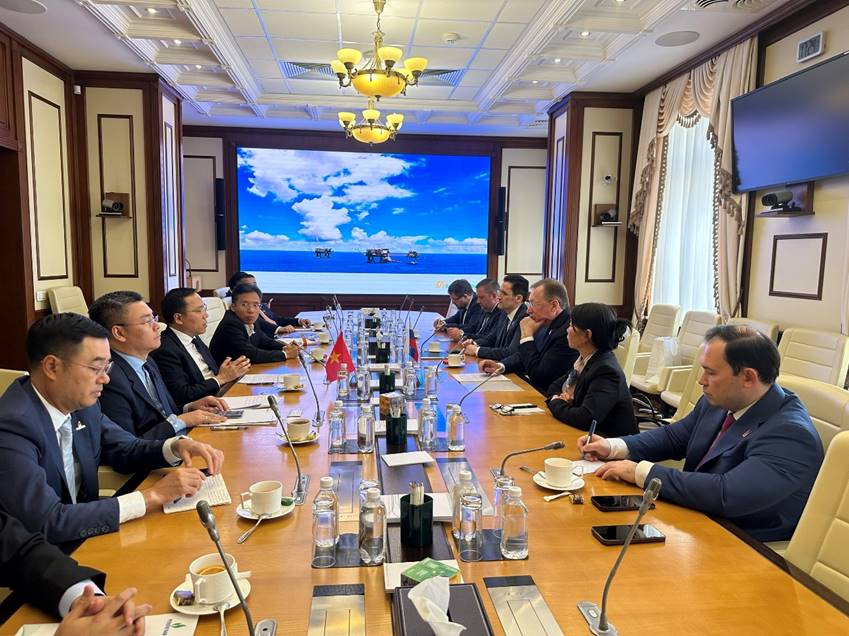

Securities companies quickly pay taxes and fines to maintain their reputation and strengthen investors' confidence - Photo: BONG MAI

Arrange to pay all taxes and penalties

Specifically, Mr. Nguyen Kim Long - Director of Law and Compliance Audit of SSI Securities, on behalf of the enterprise, said that this weekend he received a decision from the Large Enterprise Tax Department.

The enterprise was subject to additional tax collection, administrative fines and late tax payment fees for 2022 and 2023 with a total amount of more than 7.3 billion VND.

Grasping the information, this leading securities company in the market quickly arranged to pay the above amount into the state budget, fulfilling its obligation.

According to data from the Ho Chi Minh City Stock Exchange (HoSE), SSI was the second largest securities company in terms of market share in brokerage of stocks, fund certificates and covered warrants in the last quarter, just behind VPS. The remaining companies also in the top include TCBS, VNDirect, Vietcap, HSC MBS, Mirae Asset, FPTS and KIS.

Accelerate charter capital increase, consolidate position

In a new development this week, SSI Securities has just announced a resolution of the board of directors, related to the offering of about 151 million shares to existing shareholders at a price of VND 15,000/share, a ratio of 10% (shareholders holding 100 shares, can buy 10 new shares at the above price).

As of November 4, there were 5.4 million shares remaining. With these "unsold" shares, the company continued to distribute them to professional securities investors and key employees of the company. Accordingly, eight qualified investors, all of whom are senior employees of SSI Securities, have registered to buy all the remaining shares. The latest payment deadline is Thursday of this week.

According to the latest report, the company said it has sold all of its nearly 151 shares to existing shareholders, raising its charter capital to nearly VND19,640 billion.

The parent company's financial report shows that in the first three quarters of this year, SSI Securities achieved revenue of nearly VND6,500 billion and pre-tax profit of nearly VND3,000 billion, respectively completing 80% and 88% of the yearly plan.

At the end of the last quarter, the company's assets reached over VND65,300 billion, a relative decrease compared to the beginning of the year. Liabilities were slightly reduced to nearly VND42,000 billion.

On the stock market, closing the last trading session of this week, SSI code is in the red with the price of 24,350 VND/share, but still fluctuates slightly up in the past week. In the past month, this stock has decreased by about 9%.

SSI Securities was established in 1999, one of the oldest operating companies, leading financial institutions in the Vietnamese stock market. Currently, the company has a wide network of operations in Hanoi, Ho Chi Minh City, Hai Phong, Nha Trang.

![[Photo] Ho Chi Minh City people's affection for the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/7fcb6bcae98e46fba1ca063dc570e7e5)

![[Photo] Readers' joy when receiving the supplement commemorating the 50th anniversary of the liberation of the South and national reunification of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/283e56713da94988bf608393c0165723)

![[Photo] April 30, 1975 - Steel imprint engraved in history](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b5a0d7f4f8e04339923978dfe92c78ef)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of Steering Committee for key projects and railway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b9534596258a40a29ebd8edcdbd666ab)

Comment (0)