The Government has just issued Decree No. 90/2023/ND-CP regulating the collection rates, collection, payment, exemption, management and use of road use fees. The Decree takes effect from February 1, 2024.

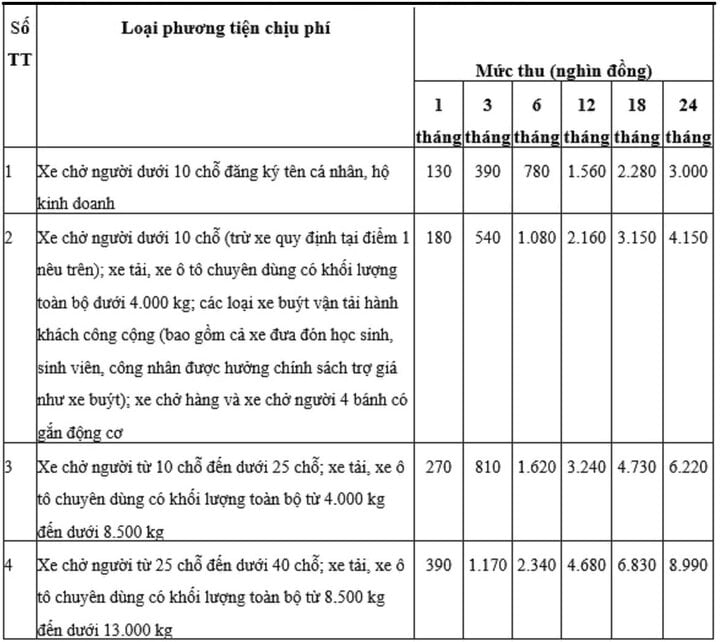

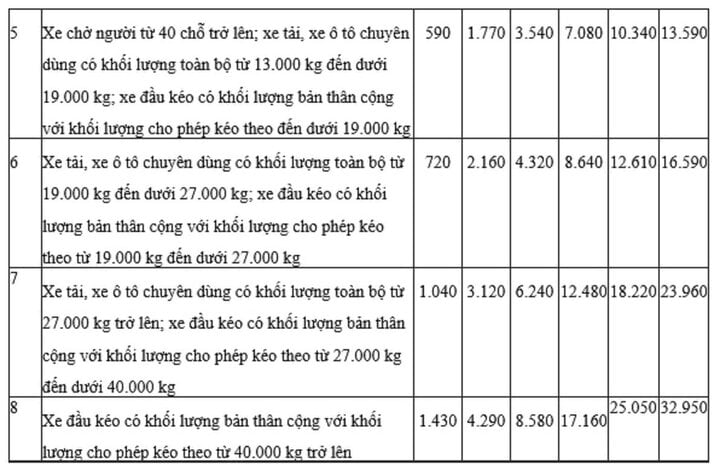

Details of road usage fees for each type of vehicle are as follows:

The Decree also clearly states: In case a vehicle is liquidated or auctioned and has paid the fee past the time of re-inspection for circulation, the vehicle owner shall pay the fee from the time following the fee payment deadline of the previous cycle.

For cars confiscated or revoked by competent State agencies; cars of administrative agencies and public service units (with blue license plates); cars liquidated by defense forces and police; mortgaged cars repossessed by credit institutions and foreign bank branches, which during the period of confiscation, revocation, and pending liquidation are not inspected for circulation and then are auctioned or liquidated, the new owner of the vehicle only has to pay road use fees from the time the vehicle is brought for inspection for circulation.

When inspecting the vehicle for circulation, the vehicle owner must present to the inspection agency relevant documents such as: Decision on confiscation or revocation by competent authority; decision on revocation of mortgaged property; decision on permission to liquidate property for properties owned by administrative agencies, public service units, defense and police units; minutes or contract to complete procedures for purchasing property to be liquidated or auctioned.

In case the vehicle owner wants to pay road use fee for a period longer than the inspection cycle, the inspection unit will collect the fee and issue a road use fee payment stamp corresponding to the fee payment period.

Specifically, in the case of paying fees annually (12 months), the vehicle inspection unit issues a Road Use Fee Payment Stamp corresponding to the 12-month fee payment period. After the fee payment period (12 months), the vehicle owner must go to the vehicle inspection unit to pay the fee and be issued a Road Use Fee Payment Stamp for the next period (12 months or the remaining time of the inspection cycle).

The Decree stipulates that for first-time vehicle inspections, the time for calculating road use fees is calculated from the date the vehicle is granted an Inspection Certificate.

For cars that have been modified, have their functions changed, or have their ownership changed from an organization to an individual (and vice versa), the fee is calculated from the date of change of function or change of ownership according to the new registration certificate of the car. Road use fees are calculated by year, month, or by the inspection cycle of the car. The inspection unit issues a road use fee stamp corresponding to the time of payment.

The Decree clearly states that the collection rate for 1 month in the second year (from the 13th to the 24th month from the date of vehicle inspection and fee payment) is 92% of the fee rate for 1 month as prescribed in the table. The collection rate for 1 month in the third year (from the 25th to the 36th month from the date of vehicle inspection and fee payment) is 85% of the fee rate for 1 month as prescribed in the table.

Minh Tue

Source

![[Photo] General Secretary To Lam and National Assembly Chairman Tran Thanh Man attend the 80th Anniversary of the Traditional Day of the Vietnamese Inspection Sector](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/17/1763356362984_a2-bnd-7940-3561-jpg.webp)

![[Photo] Government holds a special meeting on 8 decrees related to the International Financial Center in Vietnam](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/04/1762229370189_dsc-9764-jpg.webp)

Comment (0)