| Vietnamese Consumer Sentiment: The Wind Has Changed US Retail Sales Grow, Weekly Jobless Claims Fall |

US consumers cautious about spending as interest rates rise

Recently, the University of Michigan announced the US consumer sentiment index in May after the survey, the consumer sentiment index fell from 77.2 in April to 67.4 in May.

Notably, the May reading of 67.4 beat the Dow Jones consensus forecast of 76. Consumer sentiment was weaker than analysts had expected. The index fell 12.7% in just one month, up 14.2% from a year earlier.

The one-year economic outlook rose to 3.5%, up 0.3% from the previous month, to its highest level since November 2023. The five-year outlook also rose to 3.1%, up just 0.1% but reversing the downward trend of the past few months and also reaching its highest level since November last year.

The sharp decline has raised a number of questions about the economic situation and consumer sentiment, which could cause negative market moves.

In economics, inflation is often the result of rapid growth and a significant increase in the amount of money in the economy. This can affect the prices of goods and services, devalue the currency, and affect consumer spending.

“Despite some positive economic prospects, consumers remain cautious and have negative perceptions in several areas: inflation, unemployment, and interest rates, etc., will be negative in the coming year,” said Joanne Hsu, director of the Consumer Survey and associate research professor at the University of Michigan’s Institute for Social Research.

Other indicators in the survey also posted significant declines: The current conditions index fell to 68.8, down more than 10 points, while the expectations gauge fell to 66.5, down 9.5 points. Both pointed to monthly declines of more than 12%, although they were higher than a year ago.

“Reality doesn’t always match perceptions, and we believe the economy is strong enough to sustain consumer spending, while rising incomes are likely to be a driver of consumer spending in the near term,” said Oren Klachkin, an economist at Nationwide Financial.

|

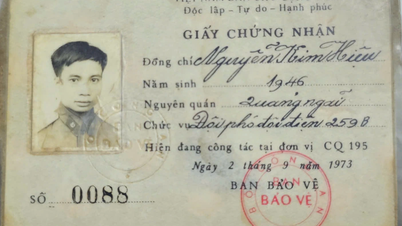

| According to a survey by the University of Michigan, the US consumer index fell sharply as inflation rose, despite positive signs of economic recovery. (Photo: CNBC) |

Many major impacts on the market and economy

The survey comes amid a strong stock market recovery and lower, though still high, gas prices. Most signs of a solid labor market remain, although jobless claims last week hit their highest level since late August.

“By all accounts, the decline in consumer confidence is an important warning sign about the overall economic situation,” said Paul Ashworth, chief North American economist at Capital Economics. “While some geopolitical factors or stock market volatility may have contributed to the decline in confidence, they are only part of the story.”

In the context of rising inflation indicators, the Federal Reserve (Fed) has been considering the short-term path of monetary policy. They have to consider factors such as inflation, economic growth, and unemployment to decide whether to raise, hold, or lower interest rates.

When consumers are concerned about inflation, they save and cut back on spending, leading to a slowing or reduced economic growth. The Fed is walking a tightrope as it balances its mandate of price stability and growth, said Jeffrey Roach, chief economist at LPL Financial.

“The risk of stagflation is rising, which could have major implications for markets and the economy,” said Jeffrey Roach. “This, coupled with the impact of the presidential election, creates uncertainty and anxiety in the markets. The outcome of the election could cause volatility in economic and fiscal policies.”

In addition, the US market is expecting the Fed to start cutting interest rates in September, after a period of keeping interest rates at their highest level in more than 20 years. However, statements from Fed Chairman Jerome Powell show uncertainty and changes in the outlook.

If inflation rises, the United States may have to implement monetary and fiscal policy measures to curb inflation and rebalance the economy. This could include raising interest rates, tightening budget controls, and strengthening monetary policy.

Source: https://congthuong.vn/chi-so-tam-ly-nguoi-tieu-dung-my-giam-sau-bat-chap-tin-hieu-phuc-hoi-tu-nen-kinh-te-319551.html

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

Comment (0)