This is the 9th time Agribank has put this debt up for sale after failing 8 times before.

From the starting price of more than 169.36 billion VND in the first auction in July 2022, up to now, this bank has lowered the starting price for the 9th auction to 118 billion VND.

It is known that Minh Viet Company's debt at Agribank was formed from 3 credit contracts signed between the enterprise and the bank during the period 2009-2011.

Total outstanding debt as of June 17, 2022 (the time the bank conducts the auction procedure) is 169,360 billion VND. Of which, principal debt is 110 billion VND, interest debt is 59,360 billion VND.

The collateral for Minh Viet Company's loans includes the right to use 3 plots of land owned by Phuong Vien Tourism Service and Trading Joint Stock Company (Song Phuong Commune, Hoai Duc District, Hanoi). This is the land licensed to build the Tricon Tower project, invested by Minh Viet Company.

According to the original plan, the investor handed over the houses to customers from the end of 2011 to the beginning of 2012. However, up to now, this project has only completed the basement and foundation and is abandoned, with rusty steel.

In addition, the collateral also includes all future assets, rights and interests of Minh Viet Company in the entire works of the Tricon Tower project.

Minh Viet Company is known as the investor of two notorious real estate projects: Tricon Tower Project (Bac An Khanh, Hoai Duc, Hanoi) and The Bayview Towers Project (located in Ha Long Bay, Quang Ninh).

This enterprise is chaired and general director by a foreign businessman.

When both projects were not yet formed, many customers had already paid to buy houses in the project. This Chairman and General Director suddenly left Vietnam in 2013 and has not returned since then.

The Bayview Tower project was later declared by the Quang Ninh Provincial People's Court to belong to Minh Viet's creditor, Cotec Company. Tricon Tower is currently being sold by Agribank.

Source

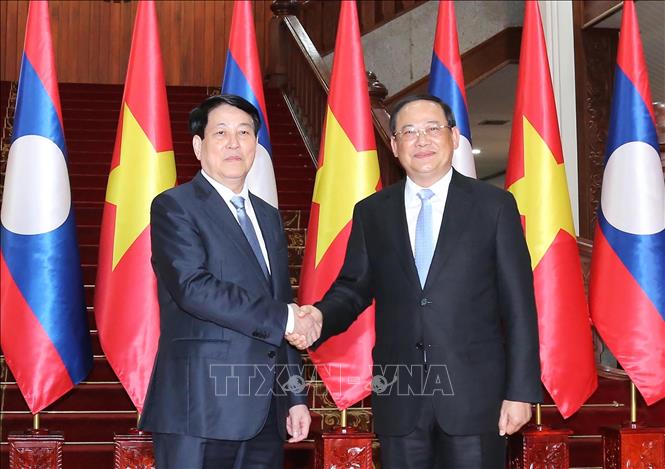

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

Comment (0)