After only 2 years of launching, the MISA Lending platform is proud of the milestone of successfully disbursing 10,000 billion via the platform. With this figure, MISA Lending has affirmed its role as a reliable companion of thousands of Vietnamese businesses.

Customer appreciation - full of offers

In December, MISA Lending cooperated with financial institutions and banks to launch a series of attractive incentive programs for MISA customers when registering for loans through the platform:

MISA Lending - The top choice for small businesses in need of capital

With the mission of helping 90% of small and medium enterprises access capital at reasonable costs, MISA Lending has cooperated with reputable financial institutions: MB, MSB, Techcombank, BIDV, Standard Chartered Bank, EVNFC... to provide financial support packages with high loan limits and preferential interest rates.

Accordingly, customers only need to use one of the following MISA software: MISA meInvoice, MISA AMIS Accounting (Online), MISA SME (offline) and MISA ASP to have the opportunity to register for a loan.

Borrowing capital through MISA Lending "impresses" businesses because: The loan process is extremely simple with only 5 minutes to submit an online application, 1 day of loan approval from financial institutions, 0 collateral requirements. The ability to successfully borrow capital through MISA Lending is 8 times higher than borrowing directly from the bank.

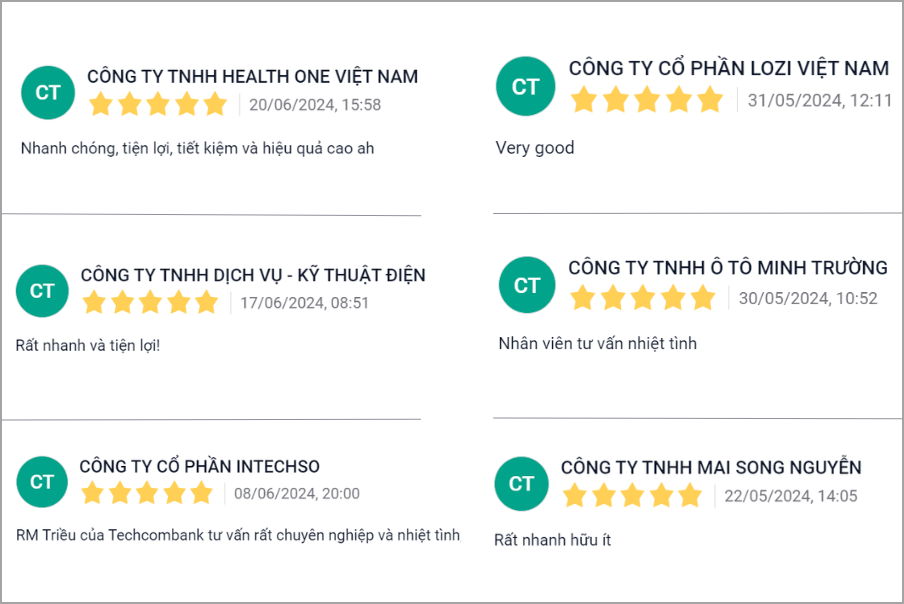

Thousands of businesses have left compliments about the application processing process as well as service quality when borrowing capital through the MISA Lending platform.

Each share and feedback from businesses is the motivation for the MISA Lending team to develop and improve every day.

Accompanying Vietnamese businesses to overcome difficultiesThe 10,000 billion VND disbursement milestone is a clear demonstration of MISA Lending's important role in accompanying Vietnamese businesses, especially in the context of many economic fluctuations. Businesses that once faced the risk of stagnation due to lack of capital have now grown strongly, even expanded their scale, affirming their position in the market.

Thanks to receiving timely capital from the bank through the MISA Lending platform, SOLIC company has had timely expenses to expand production and develop business. Ms. Tran Thi Thoa - Accountant of SOLIC company shared: "MISA Lending has supported us to solve the problem of short-term finance to have additional capital for urgent business activities. With SOLIC, when borrowing on credit and receiving quick disbursement, it helps businesses have capital to promptly import raw materials and pay salaries to employees when the money from customers has not been collected yet".

SOLIC Company promptly received capital through MISA Lending to develop production.

Not only SOLIC, Thanh Quang Group also highly appreciates the credit source on the MISA Lending platform as the fastest, most compact and effective solution that Thanh Quang has approached in the past 13 years.

Ms. Phan Thi Ha - Finance Director, Thanh Quang Group said: “Borrowing capital through the MISA Lending platform is very convenient because the loan registration procedure is online, saving a lot of time for businesses. After 3 days, Thanh Quang received a loan from Techcombank to import a new shipment without having to submit any documents. As soon as the necessary procedures were completed, Thanh Quang was also granted an overdraft credit limit and could immediately use it for business operations.”

Positive feedback from customers is the biggest motivation for MISA Lending to constantly innovate and improve. Not only stopping at 10,000 billion, MISA Lending commits to continuously strive to bring more value to the business community, fulfilling the mission of helping 90% of small and medium enterprises easily access credit sources from banks and reputable financial institutions. From there, helping the business community grow stronger, overcome challenges and reach success with the companionship of MISA Lending.

Register now – Get capital with MISA Lending!

Contact:

Sign up for consultation here.

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)