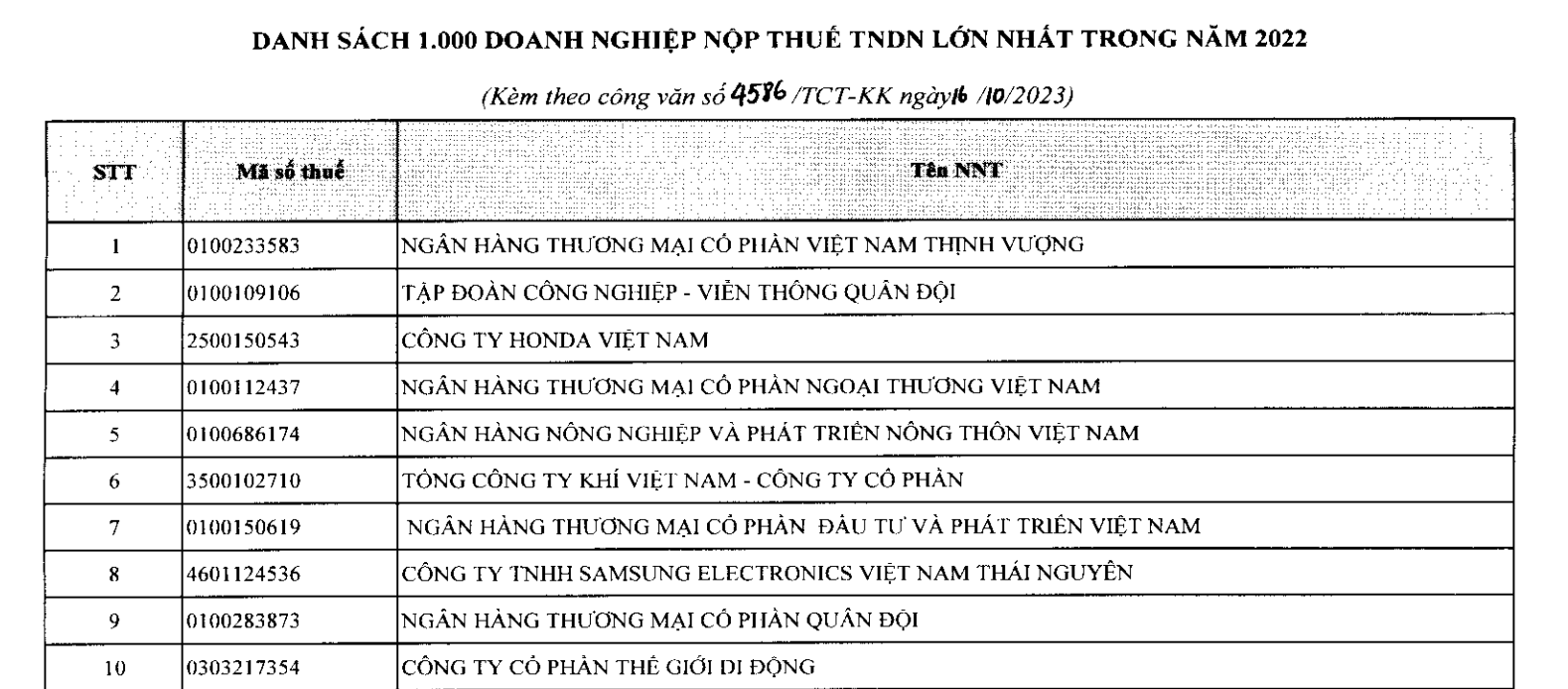

The General Department of Taxation (Ministry of Finance) has just announced V.1000 for 2022. Ranked first is Vietnam Prosperity Joint Stock Commercial Bank (VPBank); followed by the Military Industry - Telecommunications Group (Viettel).

Also in the top 10 enterprises paying the largest corporate income tax (CIT) are Honda Vietnam Company, Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), Vietnam Bank for Agriculture and Rural Development (Agribank), Vietnam Gas Corporation - JSC, Bank for Investment and Development of Vietnam (BIDV), Samsung Electronics Vietnam Thai Nguyen Company Limited, Military Commercial Joint Stock Bank (MB), Mobile World Joint Stock Company.

Top 10 enterprises paying the largest corporate income tax in Vietnam in 2022

According to the statistics of the General Department of Taxation, the total amount of corporate income tax paid by enterprises in V.1000 in 2022 accounts for 58.2% of the total budget revenue from corporate income tax and is equal to 85.1% compared to the amount paid by enterprises in V.1000 in 2021. After 6 years of implementation, there are 301 enterprises that have been in V.1000 for 7 consecutive years in 2022, 2021, 2020, 2019, 2018, 2017 and 2016.

In V.1000 in 2022, 331 enterprises in V.1000 in 2021 were eliminated, and at the same time, 331 enterprises were added to V.1000 in 2022. Through review, the main reason for 331 enterprises being eliminated from V.1000 in 2022 is due to the postponement of the time to temporarily pay corporate income tax in 2022 to early 2023.

According to Decree No. 91/2022/ND-CP amending and supplementing a number of articles of Decree No. 126/2020/ND-CP, enterprises must pay 80% of corporate income tax for 2022, the deadline is January 30 (according to the old regulations in Decree 126/2020/ND-CP, enterprises must pay 75% of provisional corporate income tax for 2022, the deadline is October 31, 2022).

Some enterprises paid large amounts in 2021 due to irregular and specific activities (real estate transfer, capital transfer, sale of medical equipment and machinery serving the Covid-19 pandemic, other activities); Enterprises paid for the collection decisions of competent authorities in 2021...

Of the 331 enterprises added to V.1000 in 2022, the majority are due to enterprises paying corporate income tax for irregular activities (real estate transfer, capital transfer, other activities); paying for the collection decision of competent authorities in 2021.

In addition, some enterprises have provisional payments in 2022 that are larger than the amount payable; enterprises increase capital, expand business operations, increase operating efficiency, leading to increased revenue and income in 2022; enterprises complete projects, accept works and officially put into operation with revenue.

See the 2022 V.1000 list

Source link

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)