The largest casino project in Vietnam

In late July 2023, Bloomberg reported that the Cheng family's investment company, Chow Tai Fook Enterprises Ltd., had replaced LET Group Holdings Ltd.... This was once part of tycoon Alvin Chau's Suncity Group business empire, taking control of the operations of the Nam Hoi An (Hoiana) resort.

Nam Hoi An Resort is known as the largest casino project in Vietnam, located in Duy Xuyen and Thang Binh districts, Quang Nam province. The project implementation organization is Nam Hoi An Development Company Limited, the foreign architectural consultant is WATG (Singapore), the foreign infrastructure technical consultant is ARUP (Ove Arup & Partners Hong Kong Limited), the domestic consultant is Contemporary Investment and Construction Consulting Company Limited.

A completed part of the Hoiana South Resort project. Photo: Ricons

The Nam Hoi An project was first granted an investment registration certificate in December 2010 and changed for the third time at the end of 2020 with the investor being Nam Hoi An Investment Company (Hoi An South Investments Pte. Ltd) in Singapore, with its contact office at 115 Nguyen Hue, Ben Nghe Ward, District 1, Ho Chi Minh City. The organization is represented by Mr. Don Di Lam (Canadian nationality). The economic organization implementing the investment project is Nam Hoi An Development Company Limited.

The project is divided into 7 implementation phases. In which, phase 1 is about 127 hectares, building a complex resort, a prize-winning game business area with 140 tables and 1,000 machines; 18-hole golf course. Phase 2 is about 209 hectares of land, building a complex resort with retail facilities, a prize-winning game business area with 1,000 machines (not including 1,000 machines of phase 1); corresponding infrastructure, commercial works. Phase 3 is about 194.5 hectares of land to build accommodation rooms and houses. Phase 4 is about 97 hectares of land to build an 18-hole golf course, corresponding infrastructure works.

The total investment capital of the project is over 81,200 billion VND (~4 billion USD). Of which, the capital contributed to implement the project is 12,600 billion VND, accounting for 15.5% of the total investment capital. The investor, Nam Hoi An Company, contributed the entire amount, equivalent to nearly 617 million USD, in cash in 7 phases. The project's operating period is 70 years (from December 10, 2010).

In a related development, on July 24, the People's Committee of Quang Nam province issued a document on urgently completing relevant planning documents and implementing the completion of compensation and site clearance for the Nam Hoi An Resort project. According to the document, the Provincial People's Committee requested Nam Hoi An Development Company Limited to confirm that it would not invest in housing business in the Nam Hoi An resort.

The Provincial People's Committee requested the People's Committees of Duy Xuyen and Thang Binh districts to urgently review and complete the Duy Hai - Duy Nghia urban master plan, Thang Binh district regional master plan, Binh Duong commune new rural construction master plan and other related planning documents in the direction of not allocating residential land within the scope of the Nam Hoi An resort project for approval according to authority or submitting to competent authorities for appraisal and approval as a basis for continuing to implement the project.

Which unit is implementing the super project?

Hoi An South Development Company Limited was established on December 10, 2010, initially with Mr. Le Minh Phuc as General Director and legal representative. In October 2016, this position was transferred to Mr. Lam Chi Keung (British nationality), charter capital of VND 15,600 billion (USD 800 million) and entirely owned by Hoi An South Investments Pte. Ltd, authorized to 6 foreign individuals, including Mr. Don Di Lam.

In November 2019, the Company changed its legal representatives to individuals including Steven Wolstenholme (American nationality) - Director, Mr. Benot Andre Henri Amado (France) - Director, Mr. Khoo Shing Yan (Malaysia) - Director, Mr. Lam Chi Keung - General Director. After many changes in charter capital, by November 2021, the Company had nearly 4,055 billion VND (178 million USD) and authorized all capital to Mr. Steven Wolstenholme.

According to the latest Business License change on June 26, the Company has 5 legal representatives including Mr. Steven Wolstenholme - Chairman of the Board of Directors and General Director of the Company, Mr. Lam Chi Keung - Vice Chairman of the Board of Directors, Mr. Lok Man Wai (China) - Director, Mr. Jimmy Rene Yvan Lopez (France) - Director, Mr. Gillian Murphy (UK) - Director. At the same time, the company's charter capital increased to nearly VND 5,911 billion (USD 259 million).

