Thien Long Group Corporation (code TLG) has just announced its business results for July. Revenue for July reached 230 billion VND, profit after tax brought in 9 billion VND.

Expenses in July, including sales and administrative expenses, both increased by 16% year-on-year as the company plans to increase operating and sales expenses to develop its brand in preparation for the upcoming strong business period.

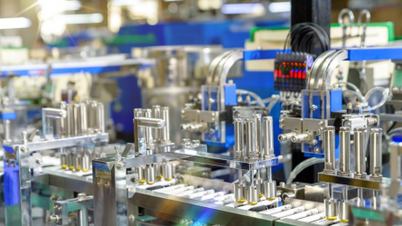

Thien Long Ballpoint Pen (TLG) profit in the first 7 months of the year decreased by 22% (Photo TL)

Overall business situation from the beginning of the year until now. Accumulated net revenue of the first 7 months of the year reached 2,218 billion VND, a slight increase but only achieved 55% of the yearly plan. Profit after tax decreased to only 277 billion VND, equivalent to a decrease of 22% compared to the same period.

In fact, Thien Long Ballpoint Pen's business results have declined since the fourth quarter of 2022. Revenue in the fourth quarter of 2022 reached only 740.5 billion VND, and after-tax profit turned from profit to loss of 2.8 billion VND.

The reason is that a series of expenses in the fourth quarter increased simultaneously, such as financial expenses increased 7.6 times, to 19 billion VND. Selling expenses increased from 147.8 billion to 216.5 billion VND, an increase of 46.5%. Business management expenses also increased by 14.3% to 91.9 billion VND.

Q4/2022 is also the first quarter in 10 consecutive quarters that this unit reported a profit. TLG's most recent loss report was from Q1/2020 with a loss after tax of VND 19.9 billion. This was also the time when TLG's stock price dropped sharply to the price range of only VND 40,000/share.

Currently, in the trading session on September 7, 2023, TLG shares of Thien Long Group are being traded at VND 57,400/share, having recovered 43.5% compared to the bottom created in November 2022.

Source

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)