Explaining the opinions of National Assembly deputies at the discussion session on the draft revised Social Insurance Law on the morning of November 23, Minister of Labor, Invalids and Social Affairs Dao Ngoc Dung said that recently, the Law Drafting Committee has received many comments from the people and organizations. The discussion session at the National Assembly also had nearly 100 deputies registered to speak, along with 148 comments compiled from previous groups, which will be seriously coordinated by the Drafting Committee with the presiding agency and related agencies to absorb to the maximum.

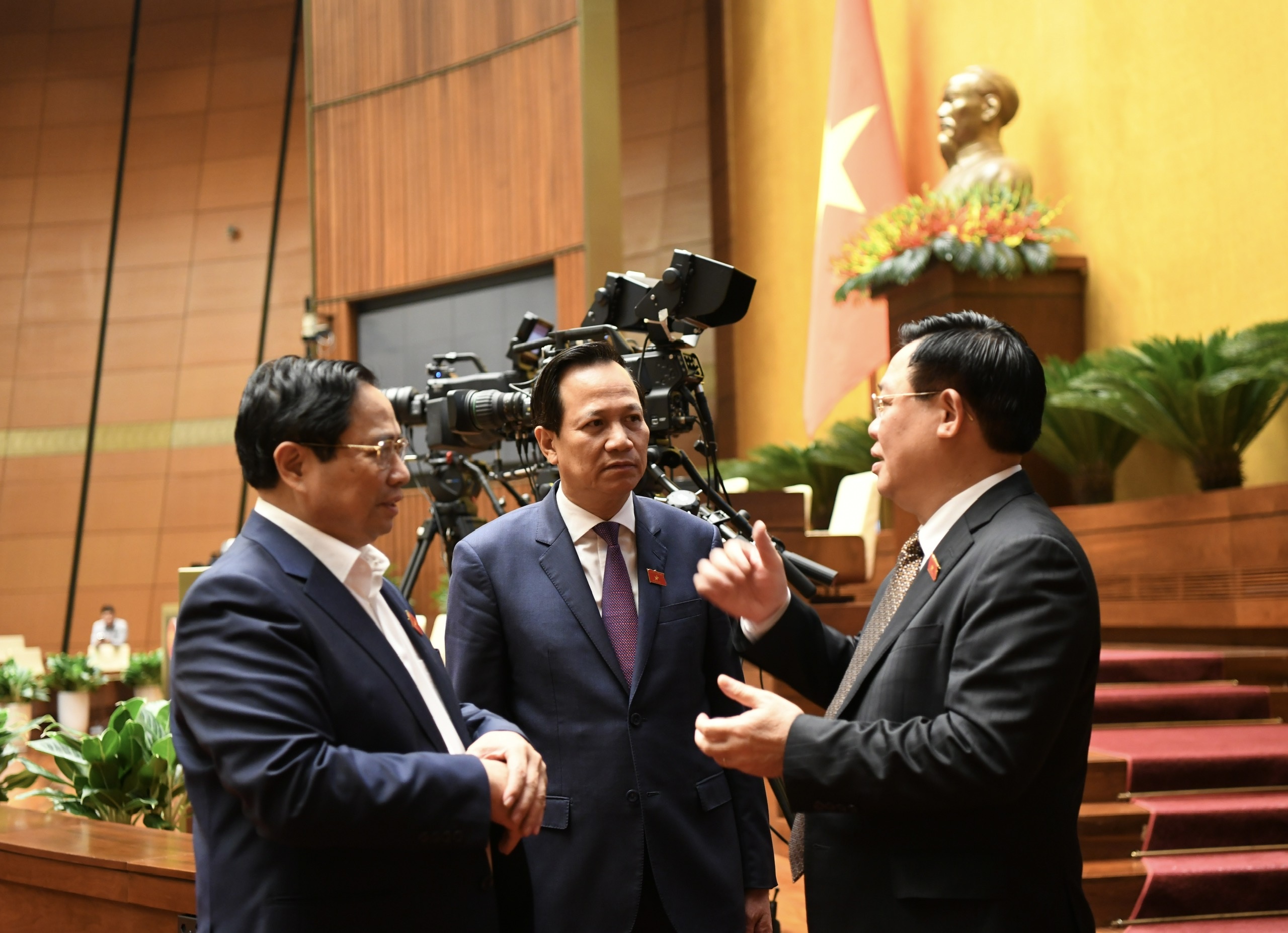

National Assembly Chairman Vuong Dinh Hue and Prime Minister Pham Minh Chinh talk with Minister Dao Ngoc Dung on the sidelines of the discussion session (Photo: Minh Chau).

First of all, mentioning the political basis for building the Social Insurance Law this time, the Minister cited Resolution 28 of the Party Central Committee on reforming social insurance policies, with the current National Assembly Chairman himself as the head of the resolution drafting committee at that time. Recently, Resolution 8 of the 13th Central Committee continued to provide guidance and orientation on social policies.

From those policies, the contents presented by the Government to the National Assembly are to institutionalize the guidelines and directions, moving towards building a multi-layered social insurance system and universal social insurance, fundamentally overcoming current problems and difficulties.

Keeping workers in the welfare system

In the draft law, the Minister stated that the regulation on receiving one-time social insurance benefits is a big, important, and sensitive issue, reflecting a high level of political and social as well as professional nature. Therefore, the Drafting Committee and the Government will continue to carefully consider, research, and collect more opinions from beneficiaries and employers.

Regarding the options for one-time withdrawal of social insurance, the Minister said that the development of options should aim at two goals. First, it is necessary to meet the legitimate needs of social insurance participants, which is the right to withdraw insurance. Second, it is necessary to strive to retain workers in the social security system and provide pensions for people when they retire, ensuring their lives.

