That is the information given in a report assessing the digital economic potential of Southeast Asia and Vietnam recently published by HSBC Bank.

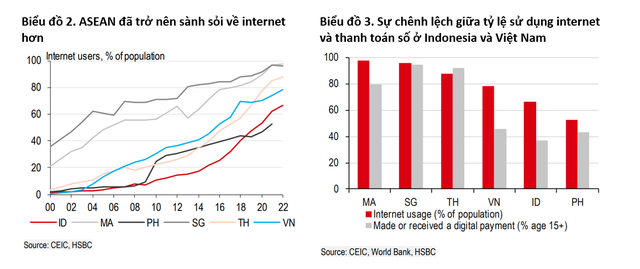

According to HSBC, a series of large-scale investments in the digital technology sector have recently attracted attention in ASEAN. Experts say that the region has become more “tech-savvy” over the past two decades, with Vietnam in a prominent position.

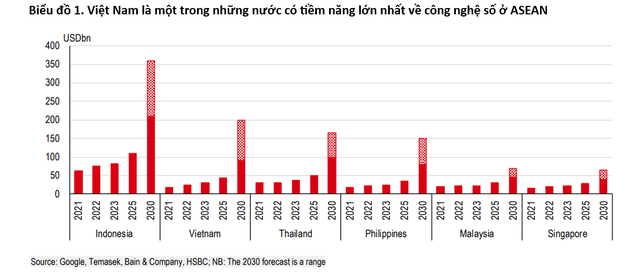

Citing information from the report on e-Conomy Southeast Asia (e-Conomy SEA), HSBC said that in 2023, Vietnam was the fastest growing digital economy in ASEAN and had the potential to become the second largest digital economy by 2030.

“With a large consumer base and growing number of internet users, the potential in Vietnam’s digital economy is understandable,” HSBC explained.

However, according to HSBC experts, there are still challenges such as: How to improve digital literacy, enhance digital technologyeducation and promote energy infrastructure, etc. are challenges that Vietnam needs to overcome if it wants to realize the above desire.

“It is encouraging that Vietnam's National Digital Transformation Program shows that the private sector is always looking for opportunities and playing an active role in supporting digital transformation for the economy,” the report stated.

|

As the first half of 2024 comes to a close, Vietnam continues to maintain its recovery progress, led by the external sectors. However, the recovery is not yet widespread, with the electronics sector leading the way.

In Southeast Asia, HSBC noted that there is a boom in digital technology-related investment in the region. Microsoft recently announced several investments in Indonesia, Malaysia and Thailand. In Vietnam, Alibaba plans to build a data center to meet the growing demand for digital technology.

“With great interest in Vietnam’s emerging digital economy, and a population of more than 100 million people with a working-age ratio of nearly 70%, we see strong potential for Vietnam’s digital consumption,” said an HSBC expert.

According to e-Conomy SEA, by 2023, Vietnam will be the fastest growing digital economy in ASEAN with an impressive growth rate of 20%. In fact, in terms of gross merchandise value (GMV), Vietnam has the potential to become the second largest digital technology market in the region by 2030, behind only Indonesia, and growth is expected to be driven by a growing e-commerce ecosystem, supported by a growing consumer base.

“In addition to demographic advantages, Vietnam’s rapid growth in internet users has also helped expand its digital market. Nearly 80% of the population now uses the internet, thanks to smartphone ownership that has more than doubled since a decade ago. However, despite the significant growth in internet users, digital adoption in some sectors has lagged behind. According to the World Bank’s 2021/2022 data, Vietnam lags behind Singapore, Thailand and Malaysia in the use of non-cash payment solutions, although the shift to digital payments has accelerated since then,” HSBC said.

|

In that context, HSBC believes that, besides consumption, digital transformation has many opportunities to be implemented in many fields. For example, trade is still a relatively paper-based industry. That can increase costs and delays, creating bottlenecks in the flow of trade.

In addition, although the National Single Window Portal - an online system for handling administrative procedures on trade between businesses and the government - is increasingly used, leading to many significant improvements in customs clearance efficiency, there are still some shortcomings.

Specifically, the use of electronic signatures is still limited, meaning that some procedures still need to be handled on paper. Or other digital application measures in commerce show room for shifting to paperless administration.

However, HSBC believes that part of the difficulty stems from the low level of technology literacy among the population, which slows down the adoption of digital tools and limits their effective use. “In terms of digital skills and talent, Vietnam lags behind other countries, limiting its opportunities to take advantage of digitalization. However, it is encouraging that the Government is well aware of these challenges and is playing an active role in supporting the digital transformation of the economy,” said an HSBC expert.

According to the National Digital Transformation Program to 2025, with a vision to 2030, Vietnam aims to build three pillars: Digital Government, Digital Economy and Digital Society. Accordingly, the Government has set a number of ambitious goals in recent years, including by 2030, processing all administrative procedures online.

Vietnam’s national strategy has opened up many opportunities in many areas. In particular, the rate of understanding about digitalization is still relatively low among rural residents and in the agricultural sector. By the end of 2021, Vietnam had more than 27,000 agricultural cooperatives, but only about 2,000 of them applied “high technology” and digital technology in production. In addition, this group is still particularly dependent on traditional financial solutions.

“Digitalization brings both opportunities and challenges for Vietnam. To take advantage of favorable demographic conditions and achieve digital ambitions, investments need to be directed not only to new areas such as artificial intelligence (AI) but also to foundational areas such as digital education and traditional infrastructure. In fact, this process is taking place not only in Vietnam but also across the ASEAN region,” HSBC emphasized.

According to a recent HSBC survey, more than 40% of businesses operating in ASEAN surveyed consider digitalization a top priority. Therefore, proactive dialogue and cooperation between the public and private sectors can help promote development to prepare for a digitally integrated population.

Source: https://congthuong.vn/co-hoi-de-viet-nam-tro-thanh-nen-kinh-te-so-thu-hai-asean-326357.html

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)