VNDirect Securities Corporation (Code: VND) has just announced its financial report for the second quarter of 2024 with operating revenue reaching VND 1,458 billion, down 8% over the same period last year.

Of which, the profit from FVTPL financial assets decreased the most, from nearly 949 billion to only 810 billion VND, equivalent to a decrease of 14.6%. Brokerage services also decreased by 10.4% to only 182 billion VND. Profit from HTN investments decreased by 4.4% to 116 billion VND. Particularly, profit from loans and receivables increased by 9.4% to 299 billion VND.

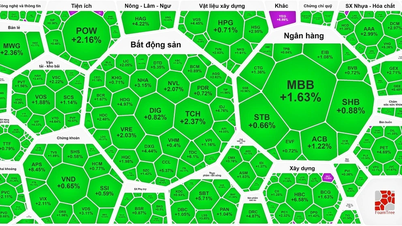

VNDirect's profit is at its lowest level in the past 5 quarters (Photo TL)

Revenue decreased but operating expenses increased significantly during the period, causing a burden for VNDirect.

Specifically, FVTPL financial assets losses in the period increased by 35.6% to VND538 billion. Self-trading expenses also more than doubled, accounting for nearly VND20 billion. The only bright spot was securities brokerage expenses, which decreased by 25.5% to VND98 billion.

Financial expenses and corporate management expenses both decreased but still could not offset the loss from FVTPL financial assets, recording VND 156 billion and VND 79 billion respectively. As a result, VND recorded a profit after tax of VND 345 billion, down 18% over the same period.

Compared to previous business periods, this is a quarter of ineffective operations for VNDirect, with profits at their lowest in the past 5 quarters.

Cumulative revenue in the first 6 months of the year reached VND 2,843 billion, unchanged compared to the same period last year. Although Q2 profit decreased, thanks to positive results in Q1, VND still reported a profit of VND 962 billion, up 71% in the first half of 2024.

With the above results, VND has completed 48% of the year's profit plan.

Source: https://www.congluan.vn/chung-khoan-vndirect-vnd-loi-nhuan-giam-18-ve-day-5-quy-gan-nhat-post304440.html

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)