730 million BCG Energy shares are about to be listed on UPCoM at a price of VND 15,600/share.

On July 23, the Hanoi Stock Exchange (HNX) announced its approval for 730 million shares of BGE code of BCG Energy Joint Stock Company - a member of Bamboo Capital Group to trade on UPCoM.

BGE's first trading day on UPCoM is July 31, 2024.

The reference price on the first trading day is VND15,600/share, fluctuation range +/- 40%. The number of securities registered for trading is 730 million shares, equivalent to a capitalization of VND11,388 billion.

|

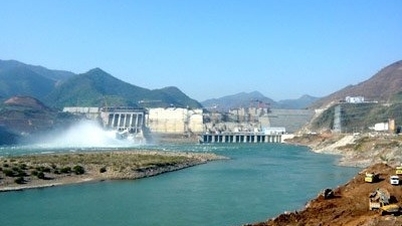

| BCG Energy has 600 MW of solar power in operation. The company owns a portfolio of wind power projects of nearly 1GW approved under the Power Plan VIII and is implementing the construction of the first waste-to-energy plant in Cu Chi district, Ho Chi Minh City. |

BCG Energy started IPO procedures in 2023. On May 20, 2024, BCG Energy officially became a public company, then was granted the stock code BGE by the Vietnam Securities Depository and Clearing Corporation (VSDC) on June 18, 2024. Trading on UPCoM on July 31 is an important milestone in BCG Energy's journey to becoming an officially listed company.

BCG Energy was established in 2017 and is the energy pillar of Bamboo Capital Group. Currently, the company has a charter capital of VND 7,300 billion, equity of nearly VND 10,000 billion and total assets of nearly VND 20,000 billion. The company is operating about 600 MW of solar power and is a top 3 renewable energy enterprise in Vietnam.

In terms of business operations, in the past 3 years, BCG Energy has continuously recorded positive results. In 2021, the company achieved revenue of 760 billion VND, in 2022, revenue grew strongly by 40% to 1,064 billion VND. In 2023, BCG Energy's net revenue increased by 5.8%, reaching more than 1,125 billion VND, the growth mainly coming from the fact that solar power plants and rooftop solar power systems have operated at an efficiency of more than 100% compared to the forecast.

Along with the positive growth in revenue, BCG Energy's debt-to-equity ratio has continuously decreased over the years. At the end of 2021, BCG Energy's debt-to-equity ratio was 2.77 times, at the end of 2022 it decreased to 1.9 times and at the end of 2023 it was only 0.96 times. This is a safe and significantly low leverage level compared to other listed companies in the same industry. In addition, BCG Energy's debt-to-equity ratio by the end of 2023 also decreased to a very safe level, only 0.66 times.

Regarding business results in 2024, at the end of the first quarter, BCG Energy's renewable energy segment was the largest contributor to Bamboo Capital Group's total revenue, accounting for 32.5%, equivalent to VND 320.4 billion. The renewable energy segment is expected to contribute the majority to the group's revenue and profit in the coming quarters.

|

| Perspective of BCG's waste-to-energy plant in Cu Chi district, Ho Chi Minh City. |

BCG Energy currently owns a portfolio of nearly 1 GW approved under the Power Plan VIII with a vision for implementation until 2030. Notably, a series of large-scale wind power projects, including: Dong Thanh 1 wind power (80 MW), Dong Thanh 2 (120 MW) in Tra Vinh province; Khai Long 1 (100 MW) in Ca Mau will be deployed by BCG Energy this year and are expected to be put into operation in 2025. Once operational, these projects will help increase BCG Energy's total power generation capacity by about 53%.

BCG Energy is also operating large-scale solar power plants, namely BCG Long An 1, BCG Long An 2, BCG Vinh Long, BCG Phu My and Krong Pa 2. In addition, the company is developing rooftop solar power systems in many provinces and cities across the country, implementing nearshore wind power projects in Ca Mau, Soc Trang, Tra Vinh and researching potential wind power projects in Dien Bien province.

Recently, BCG Energy has also recorded a lot of positive information when it has been continuously chosen by large international corporations and financial institutions to cooperate when investing in Vietnam, such as: international energy corporations SP Group, Sembcorp, SK Group, Hanwha Group, Leader Energy Group, SLC (Sudokwon Landfill Site Management Corp),...

With the experience of a leading clean energy enterprise in Vietnam, on January 31, 2024, BCG Energy acquired Tam Sinh Nghia Investment and Development Company, officially entering the field of waste-to-energy development. On July 20, Bamboo Capital Group and BCG Energy successfully held the groundbreaking ceremony for the construction of Tam Sinh Nghia Waste-to-Energy Plant in Thai My Commune, Cu Chi District, Ho Chi Minh City.

Phase 1 of the plant will be implemented from 2024 to 2025 with a total investment of VND 6,400 billion, a capacity to burn 2,000-2,600 tons of waste/day, a power generation capacity of 60MW, and an expected power output to the grid of up to 365 million kWh/year, meeting the electricity needs of about 100,000 households, while helping to reduce emissions of about 257,000 tons of CO2/year.

Phase 2 of the project is expected to be implemented from 2026-2027, with the waste incineration capacity increased to 6,000 tons/day and the power generation capacity up to 130MW, becoming the world's largest waste-to-energy plant. Phase 3 of the plant is expected to be implemented from 2027 to 2029, with the waste incineration capacity up to 8,600 tons/day and the power generation capacity reaching 200MW.

In parallel with the construction of the Tam Sinh Nghia Waste-to-Energy Plant in Ho Chi Minh City, BCG Energy will soon implement the Waste-to-Energy Plant project in Long An and Kien Giang.

By continuing to promote the development of renewable energy projects and building more large-scale waste-to-energy plants, this series of projects will help consolidate and enhance BCG Energy's leading position in the renewable energy sector in Vietnam.

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)