|

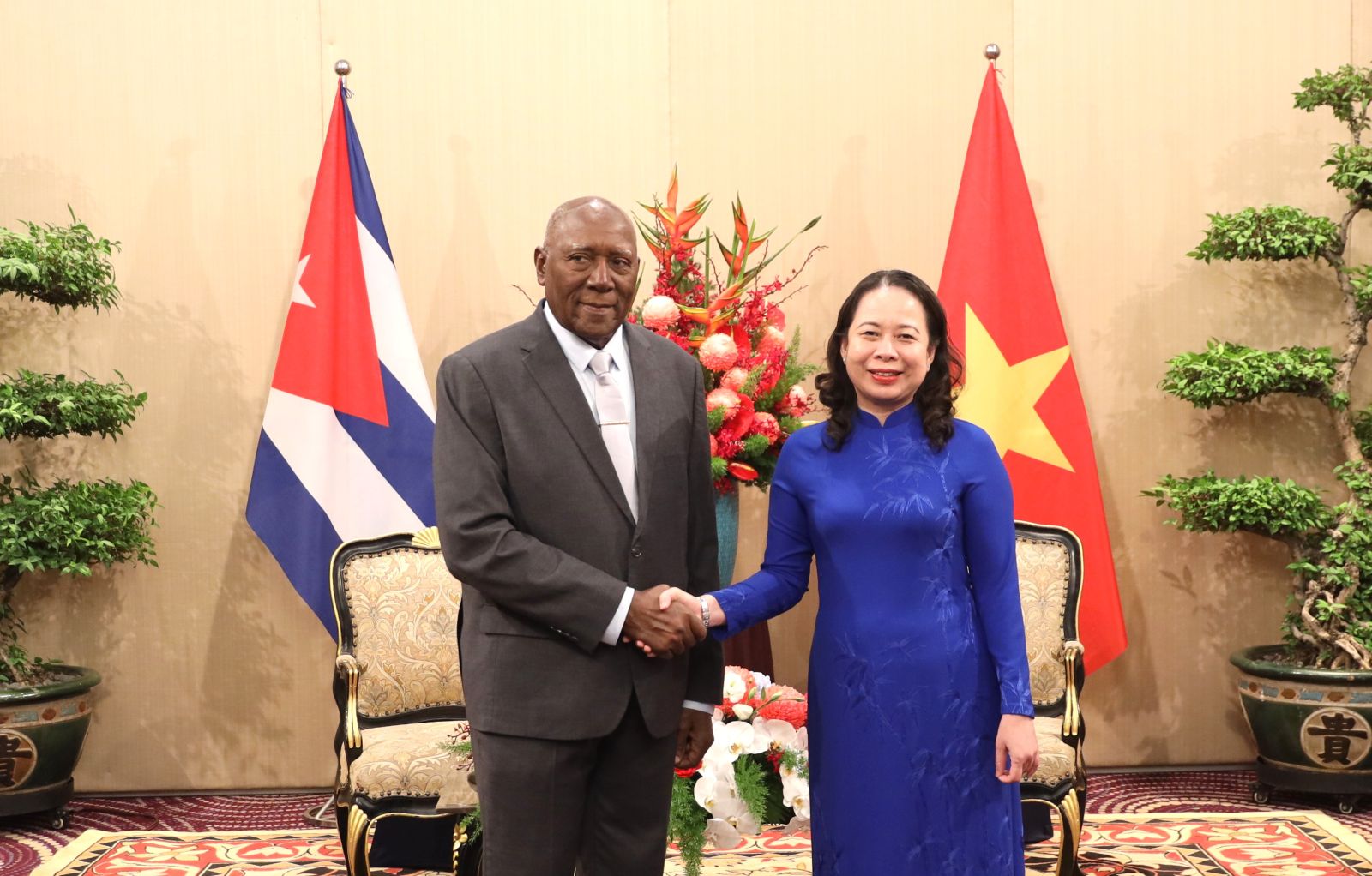

| To reduce its dependence on the US dollar, the world's second-largest economy has long been increasing the use of the yuan abroad. (Source: Reuters) |

Beyond trade, conducting more financial market transactions in its own currency would be an important step toward Beijing’s goal of promoting the use of the yuan abroad. Financial hub Hong Kong plays a key role in achieving this goal, Chinese currency and economic experts said on June 9.

