Can you tell me how many types of insurance are there for motorbikes? What are the compensation principles of motorbike insurance? - Reader Hong Ngoc

|

How many types of insurance are there for motorbikes?

According to Clause 3, Article 4 of Decree 67/2023/ND-CP, in addition to participating in compulsory insurance according to the insurance conditions, insurance premiums, minimum insurance amounts or insurance liability limits prescribed in Decree 67/2023/ND-CP, the insurance buyer and the insurance company may agree in the insurance contract on expanding the insurance conditions, increasing the insurance amount and corresponding additional insurance premiums in accordance with legal regulations.

In this case, the insurance company is responsible for separating the compulsory insurance part in the insurance contract.

The State encourages agencies, organizations and individuals who are not required to purchase compulsory insurance as prescribed in Decree 67/2023/ND-CP to purchase insurance based on agreements with insurance companies and in accordance with legal regulations.

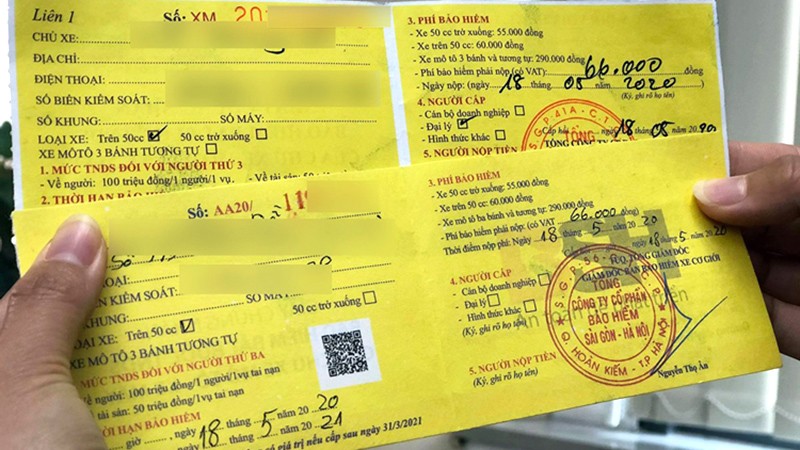

Thus, there are two types of motorbike insurance: compulsory insurance and voluntary insurance.

Principles of compulsory motorcycle insurance compensation

Insurance companies shall consider and settle insurance claims in accordance with the provisions of the law on insurance business and according to the following principles:

(1) When an accident occurs, the insurance buyer and the insured person must be responsible for:

- Immediately notify the insurance company via hotline to coordinate resolution, actively rescue, limit damage to health, life and property, and protect the accident scene.

- Do not move, disassemble or repair property without the approval of the insurance company, except in necessary cases to ensure safety, prevent damage to health, life and property or to comply with the request of a competent authority.

- Proactively collect and provide documents specified in the insurance claim file under the responsibility of the insurance buyer and the insured to the insurance company as prescribed in Article 13 of Decree 67/2023/ND-CP.

- Facilitate insurance companies in the process of verifying the documents they provide.

(2) Upon receiving notice of an accident, within 1 hour the insurance company must instruct the insurance buyer and the insured on safety measures, precautions to limit damage to people and property, and provide guidance on documents and procedures for claiming insurance compensation;

Closely coordinate with the insurance buyer, the insured, the third party and related parties within 24 hours to organize the loss assessment to determine the cause and extent of the loss as a basis for settling insurance claims.

(3) Within 3 working days from the date of receiving notification from the insurance buyer or the insured about the accident, the insurance company must make an advance payment for compensation for damage to health and life, specifically:

- In case the accident is determined to be within the scope of compensation for damages:

+ 70% of the estimated insurance compensation as prescribed for one person in an accident in case of death.

+ 50% of the estimated insurance compensation as prescribed for one person in an accident in case of bodily injury.

- In case the accident is not yet determined to be within the scope of compensation for damages:

+ 30% of the prescribed insurance liability limit for one person in an accident in case of death and estimated injury rate of 81% or more.

