The Supreme People's Procuracy's accusation is that Ms. Truong My Lan selected and placed trusted individuals with qualifications in the fields of finance and banking, who followed instructions, into key leadership positions at SCB Bank, paid salaries of 200 - 500 million VND/month; gave and rewarded money and SCB shares, so that through these individuals, she could manage all activities of SCB, including lending activities.

By acquiring, holding shares, controlling and operating banking operations through key entities, Ms. Truong My Lan used SCB Bank as a financial tool, mobilizing deposits and capital from other sources, then directing withdrawals by creating fake loans for personal purposes.

To withdraw money from SCB Bank, Ms. Lan managed and directed trusted individuals, holding key roles at SCB and Van Thinh Phat Group to direct these people to organize the establishment of many departments, units, companies, hire and use thousands of individuals, collude closely with each other, collude with valuation companies, and carry out the withdrawal of money from SCB.

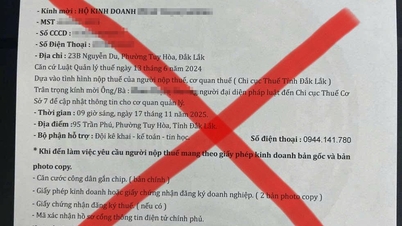

According to the indictment, every time she needed to withdraw money from SCB Bank, Ms. Truong My Lan directed her subordinates to coordinate and collude with each other to create fake loan documents and plans to legalize them; brought in individuals hired/asked to sign the loan documents, property documents, and representatives of "ghost" companies to sign fake loan documents and mortgage documents, mostly signing on blank sheets of paper with the required signature positions marked.

The legal representatives and individuals whose names are on the loan are not entitled to enjoy and use the money, do not know that they borrowed and owe SCB a particularly large amount of money; the people whose names are on the assets all confirm that they are not their assets.

Most of the loans of Ms. Truong My Lan, Van Thinh Phat Group were disbursed first and then legalized. On the documents, the loans showed the disbursement time at the same time as the signing of the credit contract and mortgage contract. But in reality, the withdrawal of money at SCB Bank was done before the credit contract and mortgage procedures were completed and legalized.

Of the 1,284 loans under Ms. Truong My Lan's responsibility that still have outstanding debt, there are 684 loans/debt balance of more than 328 trillion VND that have not had mortgage procedures when disbursing, the remaining, the collateral is mainly shares and property rights.

There are 201 loans/outstanding debt of more than 11,686 billion VND, loan applications are not approved by competent authorities at SCB Bank.

Inflating the price of collateral

The accusation also states that, in order to withdraw money from SCB through the trick of creating fake loan documents, Ms. Truong My Lan directed SCB Bank staff to collude with subjects at valuation companies to issue valuation certificates to legitimize Ms. Lan's loan documents.

In which, SCB Bank leaders directed subordinates directly or through intermediaries to contact valuation companies, collude, increase asset prices many times, and record the date and month of issuance of certificates as required by SCB Bank to legalize loan procedures.

The investigation results determined that SCB hired 19 valuation companies/46 subjects including directors, deputy directors, appraisers, and issuance staff to participate in issuing 378 certificates related to outstanding loans of Ms. Truong My Lan's group.

Up to now, it has been determined that there are 5 valuation companies/7 individuals who are directors, deputy directors, appraisers, and brokers who issued 23 valid valuation certificates for loans of Truong My Lan group. These 5 valuation companies include: New Vision Company, MHD Company, Thien Phu Company, Exim Company, and DATC Company.

To legalize the documents and withdraw money from SCB Bank, Ms. Truong My Lan and her accomplices used many assets that did not meet legal requirements and inflated their prices to use as collateral for the loans.

For 1,284 outstanding loans under the responsibility of Ms. Truong My Lan, there are 1,166 asset codes with a recorded book value of more than 1.2 million billion VND, but Hoang Quan Valuation Company only valued 726/1,166 asset codes, the remaining 440/1,166 asset codes, Hoang Quan Valuation Company did not value because the assets are shares, stocks, property rights, real estate without sufficient documents, property legality...

When it was necessary to withdraw legal and valuable assets to sell or use for other purposes, Ms. Truong My Lan directed her accomplices to exchange and withdraw valuable collateral assets from SCB Bank, replacing them with other assets, most of which had lower value than the withdrawn assets.

To easily exchange collateral, Chairman of Van Thinh Phat and his accomplices at SCB Bank did not register the collateral transaction.

Of the 1,284 loans under the responsibility of Ms. Truong My Lan, 240 secured assets with a total book value of more than 487 trillion VND were converted into 278 secured assets with a book value of more than 351 trillion VND; Hoang Quan Valuation Company only valued 260/278 assets with a total value of more than 108 trillion VND.

Source

![[Photo] Unique architecture of the deepest metro station in France](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763107592365_ga-sau-nhat-nuoc-phap-duy-1-6403-jpg.webp)

![[Photo] Unique art of painting Tuong masks](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763094089301_ndo_br_1-jpg.webp)

![[Photo] Special class in Tra Linh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763078485441_ndo_br_lop-hoc-7-jpg.webp)

Comment (0)