BAF plans to offer 65 million shares to 24 investors at an offering price of VND15,500/share. After completion, these 24 investors will own a total of 24.39% of BAF's capital.

BAF plans to offer 65 million shares to 24 investors at an offering price of VND15,500/share. After completion, these 24 investors will own a total of 24.39% of BAF's capital.

BAF Vietnam Agriculture Joint Stock Company (BAF) has just announced information on the implementation of the private share offering plan approved by the General Meeting of Shareholders in October 2024.

Accordingly, BAF's Board of Directors plans to offer 65 million shares to 24 investors at an offering price of VND15,500/share. This price is about 30% lower than the market price of BAF currently trading on the stock exchange.

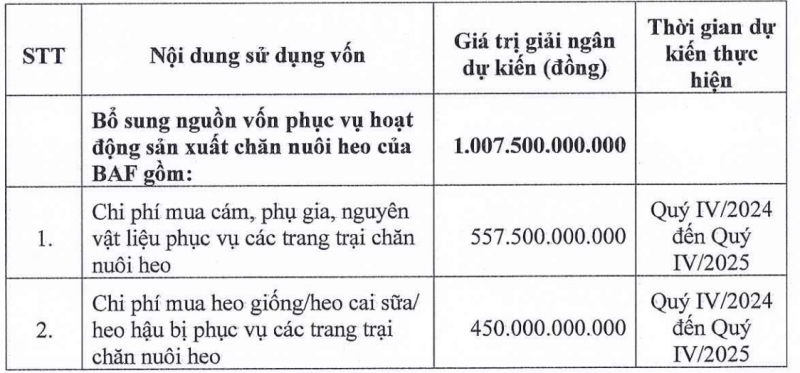

The total amount expected to be raised from this private share offering is VND1,007.5 billion, expected to supplement capital for the company's pig farming activities, enhancing the company's financial capacity and competitiveness.

The disbursement period for necessary items according to the plan will last from the fourth quarter of 2024 to the fourth quarter of 2025, so the company will open appropriate term deposit contracts to enjoy periodic interest on temporarily idle capital.

|

| BAF's plan for using capital after issuance. |

According to the list, 24 investors in the upcoming issuance currently own more than 9.1 million BAF shares. If the issuance is completed with 65 million shares allocated, this group of 24 investors will own a total of 24.39% of BAF's capital.

Meanwhile, recently, this company has just announced the acquisition of shares of a series of 6 other businesses in the livestock industry.

Specifically, on October 30, BAF approved spending 47.5 billion VND to acquire 95% of the capital of Khuyen Nam Tien High-Tech Livestock Company Limited and receive the transfer of 49% of the capital of 5 other companies in Quang Tri including Toan Thang HT Joint Stock Company, Viet Thai HT Joint Stock Company, Thanh Sen HT-QT Joint Stock Company, Hoang Kim QT Joint Stock Company and Hoang Kim HT-QT Joint Stock Company.

BAF's third quarter 2024 financial report shows that as of September 30, 2024, the company has 21 consolidated subsidiaries. Last September, the company also received a transfer of 2.8 million shares, equivalent to 40% of the capital of Rung Xanh Production JSC.

In 2024, BAF has continuously increased its capital. In May 2024, the company increased its charter capital from VND 1,435 billion to VND 1,679 billion and continued to increase to VND 2,390 billion in August 2024.

In the most recent capital increase issuance, BAF also issued more than 68.4 million common shares at VND10,000/share. These shares were offered for sale by exercising purchase rights, at a ratio of 1:0.476767.

BAF's financial report shows that the company's revenue in the first 9 months of 2024 reached VND 3,927 billion, of which revenue from livestock activities contributed 58%, the rest came from revenue from selling agricultural products.

The improved gross profit margin in the period helped the company's gross profit grow well. Thanks to that, the profit after tax in the first 9 months of this year doubled that of the same period last year, reaching 214 billion VND.

However, BAF's interest expense is increasing. In the 9-month period, interest expense accounted for more than VND157 billion, 45% higher than the same period last year.

Of BAF's VND2,330 billion in short- and long-term financial loans, in addition to borrowing from banks and financial leasing companies, BAF also has VND576 billion in regular bonds and VND469 billion in convertible bonds (corner debt structure of VND489 billion). The amount of financial debt is currently accounting for 56% of total liabilities and is approximately equal to current equity.

Source: https://baodautu.vn/baf-lai-sap-tang-von-thau-tom-loat-cong-ty-chan-nuoi-d229659.html

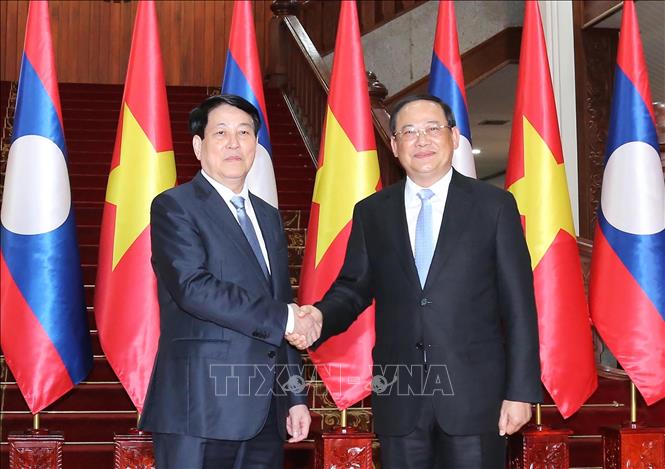

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)