Many driving forces for retail market development

The socio-economic report recently released by the General Statistics Office shows that in the first 8 months of the year, retail sales were estimated at VND3,199.7 trillion, up 7.3% over the same period last year. The remarkable growth was recorded in some localities such as Quang Ninh, Hai Phong, Can Tho, Da Nang, Ho Chi Minh City and Hanoi.

In addition, the report also said that the total number of international visitors to Vietnam in the past 8 months has recovered, even increasing slightly by 1% compared to the pre-COVID-19 pandemic period of 2019, reaching more than 11.4 million arrivals, up 45.8% over the same period in 2023.

Commenting on this trend, Ms. Tran Pham Phuong Quyen, Senior Manager of Retail Leasing at Savills HCMC, said that the retail industry is being strongly promoted thanks to demographic indicators and the widespread urbanization process in provinces and cities, thereby stimulating economic growth.

Retail space in Vietnam is growing strongly thanks to many drivers.

A study by KPMG Vietnam predicts that from 2020 to 2030, Vietnam will have about 23.2 million more middle-class people with a compound annual growth rate of 5.5%, among the fastest growing countries in Southeast Asia. This study also shows that the urbanization rate in Vietnam as of October 2023 is 42.6%. The Vietnamese government also sets a target of an urbanization rate of at least 45% by 2025 and exceeding 50% by 2030.

"The rise of the middle class, the positive recovery of the tourism industry, and the continuous emergence of new brands have created a modern, dynamic and potential retail landscape. Shopping malls have also become attractive entertainment destinations for consumers," Ms. Phuong Quyen explained.

