130,000 spectators flocked to the concert Anh trai vu ngan cong thorn in Hung Yen last weekend – Photo: NAM TRAN

After the move from the Fed, the Vietnamese stock market was in sync with the world stock market when it fluctuated right from the opening, falling more than 10 points.

Along with that, liquidity and active selling skyrocketed. However, active buying force then appeared, and gradually balanced with active selling force. Selling pressure decreased, at the end of the morning session, VN-Index lost 9 points.

After the lunch break, VN-Index continued to narrow its decline thanks to some large-cap stocks showing more positive signals. Although many stocks decreased in price and had better discounts, demand has not increased.

Negative information mainly came from international sources, while the domestic market still lacked momentum to increase prices. VN-Index closed today's session with a loss of nearly 12 points, falling back to 1,254.67 with 322 stocks losing points and 75 stocks remaining in the green.

In general, the market breadth of all 3 floors was negative when 441 stocks decreased in price, overwhelming 243 stocks increased in price, and 898 stocks remained unchanged.

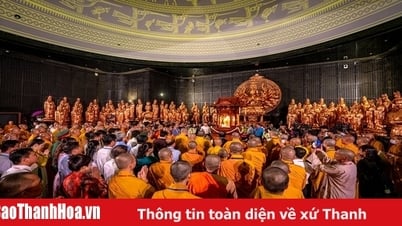

Despite the rather pessimistic general market, Yeah1 Group's YEG stock hit the ceiling with the success of the program "Anh trai vu ngan cong gai".

Looking back at the data, YEG stock has had 3 consecutive ceiling price sessions, bringing the market price to 17,800 VND/session, up nearly 62% after 1 month.

At an online conference on culture, sports and tourism on the morning of December 18 in Hanoi, Prime Minister Pham Minh Chinh suggested replicating concert models, including Anh trai vu ngan cong gai, to contribute to promoting the cultural industry.

Going against the market today, VCA stock of Vicasa-VNSteel also unexpectedly hit the ceiling after 4 consecutive sessions of floor price. Before entering the decline phase, this code had a series of 11 consecutive ceiling price sessions.

Previously, explaining the stock price movement, VCA said that on November 27, Vietnam Steel Corporation - JSC (a major shareholder owning 65% of VCA shares) announced a resolution approving the capital transfer plan at VCA. After that, VCA's stock price increased to the ceiling for 10 consecutive sessions.

According to VCA, stock price fluctuations are entirely determined by supply and demand in the stock market. Investors’ decisions regarding VCA shares are not within the company’s control.

The company also affirmed that its production and business activities remain stable and normal, without any unusual fluctuations. At the same time, they affirmed that they did not participate, intervene or take any action that could affect stock price fluctuations in the market.

Why did Vietnam's stock market fall?

According to investors, the negative performance since the opening of the Vietnamese stock market this morning was mainly due to the impact of information after the Fed's policy meeting.

Although the agency announced a further 25 basis point (0.25%) reduction in the reference interest rate to 4.25-4.5%, it also signaled a more cautious stance on monetary easing next year.

The total reduction in 2025 could be just 50 basis points, given that the labor market remains solid and inflation has not cooled much recently.

Looking at the US market, at the end of the trading session on December 18, the Dow Jones index fell 1,123.03 points after the Fed's decision. This is the second time this year that the index has lost more than 1,000 points in a trading session.

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Steering Committee for key projects in the transport sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/0f4a774f29ce4699b015316413a1d09e)

![[Photo] General Secretary To Lam holds a brief meeting with Russian President Vladimir Putin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/bfaa3ffbc920467893367c80b68984c6)

Comment (0)