Hoang Anh Gia Lai makes big profits

Hoang Anh Gia Lai Joint Stock Company (code HAG), chaired by Mr. Doan Nguyen Duc (Bau Duc), has just announced its consolidated financial report for the first quarter of 2025. Specifically, HAG's revenue reached VND 1,390 billion, up 12% over the same period, and after-tax profit was nearly VND 341 billion, up 59% over the same period.

According to Hoang Anh Gia Lai's explanation, gross profit increased compared to the same period last year mainly due to increased gross profit from banana trading activities. In addition, financial expenses - mainly interest on the company's loans - were also reduced thanks to the repayment of most of the bond debt and the reversal of provisions for long-term financial investments.

In a letter to shareholders, Chairman Doan Nguyen Duc said the company's banana products are mainly exported to China, South Korea and Japan. The company does not export goods to the US market at all, so it is not affected by President Donald Trump's new tariff policy.

As of March 31, 2025, HAGL's total assets were approximately VND 23,478.5 billion. Owner's equity was over VND 9,743 billion, liabilities were VND 12,735 billion. The company still had an accumulated loss of nearly VND 83 billion.

Hoang Anh Gia Lai has sold many assets to pay off debts.

In the document explaining the measures and roadmap to overcome the situation of securities being warned, HAGL said that, based on the orientation and direction of the Board of Directors, the company will continue to implement financial restructuring measures to further reduce the outstanding debt to banks compared to the current level, improve operations, and move towards eliminating accumulated losses.

HAGL has also just announced the delay in paying the interest of more than VND 118 billion of the HAGLBOND16.26 bond lot due to the inability to arrange capital sources (payment deadline is the end of March 2025). This interest will be extended until the bond maturity date.

Duc Long Gia Lai late in bond payment

Another “mountain town” enterprise, Duc Long Gia Lai Joint Stock Company (code DLG), has just announced information about the delay in paying a batch of bonds with an issuance value of VND134 billion, with the principal outstanding value at the end of the period being VND56 billion, the payment date is March 31. The unpaid amount is more than VND36.8 billion due to the failure to arrange the source of funds. Duc Long Gia Lai is negotiating with investors.

As of December 31, 2024, Duc Long Gia Lai's equity reached VND 751.8 billion, undistributed profit after tax was negative VND 2,456 billion. Total liabilities were VND 3,596 billion, of which debt from bond issuance was VND 417 billion. Profit after tax in the fiscal year reached VND 244 billion, accumulated loss was VND 2,664 billion.

Last year, Duc Long Gia Lai was asked by Lilama 45.3 to open bankruptcy proceedings just because of a debt of more than ten million dong.

In addition, the Board of Directors of Duc Long Gia Lai has passed a resolution to sell all 97.73% of its capital (equivalent to an investment of VND 249 billion) it owns at Mass Noble Investments Limited Company - a unit operating in the field of electronic components. This is the company that has contributed the main revenue to Duc Long Gia Lai since 2016.

On the stock market, DLG shares are only 2,050 VND/share, less than the price of a glass of iced tea.

Mr. Bui Phap is the founder and Chairman of the Board of Directors of Duc Long Gia Lai.

Quoc Cuong Gia Lai has good news

Ho Chi Minh City Stock Exchange (HoSE) has just announced that QCG shares of Quoc Cuong Gia Lai Joint Stock Company have been removed from the margin restriction list due to the correction of the violation.

Recently, this company announced its audited consolidated financial statements for 2024, with after-tax profit reaching nearly 82 billion VND, a difference of nearly 14% compared to the figure in the self-prepared report.

The main reason for the adjustment is that the company recalculated the value of the investment using the equity method after transferring shares in an associate.

Regarding the Bac Phuoc Kien Residential Area project, the company is still implementing the procedures to complete legal documents according to current regulations, and at the same time carrying out compensation and site clearance for the remaining area.

The Enforcement Agency is seizing assets which are some original documents on compensation and site clearance of the project to serve the purpose of ensuring enforcement of the judgment related to the amount of 2,882.8 billion VND.

According to Quoc Cuong Gia Lai, the production and business situation is stable and the group still ensures payment of due debt obligations, maintaining the ability to operate continuously in the future.

Last year, Mr. Nguyen Quoc Cuong (Cuong Dola) took over the position of General Director from his mother, Ms. Nguyen Thi Nhu Loan. Ms. Loan was prosecuted in July 2024 for her involvement in the transfer of the project 39-39B Ben Van Don, Ward 12, District 4, Ho Chi Minh City.

Over the past decade, QCG has also had many scandals not only related to the projects it implemented but also many violations related to information disclosure.

Source: https://vtcnews.vn/ba-dai-gia-pho-nui-lung-lay-mot-thoi-gio-ra-sao-ar938726.html

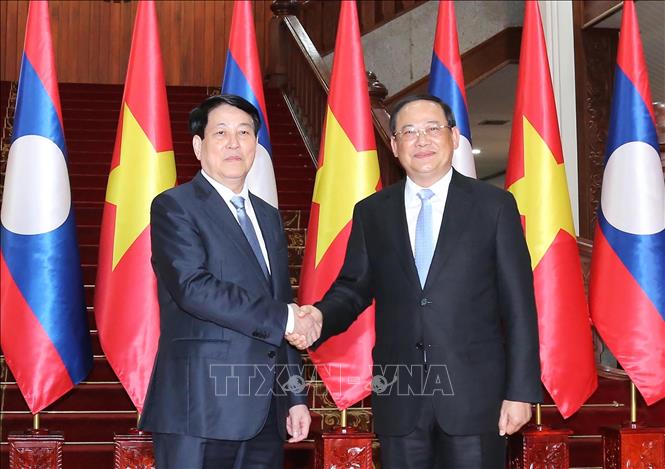

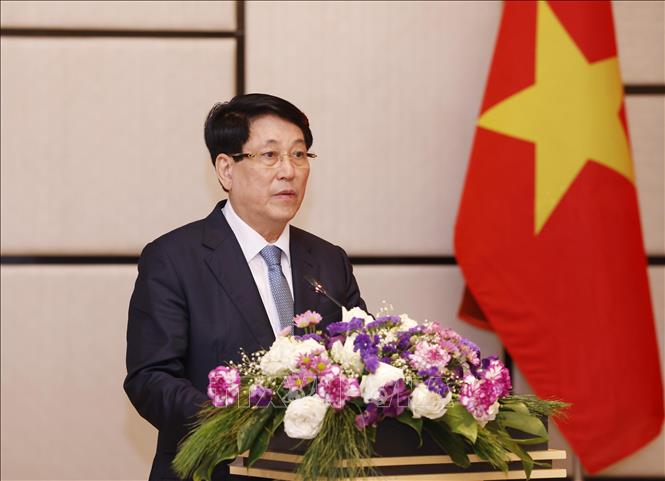

![[Photo] President Luong Cuong holds talks with Lao General Secretary and President Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/98d46f3dbee14bb6bd15dbe2ad5a7338)

![[Photo] General Secretary To Lam receives Philippine Ambassador Meynardo Los Banos Montealegre](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/6b6762efa7ce44f0b61126a695adf05d)

![[Photo] President Luong Cuong meets with Lao National Assembly Chairman Xaysomphone Phomvihane](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd9d8c5c3a1640adbc4022e2652c3401)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

Comment (0)