Thien Long pays 2nd cash dividend at 10% rate

Thien Long Group Corporation (Code: TLG) has just announced the closing of the list of shareholders to pay the second dividend of 2023 in cash. Dividends will be paid at a rate of 10%, corresponding to each shareholder owning 1 share will receive 1,000 VND in cash dividends.

The expected payment date is September 13, 2024. There are currently 78.6 million TLG shares in circulation on the market. Thus, it is expected that Thien Long will have to pay about 78.6 billion VND in dividends this time.

Thien Long Group (TLG) plans to pay a dividend of 10%, the company of Chairman Co Gia Tho will receive 37 billion VND in dividends (Photo TL)

Previously, in July 2023, Thien Long paid the first interim dividend of 2023 to shareholders at a rate of 15%. Thus, in total, Thien Long paid dividends to shareholders at a rate of 25% in cash in 2023.

Regarding the shareholder structure, Thien Long An Thinh Investment Company of Chairman Co Gia Tho is the largest shareholder holding 37.35 million shares, equivalent to 47.52%. Thus, the company will receive dividends of more than 37 billion VND.

In addition to the cash dividend payment plan, at the 2024 Annual General Meeting of Shareholders, Thien Long approved a plan to pay a 10% stock dividend. According to this plan, Thien Long will issue an additional 7.86 million shares to pay dividends to shareholders immediately after the State Securities Commission approves the issuance plan.

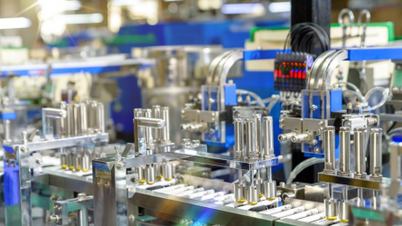

Revenue growth thanks to export market recovery

Regarding business activities, in the second quarter of 2024, Thien Long recorded net revenue of VND 1,207 billion, an increase of 13% over the same period last year. Profit after tax reached VND 241.5 billion, an increase of 43.6% compared to 2023.

Notably, Gross profit in the period reached VND 586 billion, equivalent to gross profit margin improved from 44.7% to 48.5%.

Financial revenue in the second quarter increased significantly, reaching VND20.9 billion thanks to exchange rate fluctuations. Meanwhile, financial expenses were also cut by nearly half, from VND9 billion to VND5.2 billion.

Business administration expenses and sales expenses accounted for VND90.9 billion and VND206.5 billion, respectively. Other profits reached VND891 million.

In the first 6 months of 2024, Thien Long achieved revenue of VND 2,015.8 billion, up 1.4% over the same period. Accumulated profit after tax reached VND 329.8 billion, up 23%. Profit after tax of parent company shareholders reached VND 330.6 billion, up 22.5% over the first half of 2023.

According to Thien Long, as domestic market purchasing power shows signs of recovery, export revenue growth also contributes to creating growth momentum for Thien Long in the second quarter.

Major shareholder Cayman Holdings Ltd partially divests

In addition to the positive business results in the second quarter, Thien Long's shareholder structure also recorded significant changes. At the end of July, Thien Long Group announced that major shareholder NWL Cayman Holdings Ltd sold 2 million TLG shares.

These shares were sold at the trading session on July 25, 2024 with a total value of about 100.4 billion VND.

Previously, NWL Cayman Holdings fund from Cayman Islands became a major shareholder of Thien Long Group since 2019 after purchasing 5 million TLG shares. This amount of shares is equivalent to 7.1% of charter capital.

After the recent sale of 2 million shares, NWL Cayman Holdings has reduced its ownership ratio from 7% to 4.46% of charter capital, equivalent to 3.5 million shares, officially no longer a major shareholder of Thien Long Group.

In the current shareholder structure of TLG, the largest shareholder is still Thien Long An Thinh Investment JSC with a 47.52% ownership ratio. Chairman Co Gia Tho holds 6.27% and is also the Chairman of the Board of Directors at Thien Long An Thinh Investment.

Source: https://www.congluan.vn/but-bi-thien-long-tlg-tra-co-tuc-10-cong-ty-cua-chu-tich-co-gia-tho-thu-ve-37-ty-dong-co-tuc-post308457.html

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)