Quang Ngai Sugar Joint Stock Company (Code: QNS) has just announced that its third quarter business results continued to improve with net revenue increasing by 7% over the same period, reaching VND2,467 billion. The slow increase in cost of goods sold helped the company increase its gross profit by 17% to more than VND860 billion, corresponding to an improvement in gross profit margin to 35%.

The company also benefited from the high interest rate environment as financial revenue more than doubled to VND92 billion, while sales and administrative expenses were reduced.

The result helped Quang Ngai Sugar report a post-tax profit of VND506 billion, up 60% year-on-year and the highest level in the third quarter of the year. This figure was only lower than the record profit of the previous second quarter - usually the company's peak business quarter.

The company explained that the economy has recovered after the Covid-19 pandemic, but the consumption of products such as milk, mineral water, beer, and confectionery has decreased slightly. The company has made efforts to control costs, so the profits of the products are still approximately the same as the same period.

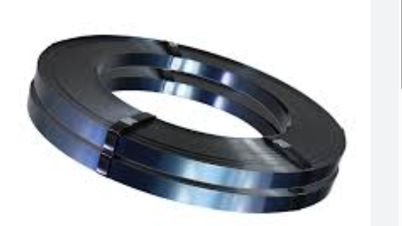

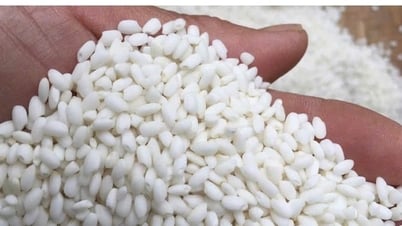

In addition, some of the company's products still maintain stable production and record high growth rates, such as sugar products with consumption output increasing by 85%, revenue increasing by 116%; electricity with consumption output increasing by 35%, revenue increasing by 38%.

In addition, the company also invests in developing raw material areas in the direction of industrial production to help increase sugarcane productivity; the sugar production line operates stably to help reduce product costs. The State's trade defense measures and good control of smuggled sugar help sugar business activities achieve high efficiency.

In the first 9 months of the year, Quang Ngai Sugar recorded VND 7,749 billion in revenue and VND 1,535 billion in profit after tax, up 23% and 79% respectively over the same period, both of which are record highs in the company's history.

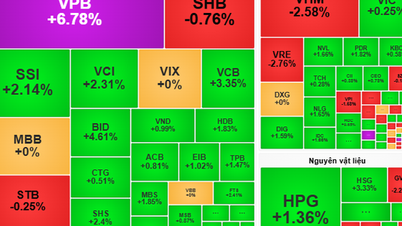

Analyzing by structure, the sugarcane segment unexpectedly rose to contribute the largest proportion of revenue with VND3,127 billion but only brought in gross profit of over VND862 billion. Meanwhile, the soy milk segment (mainly Vinasoy's Fami brand) contributed VND3,106 billion in revenue and VND1,261 billion in gross profit.

| Revenue and gross profit structure of Quang Ngai Sugar (billion VND) | Revenue 9M/2023 | Gross profit 9M/2023 | Revenue 9M/2022 | Gross profit 9M/2022 |

|---|---|---|---|---|

| Road | 3.127 | 862 | 1,449 | 240 |

| Soy milk | 3.106 | 1,261 | 3,390 | 1,416 |

| Thanh Phat | 1,955 | 32 | 1,085 | 30 |

| Other | 1.301 | 307 | 1,261 | 196 |

| Exclude | -1.741 | -11 | -873 | -8 |

According to the plan for 2023, QNS shareholders set a revenue target of VND 8,400 billion and after-tax profit of VND 1,008 billion. With the above results, the company has achieved 93% of the revenue target and soon exceeded 52% of the profit target.

As of the end of the quarter, Quang Ngai Sugar's total assets stood at VND11,214 billion, up 9% from the beginning of the year. Most of this was bank deposits of VND5,621 billion (accounting for nearly half of total assets), helping the company earn more than VND239 billion in interest after 9 months.

On the contrary, the company still borrowed from the bank but only for a value of 1,843 billion VND, completely short-term debt. The company had to pay interest equivalent to 116 billion VND, much lower than the interest on deposits.

End-of-period equity was recorded at VND7,932 billion; this figure includes mostly owners' equity of VND3,569 billion and undistributed profit after tax of VND4,129 billion.

Earning 4 billion USD, Vietnamese coffee moves to green growth path

Ranked second in the world, coffee exports help Vietnam earn more than 4 billion USD/year. This strong industry of our country is moving towards a path of green, transparent and responsible growth.

Nam Dinh goes to Europe to call for investment in marine economy

Nam Dinh province leaders are on a working trip to Italy with a focus on calling for investment in the marine economy and green economy.

Is Dong Nai too preferential for Dat Xanh subsidiary to transfer 2,305 land plots?

Although the construction of some social infrastructure projects has not been completed, the owner of the Gem Sky World project is still allowed to transfer 2,305 plots of land. Is the Department of Natural Resources and Environment of Dong Nai province giving too much favor to Dat Xanh's subsidiary?

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)