How do you evaluate the current postal, logistics, and e-commerce markets – where Viettel Post has its footprint? What are the opportunities for Viettel Post in these major “playgrounds”, sir?

The market of delivery, logistics, and e-commerce is not separate from each other, but is part of the overall field and is in a very rapid development stage. This is a great opportunity for Viettel Post.

The current express delivery sector is estimated at nearly 5 billion USD, with an initial growth rate of 30% or more. However, due to some influences from the world, it is now a little lower. Even though it is lower, it is still around 20%, which is also a high growth rate for the domestic express delivery market in Vietnam.

As for e-commerce goods, it must be 800 million USD, that is just the shipping fee, not including the value of the goods. Other areas such as cold storage have not been fully evaluated, but must certainly be calculated in billions of USD.

The above fields are all extremely competitive, reflected in the number of licenses in the delivery or e-commerce fields.

How exactly, sir?

In recent years, the express delivery market in Vietnam has had nearly 800 licenses and nearly the same number of businesses operating, including domestic businesses registered for business or businesses from abroad, including 50-70 e-commerce platforms. Giant foreign e-commerce corporations with many advantages in finance, technology, goods sources, brands, etc. are all present here.

Meanwhile, in China there are 8 large enterprises, all of which are domestic enterprises; in many other countries, the number of delivery enterprises is also very small and they all have licensing and competition management frameworks.

In Vietnam, competition in this field is so fierce that prices decrease every year. Domestic postal enterprises compete simply based on the formula of revenue minus costs to make profit. Foreign enterprises listed on the stock exchange play a different game. Specifically, these enterprises only need to develop customers, open markets and have revenue in Vietnam, then their stock prices in the country will increase, they will earn a lot of money, and then bring that money here to compete. That shows two completely different business states. Enterprises that only take revenue minus costs to make profit to compete will find it increasingly difficult.

Comparing to the telecommunications sector, if any network operator has a promotional policy that violates management regulations, it will be immediately whistled and must stop immediately. But in this sector, for example, 0 VND delivery is considered selling below cost, so how can it compete? The giant will kill the small guy. What sector competes by selling at 0 VND?

Customers of course like to get cheap prices, but it depends on the industry. Some industries need to be managed, because it is so competitive and prices are falling every year and falling to the point where no one can make a profit. Everyone can see that the quality of delivery in Vietnam is currently low.

In telecommunications, every year the management agency measures the quality of services, the indexes of the network operators and publishes them. But this field does not have that. We also do not have a strict and systematic management of prices, competition, and service quality, so businesses dump prices indiscriminately.

For large corporations in the world, when listed on the stock exchange, they have tens or hundreds of billions of dollars, so they can bring billions of dollars to other markets to "burn". Burn continuously for 5-7, even 10 years. Many "big guys" entering Vietnam are still losing money, but that's okay. Because, as mentioned, they open the market, get many customers, so the stock price increases and they have money to burn, they can even burn to the point of destroying all other businesses and the market is only left with them.

Here is the matter of pleasing customers with zero-dong prices and other macro issues of businesses, economic security, etc. As mentioned, depending on each field, the State must have a direction in price management and competition management. There are fields that are managed with price ceilings, and there are fields that are not managed at all. They compete in whatever they want, sell whatever they want, and take responsibility for their own profits and losses.

In general, Vietnam's delivery industry still has many problems, from industry management to long-term national security issues.

How has the completely different competitive situation, as you analyzed above, affected businesses operating in the postal and delivery sector, including Viettel Post?

In 2022, only a few businesses will make a profit, the rest will lose money. Businesses that are not profitable will go bankrupt if this continues.

With Viettel Post, we are fortunate to be among the few profitable businesses, even though the growth rate of revenue and profit is not as expected.

But the reason why Vietnamese delivery businesses are not profitable may be due to internal reasons, not necessarily due to the "completely different competitive situation" as you said?

That may be so, but to change internally, we need resources. In the local market or globally, they are very developed, in terms of technology, finance, and management systems. When they come to Vietnam, we cannot resist if we have not changed yet.

With the current developments, in just a short time, many businesses will have to leave the game. That is to say, to see the picture of this industry, which is rapid growth, great opportunities and terrible competition. Competition here reflects that the legal corridor for market management in Vietnam has not been completed, for a long time the legal system has not been updated, revised, or strengthened.

Recently we have raised the issue of building a Postal Law, but during the time of building the law, dumping, labor use, unmanaged service quality, etc. still continue.

You shared that Viettel Post is lucky to be among the profitable units in 2022. Can you tell us why?