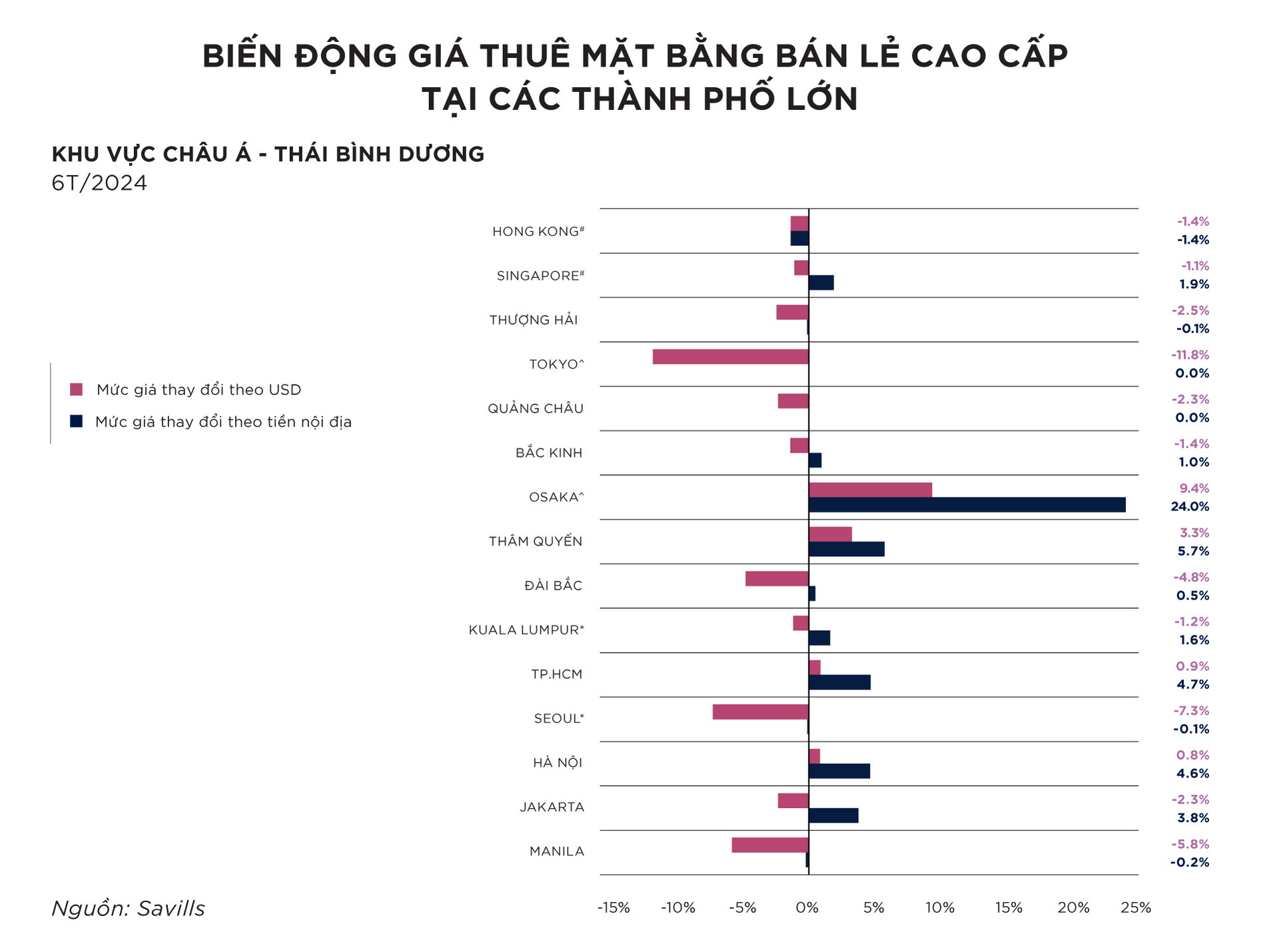

Data recently released in the Prime Benchmark report by Savills Asia Pacific also ranked Hanoi and Ho Chi Minh City among the markets with active retail real estate sectors in the first 7 months of the year.

Prices are still competitive compared to the regional market.

In the first half of 2024, prime retail rents in Osaka, Japan, grew significantly, by more than 24% year-on-year. Rents in Japan are expected to continue to rise, thanks to a weak yen and an attractive mix of travel experiences.

Following Japan, three emerging markets in Southeast Asia, Ho Chi Minh City, Hanoi and Jakarta, also saw significant improvements in rental prices with increases of 4.7%, 4.6% and 3.8% respectively. Experts attributed this result to the rise of the middle class and the recovery of the tourism industry.

The rental price of high-end premises in the central area of Hanoi is 96.4 USD/m2 and in Ho Chi Minh City is 151 USD/m2. This price is 158.6 USD/m2 in Kuala Lumpur, 399.7 USD/m2 in Singapore and 289.5 USD/m2 in Beijing.

Ms. Do Thi Thu Hang, Senior Director, Consulting and Research Department, Savills Hanoi, assessed that the cost of renting high-end premises in Hanoi and Ho Chi Minh City is still competitive compared to many markets in the region.

"The rental price of this segment in Hanoi in the coming time is quite positive, with a tendency to stabilize or increase due to limited new supply. This means that existing projects in prime locations will continue to maintain high occupancy rates and may increase rental prices," said Ms. Hang.

In contrast, in other cities in the region, the abundant supply of retail space has created great competitive pressure, forcing owners to adjust rents to attract customers.

In addition, data from Savills research department shows that the total retail space for lease in Ho Chi Minh City is currently about 1.52 million square meters with an occupancy rate of 94%. Sharing details about this market, Ms. Phuong Quyen said that the limited supply of high-end retail has led to fierce competition for shopping center projects in prime locations.

"However, high-end premises in Ho Chi Minh City are still mainly concentrated in the city center or developed districts such as District 7. In the coming time, the market will tend to expand to neighboring areas. In addition, in 2024, the increase in the USD exchange rate has contributed to a significant increase in the rental price of premises in domestic currency," Ms. Quyen added.

Source: https://www.congluan.vn/gia-thue-mat-bang-ban-le-cao-cap-tai-viet-nam-van-o-muc-canh-tranh-so-voi-thi-truong-khu-vuc-post312135.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)