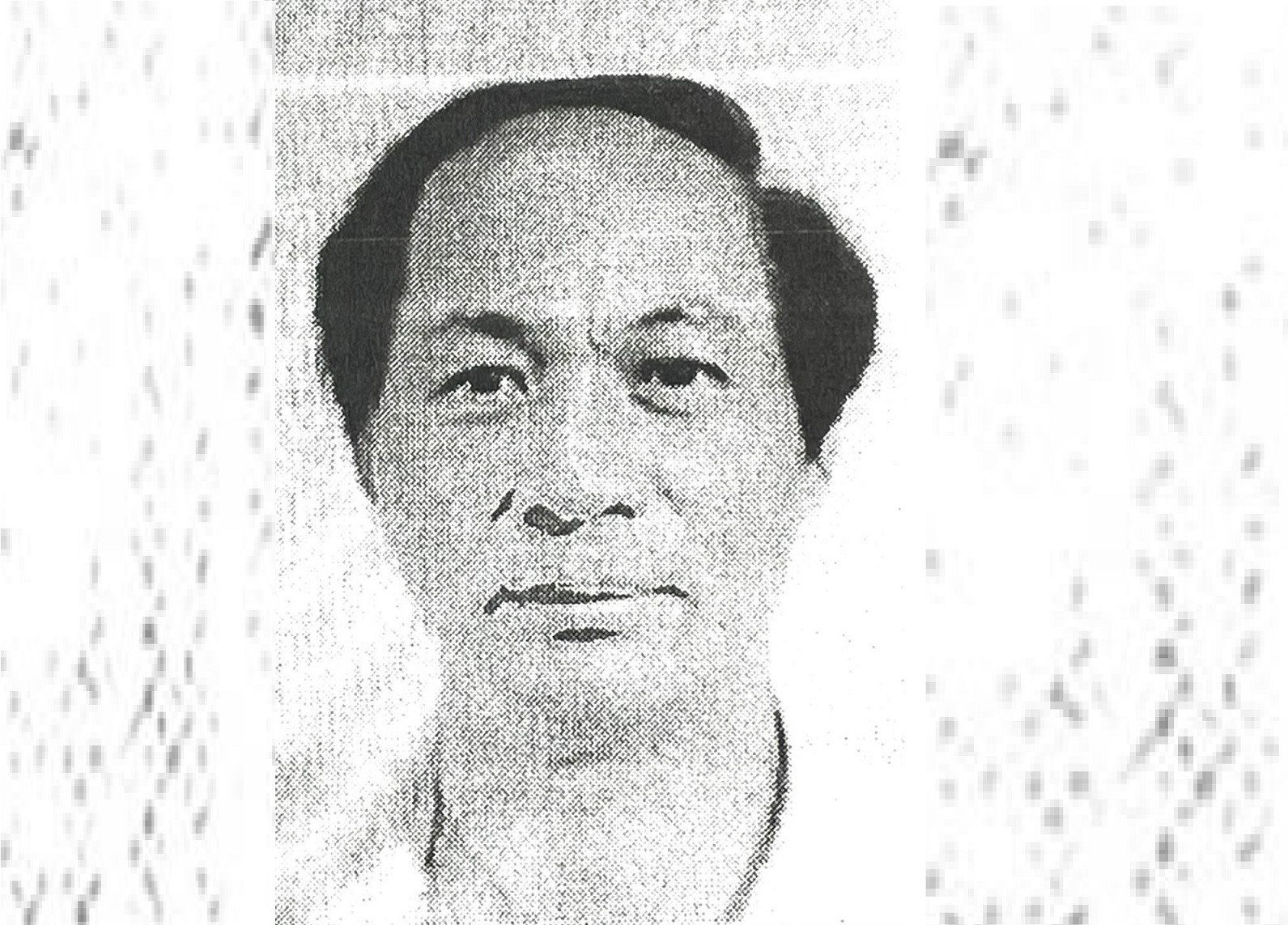

Although he had fled Vietnam, defendant Nguyen Dang Thuyet, General Director of Thanh An Hanoi Company Limited, still regularly contacted his wife via the Viber application to direct the crime.