Firstly, Viettel Post's revenue is still growing well; Secondly, we optimize costs, including higher postal productivity and costs (digital transformation). In the past, there were many costs such as making contracts on paper, administrative costs... When digitizing processes, it has helped save a lot, even tens, hundreds of billions of VND or technologies serving fraud control in operations and weight. For example, IoT scales are synchronously connected to the system, when an order is placed, the weight data will be automatically taken without the need for a person to record it, thereby helping to maximize costs, improve efficiency and productivity.

So what is the solution that Viettel Post will propose in the coming time to continue to maintain growth momentum in the context of fierce market competition, the "whirlwinds" of devaluation continue, and at the same time to create advantages for itself against the borderless power of global corporations participating in the war in Vietnam, specifically, sir?

We have discussed very carefully, firstly, we must optimize costs and secondly, we must find and focus on niches with high profit margins. For example, with express delivery, a normal delivery order can take 3-4 days, even 5 days to arrive, Viettel Post will build and design operating systems to be able to provide immediate delivery services after a few hours or within the day. For such services, customers are willing to pay 5-7 times higher, the profit margin of this segment is also much higher.

For the B2B customer segment, for this group of customers, only good quality is required, but people do not tend to force a reduction of several thousand dong. Specifically, for administrative delivery, documents, letters, cards of banks, businesses, etc., as long as they are delivered on time, without errors or damage, people are willing to pay a slightly higher price, or agricultural products, fresh goods (crabs, seafood, etc.) can absolutely receive a higher fee.

For the e-commerce sector, if we position ourselves as a regular e-commerce platform, we will have to compete with "big guys" like Shopee, TikTok, Lazada... Then the problems are finance, technology, source of goods, brand. If we position ourselves as agricultural products, a very special item, the time of existence is only calculated in hours, in days, so if we are just a platform for buyers and sellers, it will not solve everything, but we need an accompanying infrastructure to preserve from the place of production to the place of consumption so that the goods remain fresh.

That is the solution that Viettel Post is implementing and will implement in the near future. In the long term, what is Viettel Post's strategic orientation, sir?

With current core areas such as delivery, Viettel Post must redesign the network infrastructure, investing in both hardware and software, and process systems such as automatic goods sorting systems. Currently, the number of orders processed is very large, it cannot be sorted manually like before, but must have sorting technology, including the use of robots to make sorting faster, more accurate, and more efficient.

The network infrastructure also needs to be re-planned. Viettel Post will build 10 Mega Hubs (large warehouse centers), then 90 Hubs in other locations, and 1,500 post offices. The next layer, the postmen, must also be redesigned. Then comes the operating process to ensure that goods are processed as quickly as possible and the journey of the goods can be tracked. Specifically, customers only need to turn on the app, install the app, enter the order code to know where the goods are going and when they will arrive.

Next, we will have to perfect the recruitment, training, coaching and management policies to control customer experience and service quality, because in this field, each interaction with customers has many participants. In addition to having good infrastructure and good technology, how can tens of thousands of people interact with customers to achieve the best and most consistent quality? This is also a big problem that the postal service is focusing on.

Another strategy of Viettel Post is to expand into other areas to support the core areas, such as building a logistics system to serve cross-border e-commerce. Vietnamese people now buy a lot of goods from abroad. When the goods are brought back, they need to go through procedures such as customs clearance, sorting, transportation, and shipping to bring them to factories, to places of sale, and to end buyers. Cross-border e-commerce data is up to 1-1.5 million orders from abroad every day, Viettel Post must expand and grasp that flow of goods.

The next strategy is the logistics system serving cold goods - agricultural and fishery products of Vietnam. Currently, this field is still quite fragmented and in its infancy. In this field, simply having an e-commerce platform to sell agricultural products is not enough. With the characteristics of special agricultural products such as fresh goods, a complete logistics system is needed to preserve and store from the place of production, farming, means of transport, to the place of consumption, and furthermore, export and must form a chain. Viettel Post is focusing on this field, but it requires large investment. If it can be done, there will be no more scenes of thousands of containers stuck at the border gate. However, Viettel Post alone certainly cannot do it.

When looking at an agricultural product from Australia, Japan or some other countries, it can be seen that the cost of the cold chain system is very high. Therefore, in the delivery sector, if the revenue is not large enough, the profit is not large enough, then there will not be enough cost to cover the logistics cost, because the investment in a cold storage system is dozens of times higher than the investment in a normal warehouse, and requires a chain - at the place of production, the means of transport on the road, at the place of consumption.

