Positive impact from growth in retail and tourism

The socio-economic report recently released by the General Statistics Office shows that in the first 8 months of the year, retail sales were estimated at VND3,199.7 trillion, up 7.3% over the same period last year. The remarkable growth was recorded in some localities such as Quang Ninh, Hai Phong, Can Tho, Da Nang, Ho Chi Minh City and Hanoi.

In addition, the report also said that the total number of international visitors to Vietnam in the past 8 months has recovered, even increasing slightly by 1% compared to the pre-COVID-19 pandemic period of 2019, reaching more than 11.4 million arrivals, up 45.8% over the same period in 2023.

Commenting on this market, Ms. Tran Pham Phuong Quyen, Senior Manager of Retail Leasing at Savills HCMC, said that the retail industry is being strongly promoted thanks to demographic indicators and the widespread urbanization process in provinces and cities, thereby stimulating economic growth.

A study by KPMG Vietnam forecasts that from 2020 to 2030, Vietnam will have about 23.2 million more middle-class people with a compound annual growth rate of 5.5%, among the fastest growing countries in Southeast Asia. In addition, the study also shows that the urbanization rate in Vietnam as of October 2023 is 42.6%. The Vietnamese government also sets a target of an urbanization rate of at least 45% by 2025 and exceeding 50% by 2030.

High-end retail space in the center of Ho Chi Minh City

"The rise of the middle class, the positive recovery of the tourism industry, and the continuous emergence of new brands have created a modern, dynamic and potential retail landscape. Shopping malls have also become attractive entertainment destinations for consumers," Ms. Phuong Quyen explained.