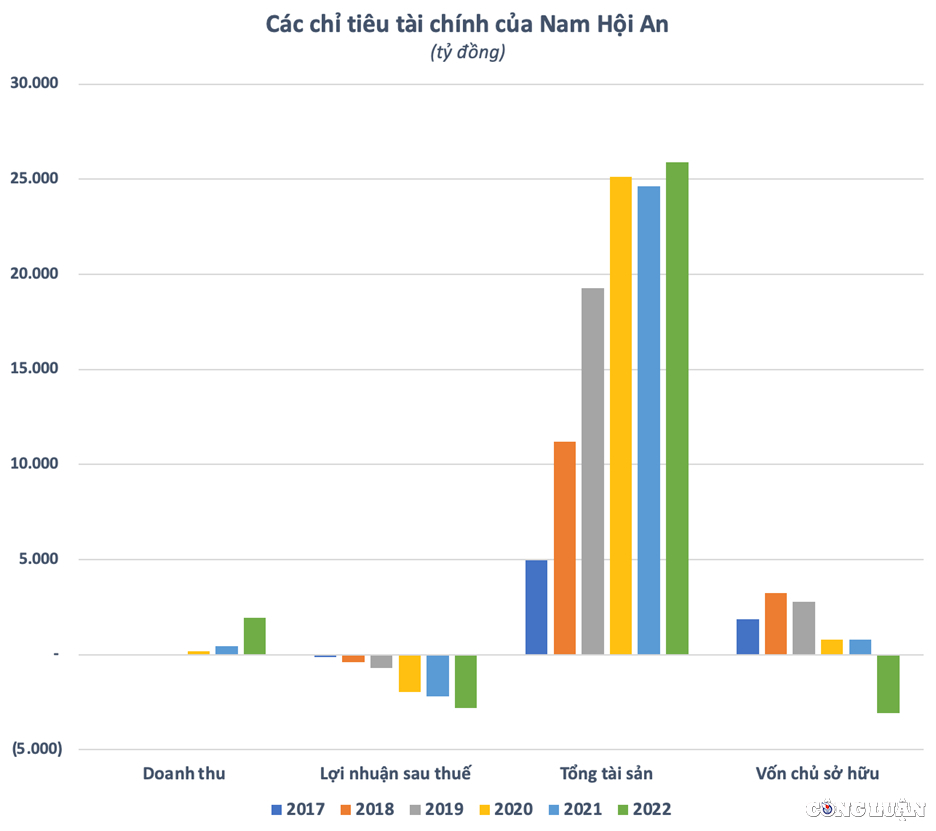

Nam Hoi An is a large-scale enterprise. After a period of continuous expansion from 2017 to 2020, Nam Hoi An's total assets have now reached more than 1 billion USD. However, most of the assets of this enterprise come from debt capital. Total liabilities have continuously increased sharply by the end of 2022 to nearly 29,000 billion, nearly 10 times higher than in 5 years and exceeding the asset value (25,900 billion VND) at the same time.

The increase in liabilities mainly comes from financial borrowing. By the end of 2022, Nam Hoi An's total financial debt amounted to more than VND 23,700 billion. Of which, short-term debt accounted for more than VND 13,000 billion and long-term debt was nearly VND 10,700 billion. The large debt caused interest expenses to swell to nearly VND 1,100 billion in 2022 and was one of the main reasons why this enterprise suffered a heavy loss of up to VND 2,800 billion.

Before 2020, Nam Hoi An's losses were mainly due to having to bear large business management costs while revenue had not yet been generated. Since 2020, Nam Hoi An began to generate revenue, then continuously grew strongly year by year and reached more than 1,900 billion in 2022. However, the revenue was not enough to offset the incurred costs, causing the company to continuously incur losses with a dizzying number.

Many years of poor business have caused Nam Hoi An to have accumulated losses of nearly VND 8,100 billion by the end of 2022. This figure has eroded the entire charter capital and caused the company's equity to be negative by more than VND 3,000 billion. Even after increasing its charter capital to more than VND 5,900 billion at the end of June, Nam Hoi An has not yet escaped the situation of negative equity.

Source

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)