End of long streak of gloom

Spot gold in the world market opened the trading week at $2,326.72/ounce and remained within $15 range on Monday and Tuesday.

Then on Wednesday, a slew of economic data such as the ADP jobs report, weekly jobless claims and ISM services PMI are all released in the morning ahead of the US Independence Day holiday, along with the minutes of the June FOMC meeting in the afternoon.

Data showing a weakening US jobs market and minutes from the Federal Reserve meeting that indicated little chance of a rate hike helped push gold prices to a high of $2,363.77 an ounce.

Gold prices then trended up a few dollars an ounce on Thursday. Traders returned on Friday morning and received solid confirmation of US economic data, including that employment (according to the June non-farm payrolls report) was indeed slowing, while the unemployment rate unexpectedly rose to 4.1%.

The news pushed gold prices from $2,367 an ounce in the minutes before the data release to a new weekly high above $2,390 an ounce in early afternoon.

Currently, spot gold prices continue to trade at their highest level in more than a month and reached the threshold of 2,400 USD/ounce.

Positive Forecaster

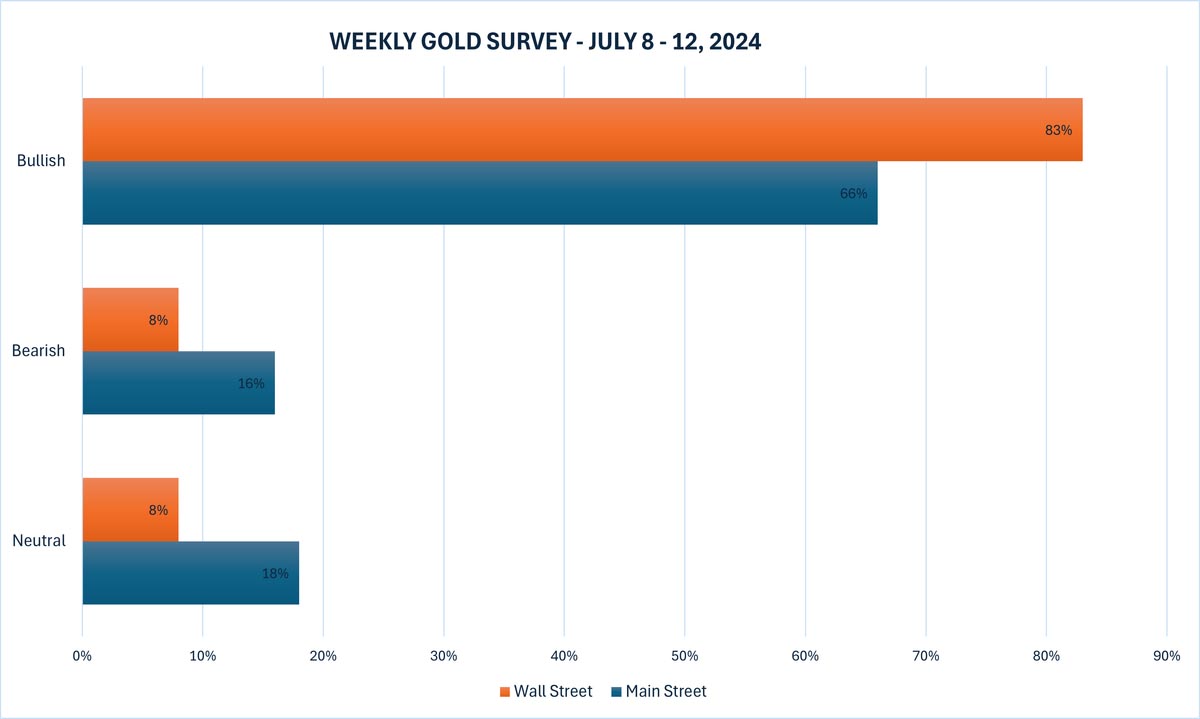

Nearly all industry experts see a positive outlook for gold prices next week, according to the latest Kitco News weekly gold survey.

Twelve Wall Street analysts participated in the Kitco News gold survey this week, with the majority of experts giving a positive outlook on the precious metal.

Ten experts predict gold prices will rise next week, while one analyst predicts a fall and another sees gold trending sideways next week.

Meanwhile, 164 votes were cast in Kitco’s online poll. 108 retail traders predicted gold prices would rise next week. Another 26 predicted the precious metal would trade lower. The remaining 30 saw prices trading sideways next week.

Should I buy SJC gold bars or 9999 round smooth gold rings?

For the domestic market, the price of SJC gold bars has been moving sideways over the past week and the difference between buying and selling prices has been kept at VND2 million/tael. This means that if investors bought SJC gold bars, they would have lost about VND2 million/tael last week.

Most gold buyers will not invest in the short term. However, in the current context, it is unclear how the price of SJC gold bars will fluctuate in the near future. In fact, buying SJC gold bars at gold shops is currently quite difficult. Most shops have announced that they have sold out of gold bars and are only selling jewelry products.

While the price of gold bars remains unchanged, the price of plain round gold rings moves quite close to the world gold price. It used to be lower than the price of SJC gold bars, but along with the price increase in the world market, the price of plain round gold rings is getting closer to the price of gold bars.

At the end of last week's trading session, the price of 9999 Hung Thinh Vuong round gold rings at DOJI Gold and Gemstone Group was listed at 74.65-75.90 million VND/tael (buy in - sell out); Saigon Jewelry Company SJC listed at 73.95-75.55 million VND/tael (buy in - sell out) and Bao Tin Minh Chau listed at 74.68-75.98 million VND/tael (buy in - sell out).

By today's session (July 7), the price of 9999 Hung Thinh Vuong round gold rings at DOJI increased to 75.65-76.95 million VND/tael (buy - sell), Saigon Jewelry Company increased to 74.6-76.2 million VND/tael (buy - sell) and Bao Tin Minh Chau increased to 75.38-76.68 million VND/tael (buy - sell).

Therefore, if buying 9999 Hung Thinh Vuong plain round gold rings at DOJI on June 30 and selling them today, the buyer will lose about 250,000 VND/tael. Meanwhile, the loss when buying at Saigon Jewelry Company SJC and Bao Tin Minh Chau is 950,000 VND/tael and 600,000 VND/tael, respectively.

Thus, although the price of 9999 round smooth gold rings has increased, investors still lose money when buying in the short term. This loss comes from the difference between buying and selling prices listed by business units.

Source: https://laodong.vn/tien-te-dau-tu/chuyen-gia-du-bao-bat-ngo-ve-gia-vang-nen-mua-vang-mieng-hay-vang-nhan-1362730.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)