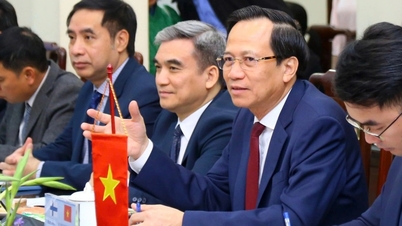

Minister Dao Ngoc Dung emphasized the goal of retaining workers in the social security system (Photo: Minh Chau).

In that general spirit, the head of the Department of Labor, Invalids and Social Affairs acknowledged: "Currently, it is very difficult to come up with an optimal solution, but will continue to propose or choose a solution with more advantages."

Through discussion, consulting with workers, the International Labor Organization and especially the opinions discussed at the National Assembly, the Minister said that the spirit is to continue adjusting the regulations designed in the direction that workers have the right to withdraw social insurance at one time, regardless of whether they paid before or after, after the law takes effect.

Regulations for withdrawing up to 50% of the time contributed to the fund

The Minister of Labor, Invalids and Social Affairs acknowledged the opinions of National Assembly deputies on the level of one-time withdrawal of social insurance, such as only allowing the withdrawal of 8% of the employee's contribution, and proposing to retain the 14% that the enterprise contributes.

This option ensures the right of workers to receive social insurance benefits at one time, and is fair between participants before and after the law takes effect. This option is also in line with the recommendations of international organizations, overcoming current problems. Furthermore, this option retains workers in the social security system.

Minister Dao Ngoc Dung affirmed that the remaining 50% is reserved for employees, specifically recorded in the social insurance book.

Delegate Tran Hoang Ngan speaks at the discussion session on the Social Insurance Law (Photo: Minh Chau).

"Thus, when returning to participate in social insurance, employees will have their contribution time added. In case they do not re-participate, employees will receive monthly benefits when they reach retirement age," said the Minister.

Explaining the proposed 50% rate, the Minister analyzed that, technically, the way to manage social insurance according to international practice is to record the time of participation in social insurance and salary as the basis for social insurance payment, regardless of the contribution of the employee or the employer.

He said, withdrawing 50% of the contribution time is equivalent to the employee's contribution being 8%. 8% of the employee's salary paid in 1 year is equivalent to 0.96% of the monthly salary.

In addition, determining the common benefit level for all cases at 50%, according to the Minister, will overcome difficulties in implementation if it is divided into 8% and 14% sections.

Employees withdrawing social insurance at one time receive a maximum of 50% of the payment period, the remaining 50% is reserved and clearly recorded in the social insurance book to continue enjoying benefits (Photo: Nguyen Son).

In addition, in reality, there are groups of workers who have to pay 22%, such as spouses of officials in diplomatic corps or Vietnamese workers abroad. Meanwhile, there are individuals who are paid 100% by the State, such as non-commissioned officers, soldiers, armed forces students, etc.

The regulation number of 50% of the social insurance payment period has been carefully calculated by us and is the most optimal solution," Minister Dao Ngoc Dung emphasized.

Roadmap to reduce pension age closer to retirement age

Regarding social pension benefits, the Minister said that the Government and the Drafting Committee closely followed the spirit of Resolution 28 to develop this content. Social pension benefits are the first layer of social security in the multi-layered social insurance system. This benefit is guaranteed by the State budget for the elderly who do not have a pension or monthly social insurance regime.

The Minister also affirmed the roadmap to gradually reduce the age of social pension benefits, this time from 80 years old to 75 years old and will continue to gradually reduce, moving towards bringing the conditions for receiving social pension benefits closer to retirement age.

Minister Dao Ngoc Dung and the Editorial Team of the draft Law on Social Insurance (amended) discussed on the sidelines of the National Assembly (Photo: Minh Chau).

The specific adjustment will depend on the socio-economic development situation and the State budget capacity. The time and level of adjustment will be considered and decided by the National Assembly and the National Assembly Standing Committee.

"In order to flexibly adjust the level of financial support for social pension benefits, as well as other supports such as maternity, support for women and children, etc., the law assigns the Government to regulate this level. Depending on the time and specific level, the Government is responsible for reporting to the National Assembly Standing Committee before considering and deciding according to its authority," the Minister summarized.

The social insurance contribution rate is appropriate.

Regarding the opinion on the social insurance contribution rate, the Minister informed that recently 13 Associations proposed to reduce the contribution rate to the level of 2009 and some delegates also mentioned. The social insurance contribution rate of each country is very different, suitable to the context and conditions of economic and social development of each country.

Vietnam's current contribution rate is 27.5% of monthly salary and is the basis for social insurance contributions. This rate is compatible with countries in the region such as China (33%), Japan (nearly 30%), Malaysia (26.7%)...

Minister Dao Ngoc Dung answers opinions of National Assembly delegates (Photo: Minh Chau).

The Minister cited that the social insurance contribution rate in some countries may be lower than Vietnam, such as Malaysia at 26.7%. However, this part does not include insurance for work-related accidents and occupational diseases. Other countries stipulate that employers must be responsible for taking care of employees when they encounter risks, accidents, or sickness or maternity benefits. In fact, such regulations have caused problems and many countries are moving towards transferring responsibility back to the Social Insurance Fund.

"Therefore, we believe that Vietnam's current social insurance contribution level is relatively appropriate," Minister Dao Ngoc Dung affirmed.

Source

![[Photo] Vietnam and Sri Lanka sign cooperation agreements in many important fields](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9d5c9d2cb45e413c91a4b4067947b8c8)

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

Comment (0)