Techcombank adjusts interest rates for the third time this month.

According to Lao Dong newspaper, on March 23, Vietnam Technological and Commercial Bank (Techcombank) listed new interest rates, reducing them by 0.1-0.2 percentage points for short-term maturities. These new interest rates will be applied from March 25.

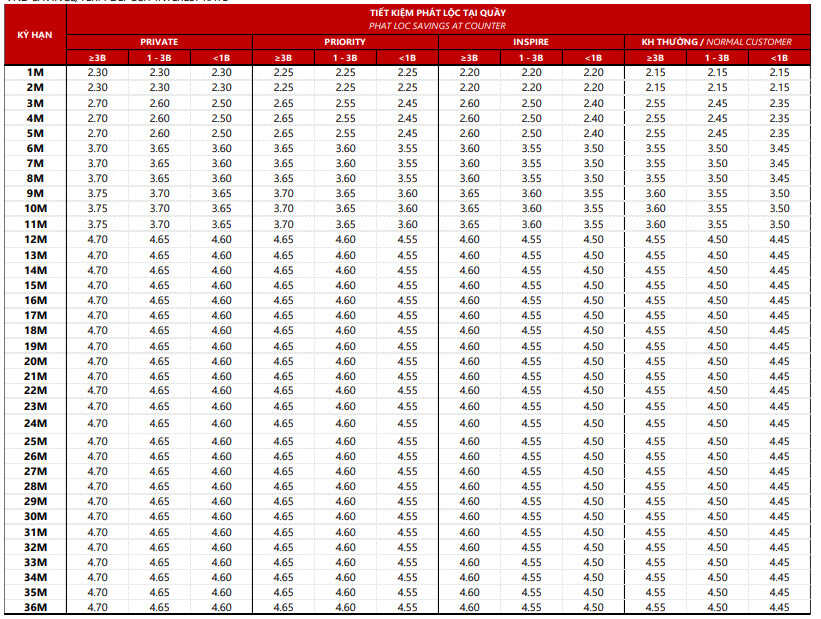

The interest rates for over-the-counter deposits, for amounts less than 1 billion VND, are listed by Techcombank as follows:

Interest rates on 1-month term deposits at the counter decreased by 0.1% to 2.15% per year.

The interest rate for 3-month term deposits at the counter is 2.45% per annum.

The interest rate for 6-month term deposits at the counter is 3.45% per annum.

The interest rate for 9-month term deposits at the counter is 3.5% per annum.

Interest rates for deposits at the counter with terms longer than 12 months are 4.45% per annum.

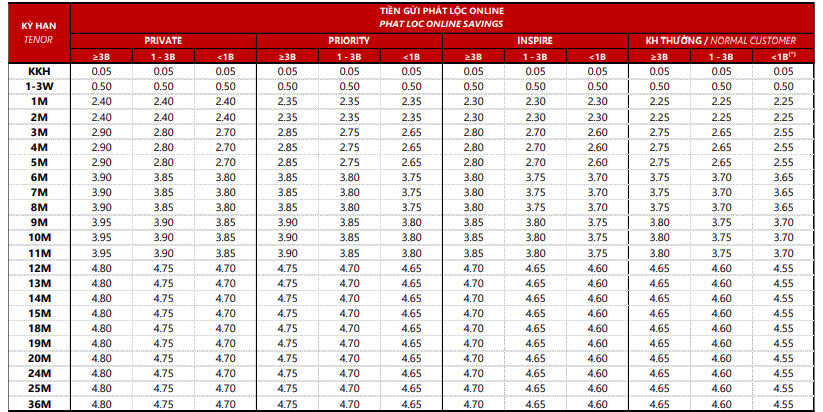

Techcombank's online deposit interest rates for amounts under 1 billion VND are listed as follows:

Interest rates for online deposits with a 1-month term decreased by 0.2% to 2.25% per year.

The interest rate for online deposits with a 3-month term is 2.55% per year.

The interest rate for online deposits with a 6-month term is 3.65% per annum.

The interest rate for online deposits with a 9-month term is 3.7% per annum.

Online deposit interest rates for terms longer than 12 months are 4.55% per year.

The downward trend in interest rates continues.

From the beginning of March 2024 until now, the market has seen 23 banks adjust deposit interest rates, including: BVBank, PGBank,ACB , BaoVietBank, VPBank, GPBank, PVcombank and Dong A Bank, MB, Techcombank, NCB, KienlongBank, SCB, Saigonbank, BIDV, TPBank, OceanBank, CBBank, Eximbank, ABBank, Sacombank, SeABank.

The general trend at banks remains to lower interest rates, mostly for the main maturities of 6, 9, and 12 months...

Notably, BaoVietBank, BVBank, PGBank, and ACB have reduced their interest rates twice since the beginning of the month, while Techcombank has reduced its rates three times.

However, some banks have gone against the trend by deciding to raise interest rates, notably Eximbank and Saigonbank with significant increases.

Source

![[Live] 2025 Community Action Awards Gala](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765899631650_ndo_tr_z7334013144784-9f9fe10a6d63584c85aff40f2957c250-jpg.webp&w=3840&q=75)

![[Image] Leaked images ahead of the 2025 Community Action Awards gala.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765882828720_ndo_br_thiet-ke-chua-co-ten-45-png.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Lao Minister of Education and Sports Thongsalith Mangnormek](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765876834721_dsc-7519-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives the Governor of Tochigi Province (Japan)](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765892133176_dsc-8082-6425-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh attends the Vietnam Economic Forum 2025](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/16/1765893035503_ndo_br_dsc-8043-jpg.webp)

Comment (0)