On the morning of October 24, nearly 204.84 million DSC shares were officially listed on the Ho Chi Minh City Stock Exchange (HOSE) with a reference price of VND22,500/share, equivalent to a valuation of more than VND4,600 billion.

DSC Securities officially listed on HOSE, profit in the third quarter of 2024 increased by 83%

On the morning of October 24, nearly 204.84 million DSC shares were officially listed on the Ho Chi Minh City Stock Exchange (HOSE) with a reference price of VND22,500/share, equivalent to a valuation of more than VND4,600 billion.

Speaking at the listing ceremony this morning (October 24), Mr. Nguyen Duc Anh, Chairman of the Board of Directors of DSC Securities Corporation, shared that the official listing on the HoSE is an important milestone for DSC in the process of affirming and committing to fully meet the standards and regulations of the financial market.

Above all, this is also an opportunity for DSC to demonstrate its determination to accompany and contribute to the management agency in creating a healthy and transparent investment environment, while bringing optimal efficiency to domestic and foreign investors and customers.

|

| Mr. Nguyen Duc Anh - Chairman of the Board of Directors of DSC said that listing on HoSE is an important milestone for DSC in the process of affirming and committing to fully meet the standards and regulations of the financial market. |

According to the third quarter 2024 business results, DSC's revenue reached VND 147 billion and pre-tax profit reached VND 89.6 billion, growing by 19% and 83% respectively over the same period in 2023.

In the profit structure, self-trading activities contribute the main profit, about 52 billion VND, accounting for 58% of the profit. Since the beginning of the year, DSC self-trading has been performing quite well in managing the investment portfolio and effectively exploiting market opportunities, bringing in 55 billion VND (exceeding 576% of the yearly plan).

DSC securities brokerage recorded VND34 billion in pre-tax profit, bringing the total profit of the first 9 months of the year to VND103 billion (63% of the yearly plan).

Regarding capital exploitation activities, by the end of the third quarter of 2024, DSC's total loan value is estimated at VND 1,830 billion, an increase of 40% over the same period.

Overall, in the first 9 months of 2024, DSC's revenue reached VND 394.6 billion (equivalent to 93% of the yearly plan) and pre-tax profit reached VND 188 billion (equivalent to 94% of the yearly plan).

It is known that the management strategy, human resource optimization and capital resources have directly and positively impacted DSC's business results in the first 9 months of 2024 in general and the third quarter of 2024 in particular. Specifically, DSC's CIR (cost/income) ratio has decreased by 14% from 66% in 2023 to 52% in 2024.

Source: https://baodautu.vn/chung-khoan-dsc-chinh-thuc-chao-san-hose-lai-quy-iii2024-tang-truong-83-d228215.html

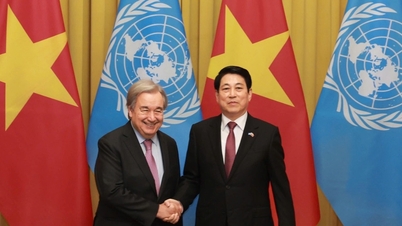

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

Comment (0)