The Vietnamese stock market has just gone through a volatile period. After increasing by nearly 120 points in March, the VN-Index quickly reversed in the first week of April, reacting to the news that the US imposed reciprocal tariffs on many countries, including Vietnam, which was subject to a tax rate of up to 46% (currently postponed and applied at 10%).

ABS’s recently released strategic report shows that the market is in a medium-term correction phase and is at risk of entering a long-term downtrend if the negative context persists. However, there are still opportunities in difficulties. ABS believes that this could be the period when the market bottoms out, opening a new growth cycle for long-term investors.

According to ABS, there are two possible scenarios. In the positive scenario (high probability): The market maintains the support zone of 1,070 - 1,030 points. Strong liquidation sessions took place in the second week of April, liquidity was shaken off and new cash flows began to quietly buy in. If developments go as predicted, the VN-Index could recover quickly and strongly in the coming sessions.

In the negative scenario: The market continues to be affected by unfavorable information without a clear solution, causing investor sentiment to decline seriously. At that time, the VN-Index may lose its support and fall to deeper support zones. However, ABS believes that this is also an opportunity for investors with cash available to participate in bottom fishing during recovery phases.

ABS also offers a number of strategies for each group of investors. For investors who have been in a weak position since the end of March, they should take advantage of the recovery to restructure their portfolios. For investors who like to take risks, they can apply the strategy of buying late and selling early according to short-term technical charts. For medium and long-term investors, this is an ideal time to collect deeply discounted leading stocks.

| “In the current context, risk control must be a top priority. Investors should allocate capital tightly, limit chasing purchases and prioritize collecting stocks during corrections. For long-term investors, this is the time to plan for partial disbursement,” recommended Mr. Han Huu Hau, a securities analyst. |

|

More specifically, there are 4 potential stocks to increase according to ABS's recommendation.

Hoa Phat (HPG): As a leading enterprise in the construction steel industry with a large domestic market share, HPG is less affected by export fluctuations because it still maintains a strong position in the domestic market. In addition, the Ministry of Industry and Trade's imposition of anti-dumping tax on HRC imported from China will support HPG in increasing product consumption.

However, ABS also warned of risks from HRC consumption demand that could be affected if businesses using HPG's HRC encounter difficulties in exporting.

PVGas (GAS): Holds a monopoly position in gas exploitation, distribution and gas infrastructure systems in Vietnam. The LNG segment is considered a medium- and long-term growth driver, especially in the context that Vietnam will increase LNG imports from the US to reduce the trade deficit.

Projects such as LNG Thi Vai, Son My or Lot B - O Mon promise to improve GAS's supply capacity and revenue in the coming time.

Vinamilk (VNM): As a leading dairy company, Vinamilk benefits directly from the Government's consumption stimulus policy. In addition, the joint venture with Sojitz Group (Japan) through the Vinabeef project will help Vinamilk expand its food business and increase revenue.

ABS expects Vinabeef to contribute significantly to business results in the coming quarters, while supporting the recovery momentum of VNM's stock price.

Masan (MSN): The company is making strategic moves in the retail sector, with plans to open 400-700 more WinCommerce stores this year. In addition, Masan High-Tech Materials is also expected to benefit from US-China trade tensions due to tax exemptions when exporting to the US.

ABS highly appreciates Masan's export prospects and product upgrading strategy in the Spices, Food and Beverage segments.

The Vietnamese stock market is in a challenging transition period. However, according to ABS, deep corrections are opportunities to restructure portfolios and select leading stocks with recovery potential.

“The market always moves in cycles. The problem is not avoiding fluctuations, but knowing how to go in the right direction during unstable periods,” Mr. Han Huu Hau added.

With 4 stocks recommended by ABS in April including: HPG, GAS, VNM and MSN, investors can consider building a reasonable portfolio, preparing for a new growth cycle when the market confirms a bottom.

Source: https://thoibaonganhang.vn/bo-tu-co-phieu-tiem-nang-cho-thang-4-tu-khuyen-nghi-cua-abs-162770.html

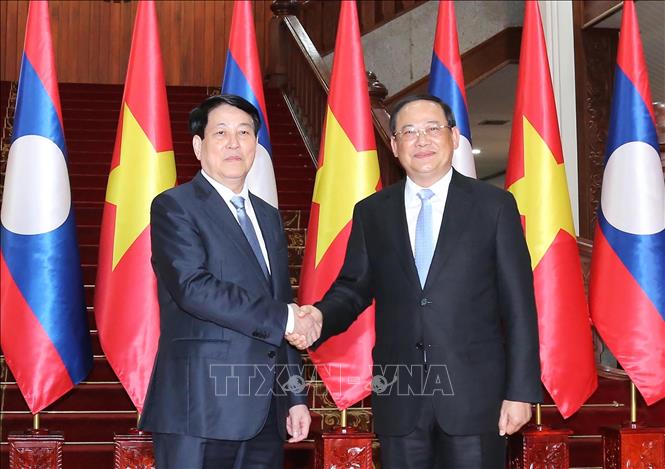

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)