|

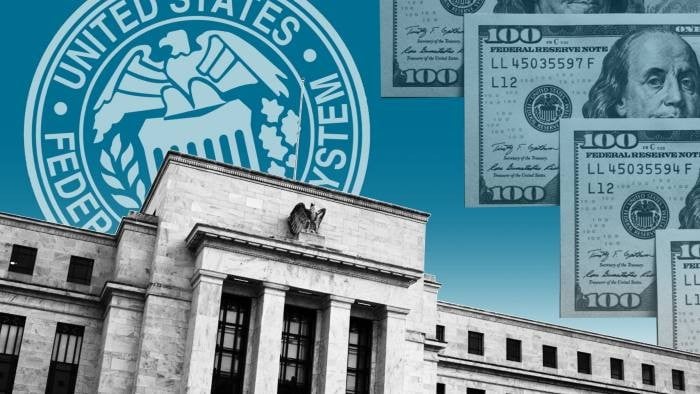

| US Economy: Consumer Price Index in January 2024 unexpectedly increased higher than expected. |

According to data released by the Bureau of Labor Statistics, under the US Department of Labor, on February 13, the consumer price index (CPI) of the world's largest economy rose more than expected in January, amid rising housing and health care costs, but the rising inflation trend is unlikely to change expectations that the US Federal Reserve (Fed) will begin cutting interest rates in the first half of 2024.

Notably, in January 2024, the CPI of the world's largest economy increased by 3.1% compared to the same period in 2023. Previously, economists polled by Reuters forecast the CPI to increase by 0.2% in January 2024 and increase by 2.9% compared to the same period in 2023.

However, the annual consumer price increase has slowed sharply from a peak of 9.1% in June 2022.

While consumer prices remain high, the Fed’s measures to keep inflation at 2% have improved significantly. The trend in the personal consumption expenditures (PCE) price index slowed to an annual rate of 1.7% in Q4 2023, compared with 2.6% in Q3 2023. Meanwhile, the core PCE price index increased 2.0%, unchanged from Q3 2023.

After the Bureau of Labor Statistics announced a higher-than-expected CPI increase, key indexes on Wall Street immediately fell to their lowest levels in the past week.

The market capitalization of “giants” such as Microsoft, Alphabet, Amazon and Meta Platforms immediately “evaporated” 1.2-2.2%; shares of semiconductor manufacturers such as Micron Technology, Advanced Micro Devices and Broadcom lost 2.5% to 4.5% of their value, causing the Philadelphia SE Semiconductor index to drop 2.5%.

At 9:42 a.m. on February 13, East Coast time (9:42 p.m. on the same day, Hanoi time), the Dow Jones Industrial Average was recorded to decrease 427.32 points, equivalent to 1.1%, to 38,370.06 points; the S&P 500 decreased 66.94 points, equivalent to 1.33%, to 4,954.90 points; the Nasdaq Composite decreased 303.61 points, equivalent to 1.9%, to 15,638.94 points.

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)