Change of ownership at a small securities company, will the market share be redistributed?

In recent months, there have been signs of a change of ownership in some small securities companies. Will the new capital flow give small and medium-sized securities companies a chance to turn things around?

|

| These two individuals alone have just bought and held 40.1% of the capital of Hai Phong Securities Company (stock code HAC). |

Changes in major shareholder structure

Recently, Ms. Nguyen Thi Huong Giang, Chairwoman of the Board of Directors of Saigonbank Berjaya Securities Company (SBBS), personally spent money to buy shares of the company, currently becoming the largest shareholder of SBBS.

Ms. Huong Giang was recently elected to the Board of Directors and became Chairwoman of SBBS Board of Directors at the end of 2023. During this time, Ms. Giang spent money to buy up to 40.22% of the company's shares from SBBS's major shareholder, Inter Pacific Securities Sdn Bhd (IPSSB) and Mr. Phuong Anh Phat, a member of SBBS's Board of Supervisors.

By September 30, 2024, Ms. Giang continued to buy all remaining SBBS shares of IPSSB (13.33%). This female Chairwoman was also the only investor to buy 5 million shares in the offering of 20 million shares to increase capital of SBBS.

The latest report shows that Ms. Giang currently owns 60.19% of SBBS shares. In addition, SaigonBank still holds 9.43%, Ky Hoa Tourism and Trade Company Limited holds 11.43% and Ms. Dinh Thi Thu Trang holds 5.84%.

According to SBBS's report, by the end of June 2024, the company had only 16 employees (down from 22 at the end of 2023). Its equity capital was 300 billion VND. SBBS has been continuously losing money, with accumulated losses of 266 billion VND as of the end of the second quarter, eroding almost all of the owner's investment capital.

While SBBS’s operations are not outstanding, Ms. Huong Giang is known as the founder of the investment application Tititada. The application’s website says that Tititada is a strategic partner of VPBank Securities – a securities company under VPBank.

On the stock exchange, recently, some securities companies have had major changes in their shareholder structure, such as a financial investment company buying more than 17% of Nhat Viet Securities Company (VFS) shares from September 16 to September 24, or two individuals buying a total of 40.1% of Hai Phong Securities' capital through negotiation on September 25.

At VFS, the buyer is Hoa An Financial Investment JSC. In fact, from the session on September 12th until now, there have been many large volume negotiated transactions, which rarely happens at VFS. More than 49.5 million VFS shares have been transferred through agreements since September 12th until now, equivalent to about 41% of VFS capital.

Hoa An Financial Investment JSC is one of the members of the Amber Holdings ecosystem. The current Chairwoman of the Board of Directors of VFS - Ms. Nghiem Phuong Nhi is also the Chairwoman of Hoa An Financial Investment JSC and Chairwoman of the Board of Directors of Amber Capital. In fact, Amber Holdings has invested in VFS since 2017 and has continuously increased the capital scale of this securities company. The participation of a member company of Amber Holdings in increasing shares at VFS is likely a move to restructure Amber Holdings' financial investment portfolio. Recently, Amber Holdings has been more clearly present in the board of directors of Eximbank with a number of individuals related to this ecosystem.

The “game” of changing owners at Hai Phong Securities Company (HAC) took place more clearly. In a trading session on September 25, 2024, two individuals, Tran Anh Duc and Vu Hoang Viet, bought 15.23% and 24.87% of HAC shares, respectively. Thus, these two individuals alone held 40.1% of HAC capital.

Previously, Hai Phong Securities was known as a company related to Hapaco Group. Last August, Mr. Vu Duong Hien, Chairman of the Board of Directors of Hapaco Group and also Chairman of HAC at that time, sold all of the HAC shares he owned. At the same time, some members of the board of directors also divested capital. Meanwhile, Hapaco Group has divested all of its capital from HAC since May 2024.

After the Hapaco group left HAC, the company also re-elected the Board of Directors. Currently, the Chairman of the Board of Directors of HAC is Mr. Ninh Le Son Hai. Hai Phong Securities is a fairly small company with total assets of more than 279 billion VND. Currently, HAC is still suffering from an accumulated loss of more than 31 billion VND. In the first 6 months of this year, HAC only made a profit of more than 7.7 billion VND.

Waiting for the explosion of new money

In the past two years, new capital flows have caused some small securities companies to suddenly "grow as fast as Saint Giong".

For example, Kafi Securities Company, just 3 years ago, was little known as Globalmind Capital, until the appearance of a new group of shareholders, Uniben Joint Stock Company - a business related to VIB owner Dang Khac Vy in 2022.

After changing ownership, from an unknown company with an extremely bleak financial picture, Kafi was strongly injected with capital, from a charter capital of only 155 billion VND in 2021, after only 1 year, the charter capital increased 6 times, reaching 1,000 billion in 2022, increasing further to 1,500 billion in 2023 and has now successfully increased to 2,500 billion.