As reported by VietNamNet, the Supreme People's Procuracy has just completed the indictment to prosecute 38 defendants in the case of Violating accounting regulations causing serious consequences; Illegal printing, issuing, and trading of invoices and documents for payment to the State budget.

In connection with the case, Mr. Nguyen Dang Thuyet, General Director, and his wife Nguyen Nhat Linh, Deputy General Director of Thanh An Hanoi Company Limited, were prosecuted for violating accounting regulations causing serious consequences.

According to the accusation, Mr. Thuyet established and managed all activities of Thanh An Company, Danh Company, and Trang Thi Company. Mr. Thuyet was also the person who directed the accountant to set up 2 accounting systems.

Under the direction of Mr. Thuyet, the defendants Nguyen Quy Khai (director of Danh Company), Do Thi Hoa (chief accountant of Thanh An Hanoi Company), Bui Thi Mai Huong (chief accountant of Danh Company), Nguyen Thi Hoa (tax accounting supervisor of Thanh An Hanoi Company, Danh Company, Trang Thi Company) established and used 2 accounting systems on FAST software to account, declare, report taxes and monitor the business performance of 3 companies.

The internal accounting system recorded all actual revenue, expenditure, actual business results, expenditure figures without legal documents, and the financial and tax accounting system falsified data to prepare financial and tax reports. To control the cash flow of revenue and expenditure, Mr. Thuyet asked the representatives of the companies to authorize him to sign the account on the bank documents of the 3 companies. Then, Mr. Thuyet assigned his wife, Nguyen Nhat Linh, to sign the account.

In September 2017, Ms. Nguyen Nhat Linh married Mr. Nguyen Dang Thuyet. In early 2018, Ms. Linh took the position of Deputy General Director of Thanh An Company, in charge of human resources, finance and accounting of all 3 companies: Thanh An Company, Danh Company and Trang Thi Company.

In January 2019, under the direction of Mr. Thuyet, the directors of the three companies authorized Ms. Linh to sign the accounts for bank transactions and from this point on, Ms. Linh participated in establishing two financial accounting systems at the three companies.

The accusations indicate that from June 2021 to 2022, despite having fled Vietnam, Mr. Thuyet still regularly contacted his wife via the Viber application to direct the establishment and use of two accounting systems (Ms. Linh did not have to give detailed instructions because the accountants had been doing everything for many years according to Mr. Thuyet's plan).

Regarding the actual daily business results, the defendant Do Thi Hoa controlled and reported to Ms. Linh to monitor the cash flow and profits of the 3 companies.

The accounting system to report to authorities and tax reports related to the data of contracts for buying and selling fake invoices was reported by the defendants Bui Thi Mai Huong and Nguyen Thi Hoa to Mr. Nguyen Dang Thuyet and Ms. Linh to control the source of money.

Since September 2009, Ms. Linh has been the one who approved the "fee" for buying and selling fake invoices; signed the authorization to transfer money to companies/business households based on the request of Ms. Hoa and Ms. Huong.

The accusation is that the defendant Nguyen Nhat Linh assisted her husband in establishing two financial accounting systems, concealing the actual profits and accounting figures of three companies during the period from 2019 to 2022, and together with Mr. Nguyen Dang Thuyet, caused a loss to the State of more than 498 billion VND.

The investigation agency determined that from 2017 to 2022, the defendants Hoa and Huong purchased 19,167 fake invoices (the items were medical supplies) from 110 companies and business households with a total pre-tax value of more than VND 3,689 billion. Of which, VAT was more than VND 75 billion; the total post-tax value was more than VND 3,765 billion.

The total amount of invoices paid to these 110 companies and individual businesses was more than VND257 billion. Ms. Hoa and Huong recorded 19,167 fake invoices in the tax accounting software to increase costs and reduce taxes payable. The cost of buying fake invoices, other actual receipts and actual payments were tracked in the internal accounting books.

Source: https://vietnamnet.vn/bi-can-nguyen-dang-thuyet-tron-khoi-viet-nam-van-chi-dao-vo-pham-toi-2345573.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

![[Photo] Prime Minister Pham Minh Chinh chairs the fourth meeting of the Steering Committee for Eliminating Temporary and Dilapidated Houses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/e64c18fd03984747ba213053c9bf5c5a)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)