Multi-color painting

Accordingly, Moody's Analytics forecasts that economies in the Asia-Pacific (APAC) region are doing better than most economies worldwide and are forecast to achieve average economic growth of 3.9% in 2024 and 2025. This figure is unchanged from Moody's Analytics' May forecast and significantly higher than the global economic growth forecast of 2.6% and 2.7%, respectively.

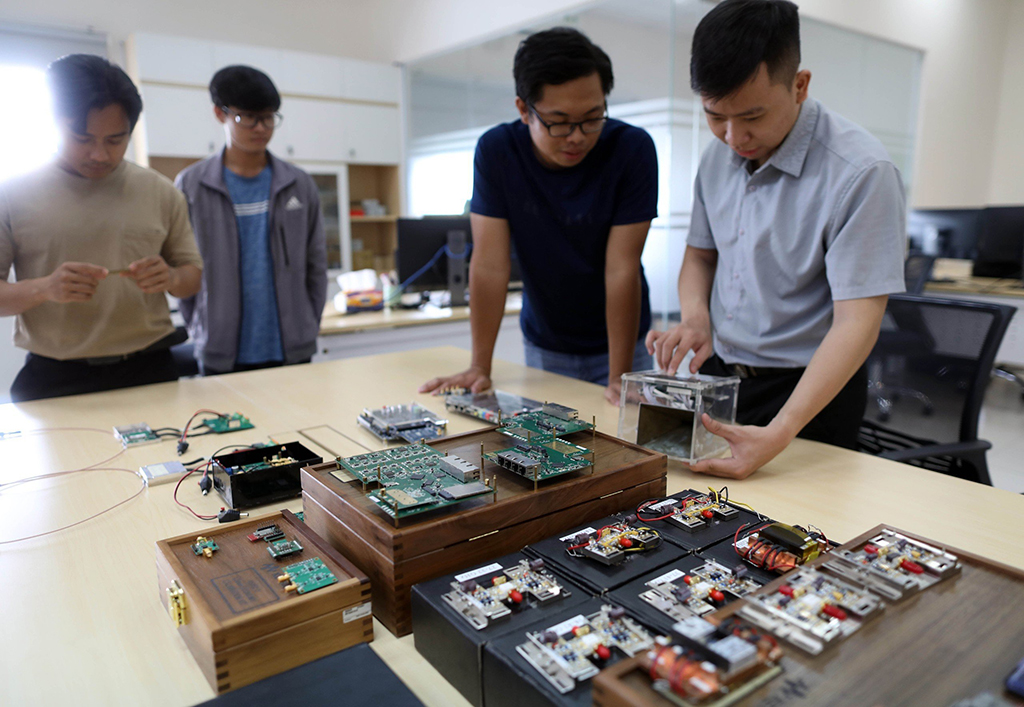

Semiconductor industry helps boost APAC economy ( In photo : microchip laboratory of Ho Chi Minh City University of Technology)

However, there are significant differences between the economies in the region this year. Specifically, Vietnam, India, the Philippines and Indonesia are expected to grow real GDP by more than 5% this year, followed by China at 4.9%. Meanwhile, Australia, New Zealand and Japan are estimated to grow by 1% or less. The rest of APAC will have growth rates of 2-4%.

Rising exports and stronger domestic demand drove better-than-expected growth across most regions in the first quarter, the report said. Demand for advanced semiconductors drove orders for Taiwan and South Korea. Stronger household consumption also contributed to the region’s overall output increase. Exports from elsewhere in the region are also doing better, although Southeast Asia has yet to see a significant increase in demand for the older chips it produces. Shipments from APAC goods makers also appear to be turning around as lower commodity prices have held down export values over the past year. And tourism across the region is slowly recovering.

But with high household debt in economies such as Australia, South Korea, Thailand and New Zealand, combined with slowing wage growth and high interest rates, household spending is likely to be under pressure, so consumption is unlikely to be the main growth driver in the second half of the year for these economies.

The challenge remains great

According to Moody's Analytics, the uncertainty surrounding economic growth forecasts in APAC stems largely from China, the region's largest economy. China's manufacturing economy is doing better, with industrial production and exports showing moderate growth. But households are struggling, causing consumption to weaken. This coincides with growing global unease about China's excess capacity. In May, the US announced new and higher tariffs on a range of Chinese exports such as electric vehicles and batteries. Mexico, Chile and Brazil raised tariffs on Chinese steel, and the EU detailed additional tariffs on Chinese electric vehicles in June. Faced with the prospect of a shrinking export market, Chinese policymakers are showing signs of focusing more on domestic consumption. Rebalancing China's economy toward domestic consumption has been a policy goal for more than a decade, but there have been few clear signs of progress.

Overall, the APAC economy is doing better but is not performing as well as it could. Growth in many countries is below potential, meaning it is too early to say when the region will emerge from its slump. The main challenges in the coming period are generally uncertain global demand and delayed monetary easing in many countries. If a new round of commodity price increases emerges, tightening monetary policy will weigh on the APAC economy. Further, the shift in US economic policy following the upcoming presidential election, geopolitical frictions and changing growth dynamics in China will pose challenges for APAC in the medium to long term.

Source: https://thanhnien.vn/chenh-lech-lon-giua-cac-nen-kinh-te-chau-a-thai-binh-duong-185240621231740042.htm

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)