A report says the coffee chain Starbucks uses a Swiss subsidiary to book profits to avoid high taxes in the US, although it insists there is no evidence the company is doing anything illegal.

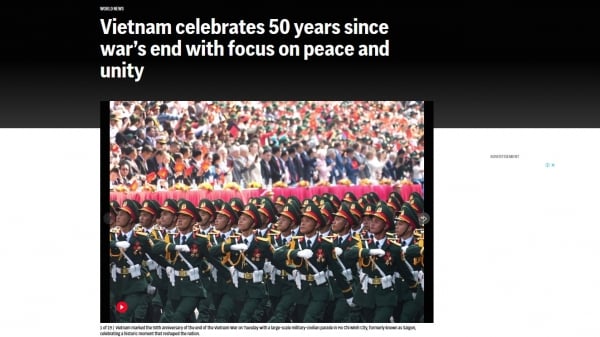

A Starbucks store in Encinitas (California, USA)

Business Insider recently cited a report by the Center for International Corporate Tax Transparency and Accountability (CICTAR) showing that a little-known branch of Starbucks in Switzerland appears to have played a big role in the coffee chain's tax payments over the past decade.

On paper, the Starbucks Coffee Trading Company (SCTC), based in the Swiss canton of Vaud, is responsible for sourcing unroasted coffee from countries like Colombia and Rwanda before it is used in drinks at Starbucks stores. The company also oversees Starbucks’ Fair Farmer and Coffee Practices program to source ethical coffee.

However, according to a CICTAR report released on March 8, there is evidence that since 2015, the company has helped shift about $1.3 billion of Starbucks' profits away from other countries where they are subject to higher taxes.

"Sense of role"

The chain isn’t the only major company to record profits outside the U.S. The report’s authors found no evidence that the company was doing anything illegal.

Still, analyst Jason Ward at CICTAR says Starbucks' reputation for being conscious of its role in society is at odds with its use of tax loopholes.

“Starbucks is different in that they really lean into their socially responsible image,” said Mr. Ward.

Starbucks reportedly uses Swiss-based SCTC to record costs for unroasted coffee, even though the coffee does not appear to be shipped through Switzerland.

Starbucks sign in New York, USA

SCTC “then sold the exact same green coffee beans at a higher price to other parties within the Starbucks corporate structure,” the report said. That markup was about 3 percent from 2005 to 2010, then increased to 18 percent from 2011 to 2014, according to the report.

The report's authors said profits are subject to "significantly lower tax rates" in Switzerland than in the United States or other countries.

What does Starbucks say?

Responding to CICTAR, a Starbucks spokesperson said the information in the report "does not accurately reflect our business model and how different parts of the business contribute to the company's success."

"Starbucks pays appropriate and accurate taxes in every jurisdiction in which it operates and actively engages with tax authorities to inform them of its business model and related tax implications," the spokesperson said on page 4 of the report.

Responding to Business Insider , a Starbucks spokesperson said the company "fully complies with tax laws around the world" and had an effective global tax rate of about 24% last year.

SCTC provides “high-quality coffee to meet our global needs” and includes farmer support centers in coffee-growing regions around the world, according to the spokesperson.

In addition, the spokesperson said Switzerland has been a global hub for coffee trading for decades and SCTC is located there to help Starbucks access the "best coffee trading talent in the world."

Starbucks isn’t the only company looking overseas to minimize its tax liability. A 2021 report from CICTAR looked at Uber’s use of shell companies in the Netherlands to limit its tax bill.

Source: https://thanhnien.vn/bi-to-dung-chieu-ne-thue-tren-13-ti-usd-loi-nhuan-starbucks-noi-gi-18525031216445762.htm

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)