The total assets of this securities company have also surpassed the VND10,000 billion mark. Of which, more than VND6,132 billion are in FVTPL assets, mainly money market instruments (Certificates of deposit, term deposits) and unlisted bonds of credit institutions. In particular, the new cash flow helps Kafi increase its margin lending category, helping the company significantly increase revenue from lending and receivables.

|

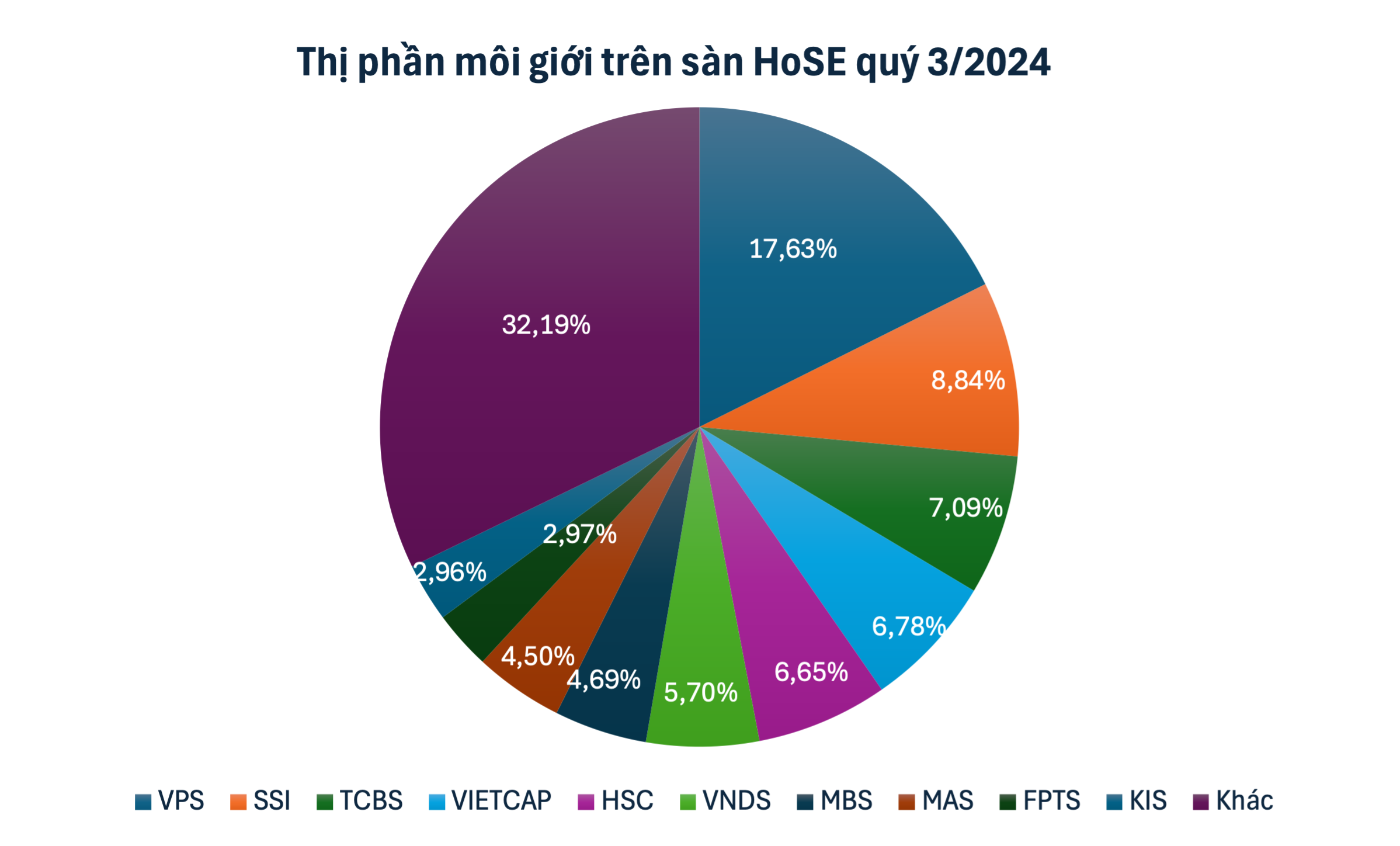

The stock market is still mainly in the hands of long-standing giants such as SSI, VNDirect, Vietcap... which means competition is becoming fiercer, the "pie" is getting smaller for the lower-ranking securities companies. But this is also the basis for promoting transfer and merger transactions in this industry group.

Instead of establishing a new enterprise with many procedures and conditions on capital, shareholders, etc., many organizations choose to acquire a small, inactive securities company for restructuring. With capital trading and many products requiring the expertise of a securities company, typically securities issuance consulting, corporate bond issuance consulting, etc., along with the M&A policy and restrictions on opening new securities companies from the State Securities Commission, investing in an existing securities company is not difficult to understand.

In particular, when there is a wave of securities company acquisitions such as VPBank acquiring ASC Securities and changing its name to VPBank Securities, Public Bank acquiring RHB Vietnam, KS Finance acquiring Vietnam Gateway Securities, SeABank planning to acquire ASEAN Securities... it shows the high demand in perfecting the financial ecosystem of large banks and financial groups.

With many successful blood transfusions, new capital flows have given small and medium-sized securities companies a chance to turn things around, and the stock market picture in the near future may also have many big changes.

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)