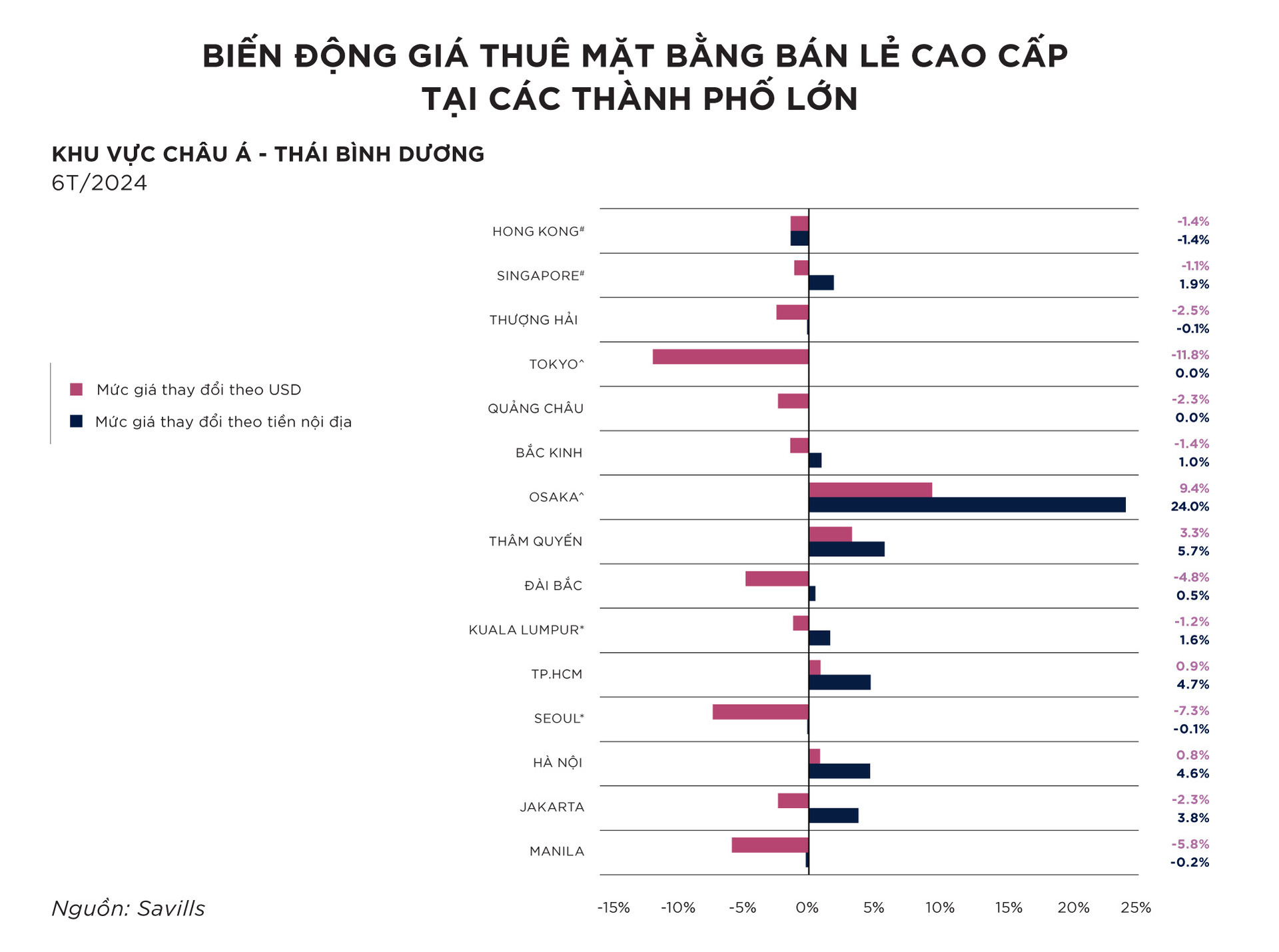

According to data recently published in the Prime Benchmark report by Savills Asia Pacific, Hanoi and Ho Chi Minh City are among the markets with active retail real estate activities in the first 7 months of the year.

Premium retail space with competitive rents

Rents for prime retail space in Osaka, Japan, grew significantly in the first half of the year, up 24% year-on-year. Rents in Japan are expected to continue to rise, thanks to a weak yen and an attractive mix of travel experiences.

Following Japan, three emerging markets in Southeast Asia, Ho Chi Minh City, Hanoi and Jakarta, also saw significant improvements in rental prices with increases of 4.7%, 4.6% and 3.8% respectively. Experts attributed this result to the rise of the middle class and the recovery of the tourism industry.

The rental price of high-end premises in the central area of Hanoi is 96.4 USD/m2 and in Ho Chi Minh City is 151 USD/m2. This price in Kuala Lumpur is 158.6 USD/m2, Singapore is 399.7 USD/m2 and 289.5 USD/m2 in Beijing.

Fluctuations in rental prices of high-end retail space in major cities (Photo: Savills Vietnam)

Ms. Do Thi Thu Hang, Senior Director, Consulting and Research Department, Savills Hanoi, assessed that the cost of renting high-end premises in Hanoi and Ho Chi Minh City is still competitive compared to many markets in the region.

"The rental price of this segment in Hanoi in the coming time is quite positive, with a tendency to stabilize or increase due to limited new supply. This means that existing projects in prime locations will continue to maintain high occupancy rates and may increase rental prices," said Ms. Hang.

In contrast, in other cities in the region, the abundant supply of retail space has created great competitive pressure, forcing owners to adjust rents to attract customers.

Data from Savills Research shows that the total retail space for lease in Ho Chi Minh City is currently around 1.52 million square metres with an occupancy rate of 94%. Sharing details about this market, Ms. Phuong Quyen said that the limited supply of high-end retail has led to fierce competition for shopping mall projects in prime locations.

"However, high-end premises in Ho Chi Minh City are still mainly concentrated in the city center or developed districts such as District 7. In the coming time, the market will tend to expand to neighboring areas. In addition, in 2024, the increase in the USD exchange rate has contributed to a significant increase in the rental price of premises in domestic currency," Ms. Quyen added.

Source: https://www.congluan.vn/bds-ban-le-cao-cap-tai-ha-noi-va-tp-hcm-co-toc-do-phat-trien-hang-dau-khu-vuc-post312759.html

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

Comment (0)