(NLDO)- This is the 4th consecutive increase of this stock.

At the end of the trading session on October 29, the VN-Index increased by 7 points, closing at 1,261 points, maintaining the increase for 2 consecutive sessions. Order matching liquidity increased with 490 million shares matched on the HOSE floor.

Market openness has improved more clearly than yesterday's increase with 19/21 industry groups increasing by more than 2% such as: Telecommunications technology (+3.52%), seafood (+2.45%), aviation (+2.4%), fertilizer (+2.2%)...

On the contrary, selling pressure still overshadowed two large-cap industry groups such as: residential real estate (-0.08%), consumer food (-0.86%).

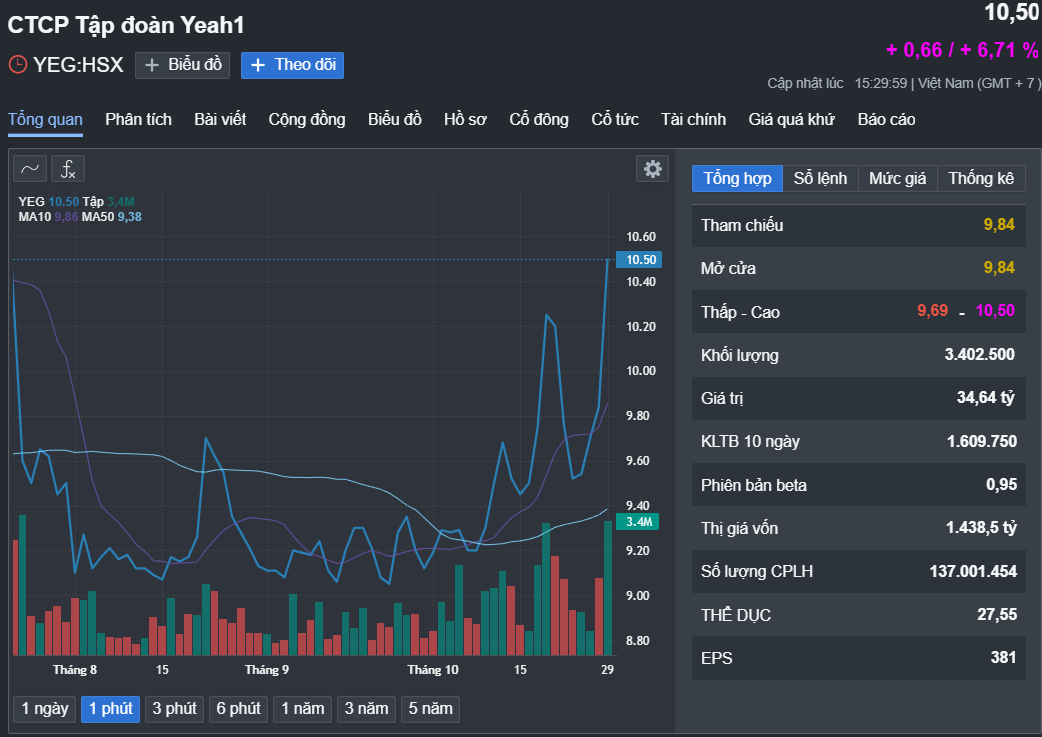

Notably, in today's session, YEG shares of Yeah1 Group Corporation, the producer of "Anh trai vu ngan cong gai", a program that caused a big stir this year, suddenly attracted attention when they "turned purple", reaching 10,500 VND/share.

YEG stock fluctuations from August to present Source: Fireant

This is the highest closing price in the past 3 months and also the 4th consecutive increase of this stock. The liquidity of the stock in the session reached 3.4 million shares, a sharp increase compared to previous sessions.

The move to increase the ceiling price of YEG shares took place after Yeah1 Group announced its business results for the third quarter of 2024 with revenue reaching more than 345 billion VND, 3 times higher than the same period.

After deducting expenses, the company reported a profit after tax that increased nearly 11 times compared to the same period last year, to 34.3 billion VND.

Accumulated in the first 9 months of 2024, Yeah 1 recorded revenue of more than 629 billion VND, 2.4 times higher and after-tax profit of nearly 56 billion VND, 4.5 times higher than the same period in 2023.

In the trading session on October 29, foreign investors continued to net sell on the HOSE floor, with a value of VND5,252.2 billion. Of which, they sold heavily at VIB (-VND5,540 billion), VHM (-VND95.1 billion), BID (-VND66.3 billion), MSN (-VND44.8 billion)...

On the contrary, they bought many shares of VPB (+275 billion VND), GMD (+172 billion VND), EIB (+63 billion VND)...

Commenting on tomorrow's trading session, Rong Viet Securities Joint Stock Company believes that the market has approached the resistance zone of 1,265 - 1,270 points, and the risk of being blocked and retreating from this resistance zone is still latent.

Therefore, investors still need to observe supply and demand developments and keep the portfolio proportion at a reasonable level, avoiding falling into a state of overbought. Temporarily, it is still necessary to consider the recovery period to restructure the portfolio in a direction to minimize risks.

According to Vietnam Construction Securities Corporation, investors should reduce their holdings in stocks that are violating risk management thresholds when the VN-Index is pulled up to the resistance level of 1,270 - 1,275 points.

In a new buying trend, it is necessary to patiently wait for clear confirmation signals from the market, especially from liquidity.

Source: https://nld.com.vn/co-phieu-yeg-cua-nha-san-xuat-anh-trai-vuot-ngan-chong-gai-bat-ngo-tang-kich-tran-196241029180920555.htm

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)