+ 10% of the prescribed insurance liability limit for one person in an accident for cases where the estimated injury rate is from 31% to less than 81%.

After making an advance payment, the insurance company has the right to request the Motor Vehicle Insurance Fund to refund the advance payment in case the accident is determined to be excluded from insurance liability or not covered by insurance.

(4) Within 5 working days from the date of the accident, except in cases of force majeure or objective obstacles, the insurance buyer and the insured must send a written or electronic notice of the accident to the insurance company.

(5) When an accident occurs, within the scope of the insurance liability limit, the insurance company must compensate the insured for the amount that the insured has compensated or will have to compensate the damaged person.

In case the insured person dies or loses civil capacity according to a court decision, the insurance company shall directly compensate the damaged person or the heir of the damaged person (in case the damaged person has died) or the representative of the damaged person (in case the damaged person loses civil capacity according to a court decision or is a minor according to the provisions of the Civil Code).

(6) Insurance compensation level:

- The specific level of compensation for health and life is determined according to each type of injury or damage according to the Table of regulations on payment of compensation for health and life damage as prescribed in Appendix VI issued with Decree 67/2023/ND-CP or according to the agreement (if any) between the insured person and the damaged person or the heir of the damaged person (in case the damaged person has died) or the representative of the damaged person (in case the damaged person loses civil act capacity according to the decision of the Court or is a minor according to the provisions of the Civil Code), but does not exceed the compensation level prescribed in Appendix VI issued with Decree 67/2023/ND-CP.

In case of a Court decision, the Court decision shall be based on it but shall not exceed the compensation level prescribed in Appendix VI issued with Decree 67/2023/ND-CP.

In case multiple motor vehicles cause an accident resulting in damage to health or life, the compensation level is determined according to the level of fault of the motor vehicle owner, but the total compensation level must not exceed the insurance liability limit.

For accidents determined by competent authorities to be caused entirely by the fault of a third party, the level of health and life insurance compensation for third party subjects is equal to 50% of the compensation level specified in Appendix VI issued with Decree 67/2023/ND-CP or according to the agreement (if any) between the insured person or the heir of the damaged person (in case the damaged person has died) or the representative of the damaged person (in case the damaged person has lost civil act capacity according to the decision of the Court or is a minor according to the provisions of the Civil Code), but does not exceed 50% of the compensation level specified in Appendix VI issued with Decree 67/2023/ND-CP.

- The specific compensation for property damage in an accident is determined based on the actual damage and the level of fault of the motor vehicle owner, but does not exceed the insurance liability limit.

(7) The insurance company has the right to deduct up to 5% of the compensation for property damage in case the insurance buyer or insured person does not notify the insurance company of the accident as prescribed in Clause 4, Article 12 of Decree 67/2023/ND-CP or after the occurrence of an insured event, the insurance company discovers that during the implementation of the insurance contract, the insurance buyer or insured person does not fulfill the notification obligation when there is a change in the factors that serve as the basis for calculating the insurance premium, leading to an increase in insured risks.

(8) The insurance company is not responsible for compensating for the amount exceeding the insurance liability limit as prescribed in Decree 67/2023/ND-CP, except in cases where the motor vehicle owner participates in a voluntary insurance contract.

(9) In case multiple compulsory civil liability insurance contracts are concluded for the same motor vehicle, the compensation amount shall only be settled according to the first concluded insurance contract. The insurance company must refund to the insurance buyer 100% of the insurance premium paid for the remaining insurance contracts.

(10) The insurance buyer and the insured are responsible for notifying the damaged person or the heir or representative of the damaged person of the amount the insurance company has paid for each case of damage to health or life as prescribed in Point a, Clause 6, Article 12 of Decree 67/2023/ND-CP.

(11) The insurance company is responsible for notifying the insurance buyer, the insured, and the damaged person of the amount of compensation for damage to health and life and paying the compensation amount specified in Point a, Clause 6, Article 12 of Decree 67/2023/ND-CP.

(Article 12 of Decree 67/2023/ND-CP)

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)