Sea was once a stock market phenomenon, soaring to more than $200 billion in market capitalization despite huge losses. But the world has changed. Investors have turned away from tech companies that burn money. This is what Sea must change, Li wrote. Amid a high fever and a persistent cough, he told his board that it was time to focus on profits and pull out of India.

Li’s sick note led to a sweeping overhaul at Sea in the months that followed. Parent company Shopee laid off more than 7,500 employees, or 10% of its workforce. Employees were not offered raises, while Li and his executive team decided to forgo their salaries.

Business-class flights were banned; everyone flew economy no matter how far. Daily food costs were capped at $30, and hotels were $150 a night. Snacks disappeared from the office. Luxury tea brand TWG was replaced by Lipton. In some bathrooms, double-ply paper gave way to single-ply.

“We care about every penny,” Li said in his first interview in two years. “You can dream big and be ambitious, but what if you can’t survive? There’s always that voice in your head that says we might run out of money.”

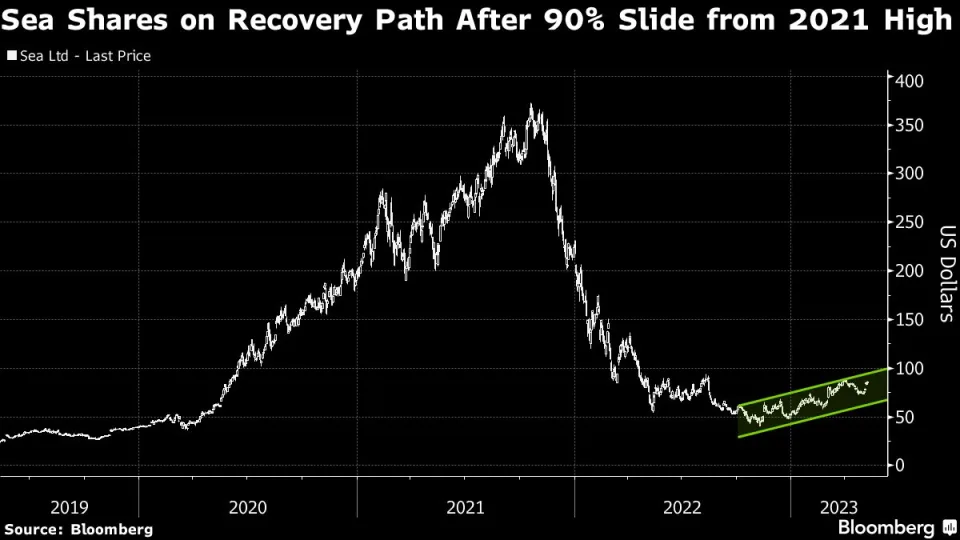

Li’s shock move paid off. In March, Sea reported its first quarterly profit in its 14-year history. Sea’s stock rose 22%. Last week, the company announced it would give most employees a 5% pay raise. Its market capitalization has more than doubled since November 2022.

Like many tech startups of its era, Sea has been losing money for years. In fact, the giant has lost more than $8 billion since its founding, in exchange for growth in e-commerce, gaming, and finance. For now, at least, Sea has proven that if your core business is stable, you can break even.

That’s a challenge for Sea’s rivals, of which Grab is still losing more than $300 million a quarter, while GoTo is losing more than $250 million. Sea “read the market much earlier and made the right moves,” said Amit Kunal, managing partner at investment firm Growtheum Capital.

Li sensed trouble was coming. In November 2021, he invited his executives to dinner at his home to celebrate his 44th birthday. They had plenty to celebrate, including a record stock price a month earlier. At one point in 2020, Sea was the world’s best-performing stock.

That same evening, though, Li saw troubling signs. He noticed people were starting to spend less time on Free Fire, a popular mobile game with 150 million daily users, as Covid restrictions eased. The dinner quickly turned into a discussion about how the world would change after the pandemic.

In February 2022, India abruptly banned Free Fire and dozens of other Chinese apps amid escalating tensions. Although Li is a Singaporean citizen and Sea is headquartered there, he is originally from China, and Tencent is a major shareholder. It was a significant setback in a key growth market.

A month later, as Li discussed his plans for growth on a quarterly earnings call, investors dumped Sea shares. The company lost more than 45% of its market value in five days. For Li, it was a wake-up call that things were worse than he thought. He wrote the plan from his hospital bed.

Li and his team went into crisis mode. They began meeting monthly to discuss cash flow projections, in addition to their weekly meetings. They went through 200 different versions of their 2022 financial projections, he says, which equated to rewriting the budget every two days.

In addition to layoffs and salary freezes, Sea is also withdrawing from Europe and most Latin American countries.

In August 2022, a Chinese engineer said on WeChat that Shopee revoked his job offer as soon as he arrived in Singapore with his wife. Amid the backlash, Shopee apologized and compensated the engineer.

According to Bloomberg , Sea employees even spend their own money to organize group events to boost morale.

During the crisis, Li used internal memos to engage with employees and explain what he was trying to achieve. In a September memo, for example, he said senior management would not take salaries until the company achieved self-sufficiency. He acknowledged that this was not an “easy storm to weather” as investors sought “safe havens.”

At one point, Mr. Li said, Sea prided itself on providing Singapore’s finest tea to its employees and benefits that rivaled Silicon Valley giants. Now, he wants to change that mindset and cut costs. Some employees in some offices have noticed that toilet paper is thinner and even running out faster because people are using more.

Li said they will continue to cut costs, not just to save money but to operate more efficiently. This will be a long-term strategy for Sea.

After Sea slashed its entertainment budget, cutting off meals with partners and suppliers, Li encouraged employees to admit that the company couldn’t afford such things. Sea also called most of its Southeast Asian workforce back to the office late last year.

Despite the rough road ahead, Li has no doubt that Sea can break even. Sea’s path is in some ways similar to that of Amazon and its founder Jeff Bezos. Amazon lost money in its first year on the stock market, while Bezos has consistently argued that investing in growth is more important than quarterly revenue. Sea similarly built Shopee by burning through more than $1 billion a year before surpassing Tokopedia and Lazada in Southeast Asia.

Li argues that Sea has a unique opportunity to bring e-commerce to emerging markets, where success will depend on serving customers on remote islands, finding payment solutions where few people have credit cards, or delivering to places with poor roads or no postal codes.

Besides expanding in Asian markets like Indonesia, Li sees Brazil as the most potential growth market.

These days, Li splits his time between Singapore and California to stay close to the AI revolution taking place in Silicon Valley. He believes AI will play a big role in replacing most of the company’s repetitive jobs.

Asked whether Sea could maintain its quarterly profits, Li tilted his head to one side and laughed, saying he couldn’t reveal too much because Sea was in a quiet period before reporting its results on May 16.

But that’s not the point, the founder says. What’s important is that Sea has shown its employees and investors that it can break even when necessary. So far, it has been able to calibrate growth and profits based on strategic priorities.

“The numbers show that our fate is in our hands. Now, we can sleep well,” he told Bloomberg .

(According to Bloomberg)

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)