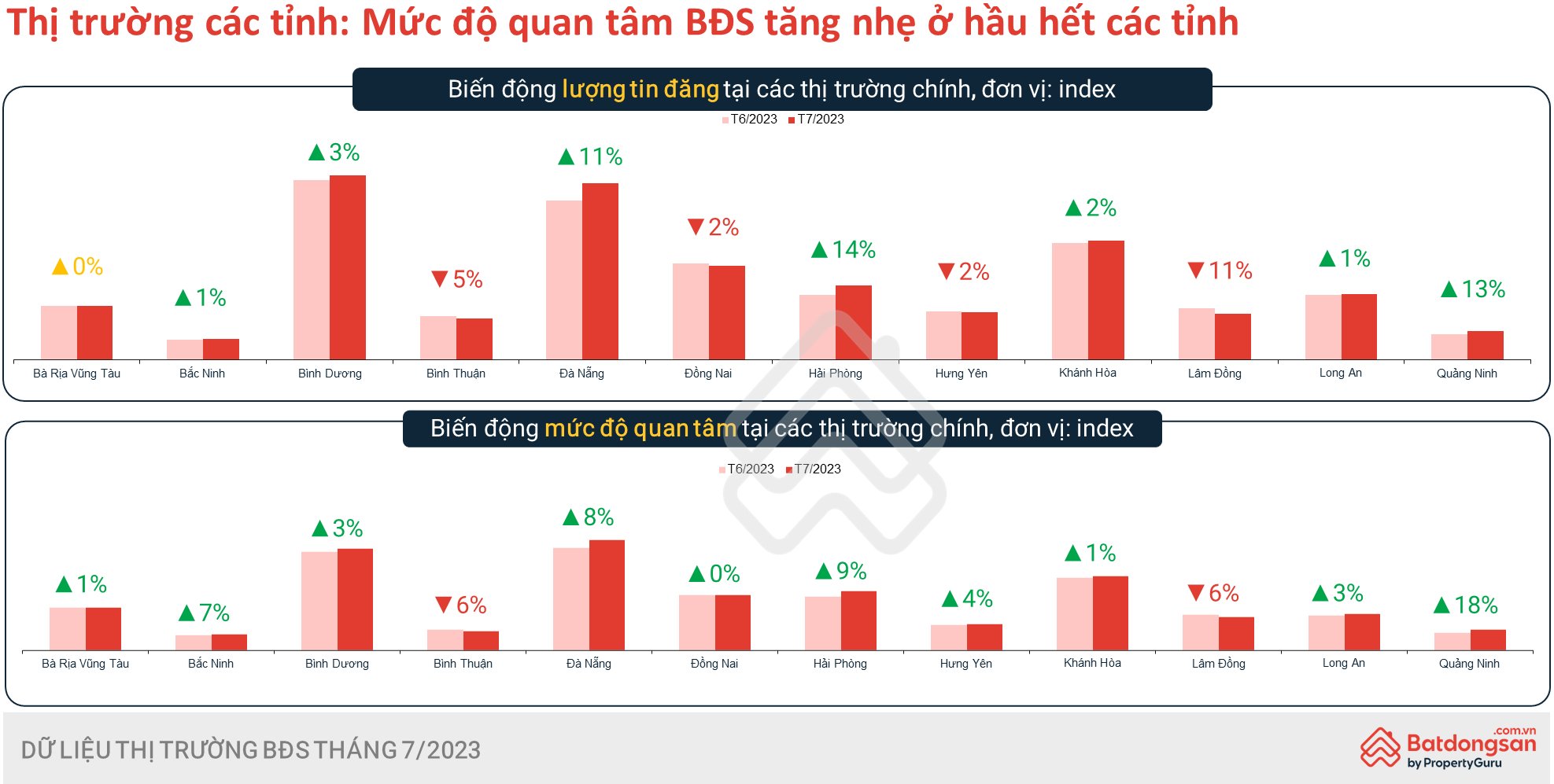

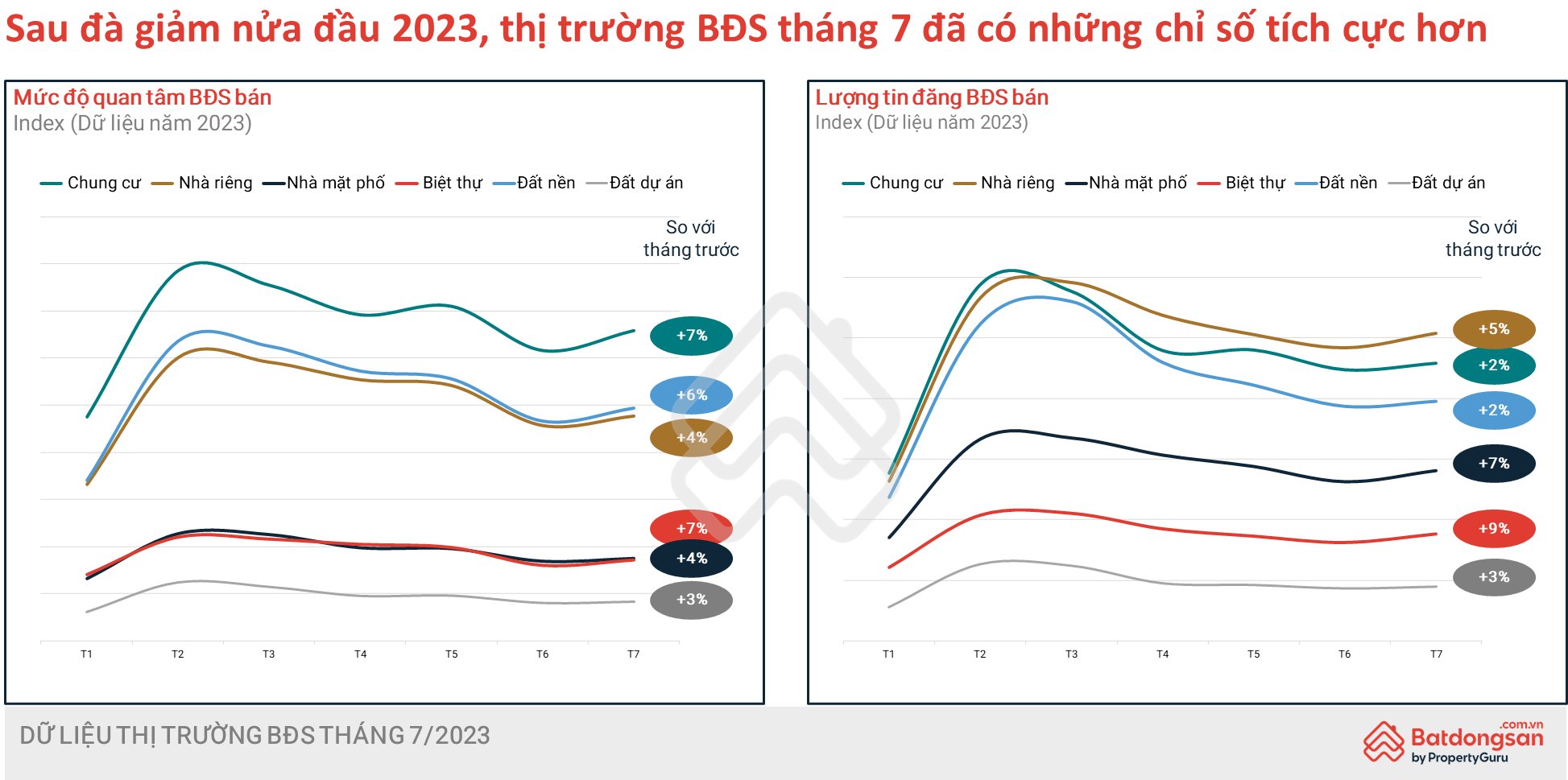

According to the July market report data of Batdongsan.com.vn recently published, the interest in all types of properties has strongly recovered.

Investors have begun to pay more attention to the real estate market.

Of which, apartments and villas witnessed the strongest recovery in interest, up 7% compared to June 2023; land increased by 6%; private houses and project land increased by 3%. The number of listings for sale of all types of real estate also increased from 2% to 9%. In Ho Chi Minh City, the number of interests also increased by 8% compared to the previous month.

With the price level decreasing but the demand and interest increasing, many experts believe that the real estate market in general is showing signs of recovery in the short term. Especially with the land segment, the type that has received much attention from investors so far in this market.

Although the transaction volume has not yet recorded a recovery, the fact that investors continue to maintain preferential policies for buyers will be a factor to help liquidity reach expectations by the end of the year.

Positive indicators of the real estate market.

Experts believe that the overall market demand in the third quarter is expected to increase slightly compared to the second quarter, but there are unlikely to be any short-term breakthroughs. Secondary market payments are at an average level, with transactions occurring mainly in projects with completed infrastructure and full legal status.

In the coming time, along with positive signals about banks reducing loan interest rates and many moves by the Government to remove difficulties for the real estate market, the market will increasingly flourish. Not to mention, the cash flow has begun to show signs of withdrawal from banks when interest rates are continuously adjusted down. Many investors expect this cash flow to return to the real estate market in general and land in particular. From there, the market will "warm up", liquidity will increase sharply and mark the beginning of a new cycle of the market.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

Comment (0)