Many reports say that Vietnam’s logistics costs are high in the double digits. However, according to some Chinese partners, logistics costs there account for less than 10% of GDP, while Singapore’s is only 8.5%.

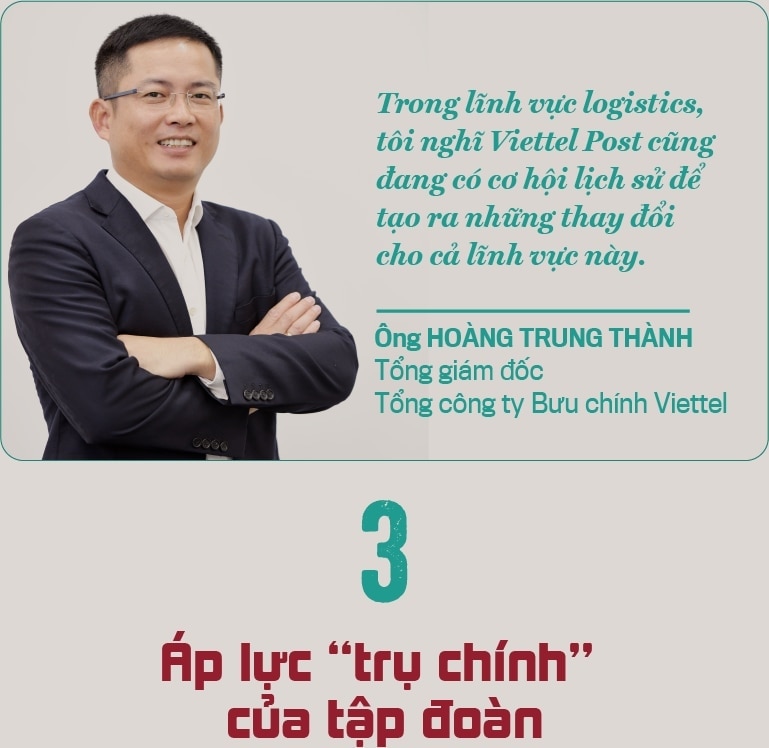

Viettel Post is identified as one of the four main pillars (including domestic and foreign telecommunications; digital solutions and payments; high-tech manufacturing research; and trade and logistics – Viettel Post) in the current development strategy of Viettel Group. How do you feel about the so-called “main pillar” of the Group?

Setting a target for this sector is to determine the direction of further growth and is absolutely correct. This sector is growing at 30% per year, if Viettel Post does well, it can grow by 50% and in 5 years the revenue will be 10 times higher than today, so setting it as a pillar, in my opinion, is absolutely correct. Now it is just a matter of how to do it.

50% growth per year? Is that too ambitious, sir?

Looking back 17-18 years ago, Viettel started with telecommunications, there were years when it grew 200-300%.

In my opinion, Viettel Post may not be able to reach that speed in the first year, but if it can do and keep up with the things I mentioned above, such as technology (both hardware and software), developing surrounding industries, and not being the only "delivery man" standing alone, it will be possible.

Many people think that Viettel Post is carrying the shadow of Viettel, that Viettel used to develop very quickly (mainly mobile telecommunications) and in recent years has had to push into new areas such as digital technology, digital services... However, these areas are still new and only account for a relatively small proportion, and as for the core area of mobile telecommunications, not only Viettel but also other networks in general will be lucky to maintain the growth momentum like last year. With Viettel Post, the core area of delivery is also the same, it seems to be slowing down and reaching its limit, and the new areas have not yet arrived? Do you think so?

As for the postal, logistics, and e-commerce sectors, the situation is completely different from telecommunications. Telecommunications has been saturated for nearly 10 years, not just 2-3 years ago, meaning the number of subscribers - growth over the past 7-8 years - is now the same.

As for postal services, all reports on e-commerce and logistics show that they are in a very rapid development phase, so they are completely different. The competition is huge but the opportunities are also huge.

After many years of hardship, Viettel has risen to the number 1 position. Some member units have become number 1 or aim to become number 1. What do you think about Viettel Post's "number 1"?

Anyone who does business has the desire to become a leader. Viettel Post is not number 1 in the field of transportation and I have never declared to become number 1. We just want to focus and do the immediate tasks well.

Viettel Post has a belief that, like 17-18 years ago, Viettel Group is facing a historic moment to change the entire Vietnamese telecommunications industry. And now, in the field of logistics, I think Viettel Post also has a historic opportunity to create changes for this entire field.

Vneconomy.vn

Comment (0)