China's efforts

Speaking at a recent conference, Wang Yongli, General Manager of China International Futures and a former member of the Board of Directors of Swift, an international financial payment system, said: “The internationalization of the yuan has come a long way, but so far, the currency has not met expectations.”

Mr. Wang pointed out that the current use of RMB overseas is mainly shifted to payment and trade settlement.

“The internationalization of a currency is not just about trade. Whether the currency can be used for pricing and settlement in major financial transactions is a very important indicator,” said Mr. Wang.

To reduce its dependence on the US dollar, the world's second-largest economy has long been trying to increase the use of the yuan abroad, and the Russia-Ukraine conflict has only accelerated the process, especially as Western sanctions against Moscow have shown the potential for global economic destruction from overreliance on the US dollar.

In response to Western sanctions, China and Russia have attempted to arrange transactions in yuan, which quickly became Moscow's reserve currency.

Even better news for the yuan is that in 2023, many countries such as Brazil, Bangladesh and Argentina have moved to accept payments in trade and investment in yuan.

Will Beijing seize the opportunity?

Analysts say the months-long debt ceiling impasse, coupled with its own threats or a series of successive US interest rate hikes, could be "time" for the Chinese currency.

As China recovers from the economic impact of the Covid-19 pandemic, analysts say it could use a number of tools, including yuan investment in Belt and Road Initiative projects, yuan settlements with major trading partners, promoting a digital yuan and diversifying non-dollar reserves — measures that could “dent” the world financial order, which is led by the dollar.

China's economy is shifting from an export-dependent model to one that is more focused on domestic consumption and more dependent on imports of commodities such as oil and food.

This would certainly entail a shift away from the US-centric financial system, in which China attracts USD investment in export-oriented factories and then uses the resulting USD to invest in low-yielding US Treasury bonds.

“China believes that the US-led system, especially the US dollar hegemony, includes rules that are against its interests,” said Sun Yun, director of the China Program at the Washington-based Stimson Center. “Therefore, Beijing is gradually undermining Washington’s credibility and reshaping the system to China’s long-term interests.”

Difficult to replace USD in the near future

However, Mr. Sun also said that the NDT cannot replace the USD in the near future.

“The biggest obstacle to the internationalization of the yuan is not only the relatively strong position of the US dollar, but also, importantly, Beijing’s unwillingness to let go of the financial system and loosen its capital account,” commented Dexter Roberts, director of China studies at the Mansfield Center at the University of Montana.

The currency's overseas expansion remains constrained by a number of factors, including its lower convertibility compared to the US dollar or euro and Beijing's continued strict capital controls on the yuan.

As a result, more than 70% of overseas transactions using the yuan must go through Hong Kong - China's important financial center and a place where capital flows freely.

Eddie Yue Wai-man, head of the Hong Kong Monetary Authority, said the special administrative region could play a bigger role in promoting the use of the yuan in capital markets.

“For example, for some foreign companies that have used RMB for trade settlement through Hong Kong, if they can easily invest their money in the mainland capital market through some financial products in Hong Kong, this may increase the demand for RMB settlement, settlement and investment. More importantly, it will promote the use of RMB in cross-border business and global financial investment,” he said.

According to Mr. Wang, the center of future RMB internationalization should shift from overseas to domestic, and China must strengthen financial infrastructure reform and do more to promote opening up.

“If domestic financial transactions cannot attract large amounts of international investment, or most international financial sanctions cannot be priced or settled in RMB, then the internationalization space of the currency will be largely limited,” Wang analyzed.

Accordingly, increasing the proportion of the yuan in the reserve currency basket of countries will be more difficult because it requires higher standards of security, liquidity and profitability.

Jean-Claude Trichet, former President of the European Central Bank, predicted that if the yuan were fully convertible in China, it would change the landscape of the international monetary system by creating a triumvirate of major currencies, on par with the US dollar and the euro. According to him, the yuan still needs more depth and liquidity.

Source

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

Comment (0)